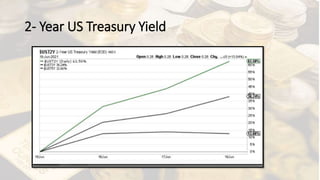

The document discusses how 2021 is shaping up to be the "year of the hike" for interest rates as the Federal Reserve begins tightening monetary policy earlier than expected. It notes that the Fed will likely taper its asset purchase program sooner in response to inflation rising above forecasts. The document also analyzes how higher rates and reduced liquidity could impact precious metals as the amount of liquidity the Fed provides declines. It concludes that signs of diverging messaging among Fed officials suggests a climax in monetary policy is approaching.

![Inflation Expectations Have Peaked - I

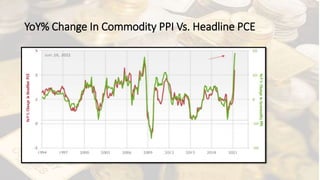

• the FED increased its year-over-year (YoY) headline PCE Index forecast

from a rise of 2.40% YoY to a rise of 3.40% YoY on Jun. 16.

• However, with the Commodity Producer Price Index (PPI) surging by

18.98% YoY – the highest YoY percentage increase since 1974 – the

wind still remains at inflation’s back.

• Moreover, with all signs pointing to a YoY print of roughly 4% to

4.50% on Jun. 25, the “transitory” narrative could suffer another blow

on Friday.

• If we begin with the reported figure [an 18.98% YoY increase], the

commodity PPI implies a roughly 4.50% YoY increase in the Personal

Consumption Expenditures (PCE) Index.](https://image.slidesharecdn.com/gold23june-210622172143/85/June-23-I-Session-1-I-GBIH-8-320.jpg)

![FED Fund Rate Vs.UST2Y - I

• To explain, the green line above tracks the U.S. 2-Year Treasury yield,

while the red line above tracks the U.S. federal funds rate. If you

analyze the relationship, you can see that the two often follow in

each other’s footsteps. Thus, if the former continues its rally, the FED

may find itself behind the interest rate curve.

• To that point, Hans Mikkelsen, credit strategist at Bank of America,

told clients on Jun. 21 that he expects the FED “to soon begin

tapering its [QE] purchases, and to start hiking interest rates earlier

than expected – and, most importantly, much faster than currently

priced in the markets,”](https://image.slidesharecdn.com/gold23june-210622172143/85/June-23-I-Session-1-I-GBIH-14-320.jpg)