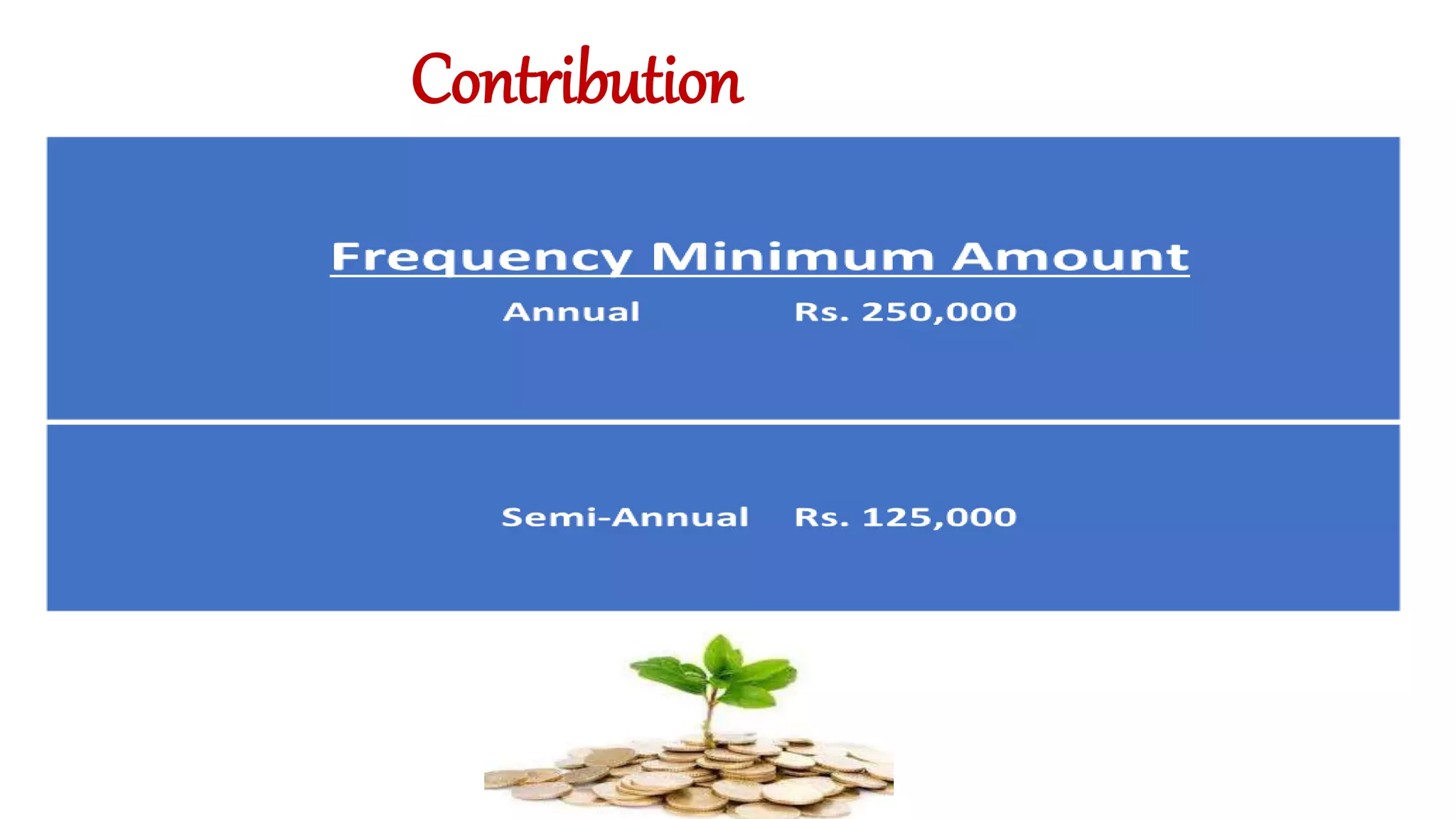

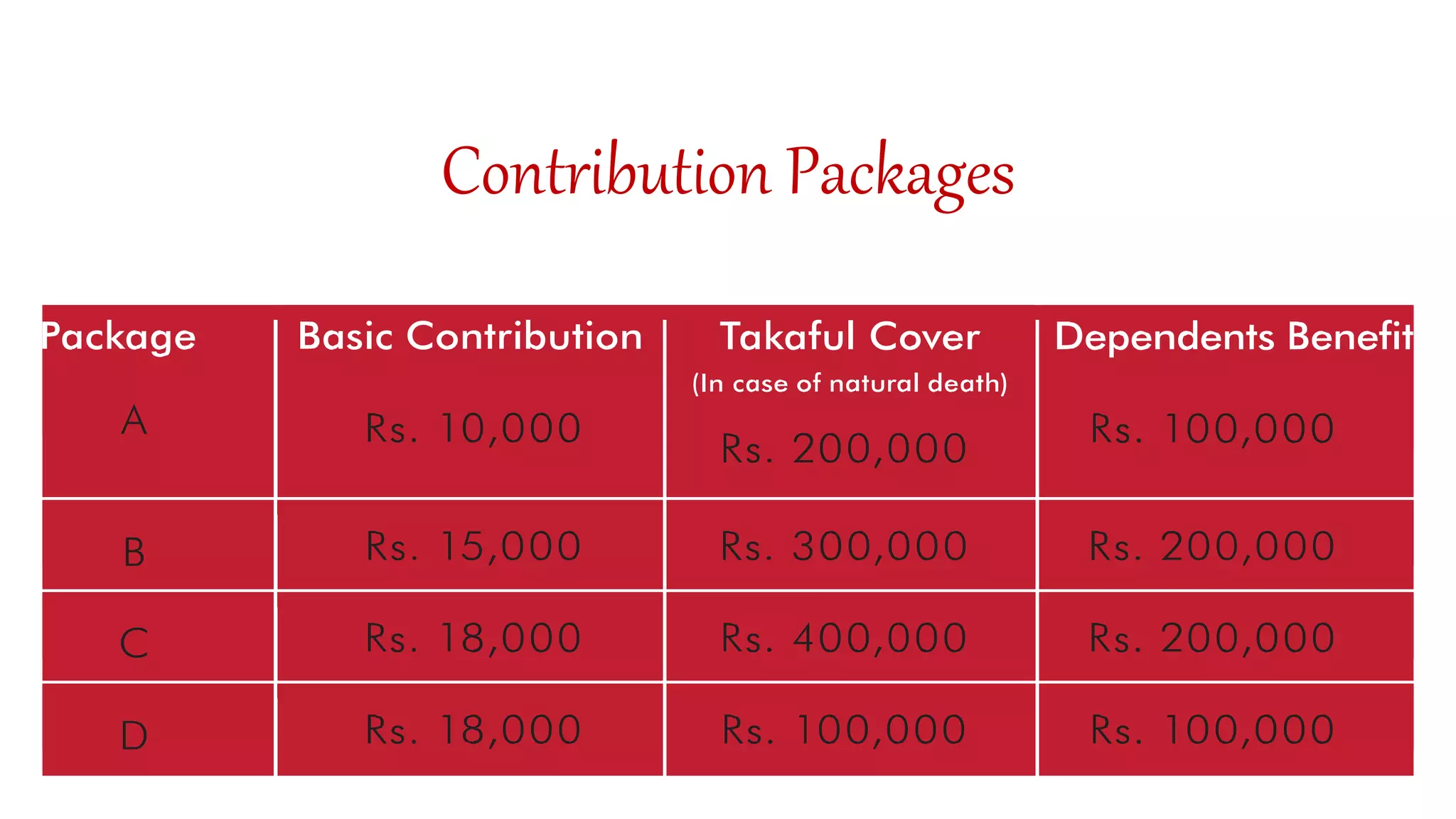

This document discusses various family takaful plans offered by a takaful operator. It provides details on the Secure Sarmaya Takaful Plan, Savings Plus Takaful Plan, Five Pay Takaful Savings Plan, Jiyapo Takaful Plan, and Wafa Education Takaful Plan. Key information includes eligibility requirements, available contribution amounts and terms, benefits like maturity payments and death benefits, and how participant funds are invested and managed in accordance with Shariah principles.