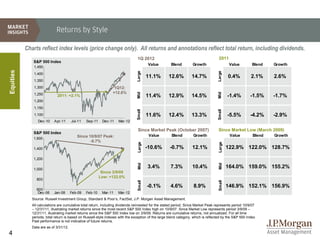

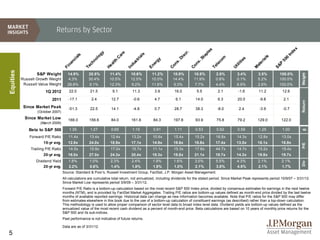

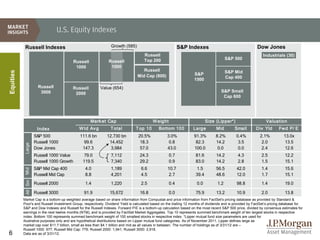

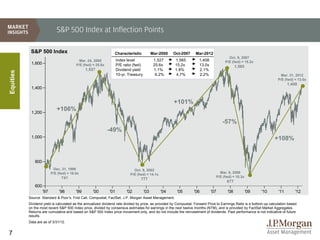

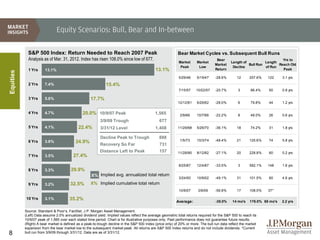

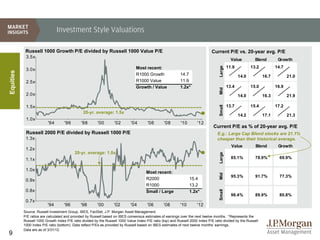

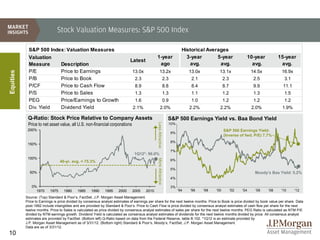

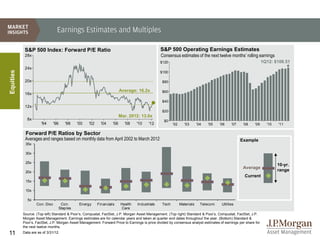

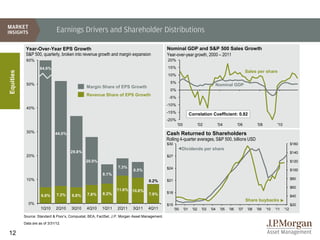

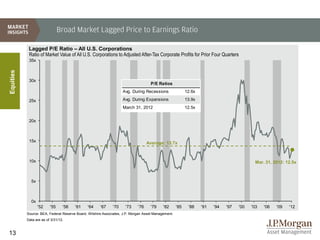

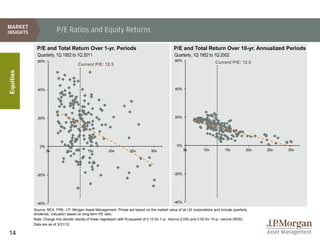

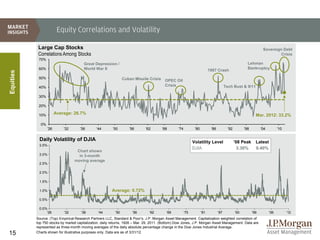

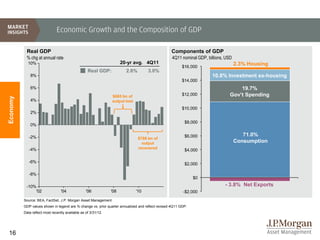

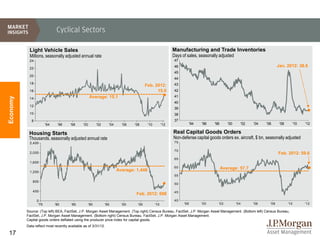

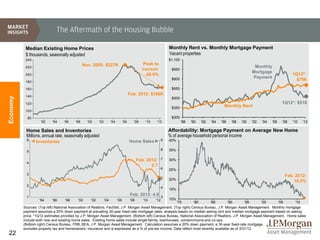

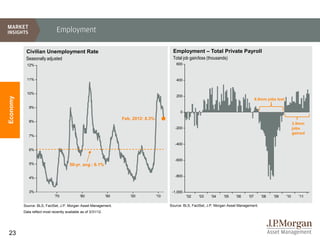

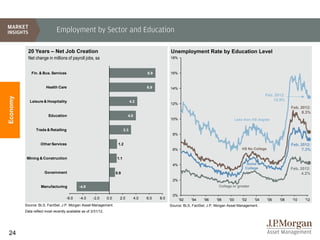

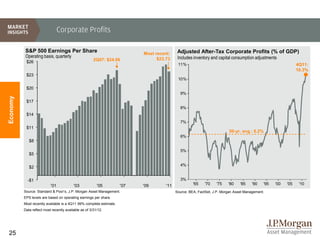

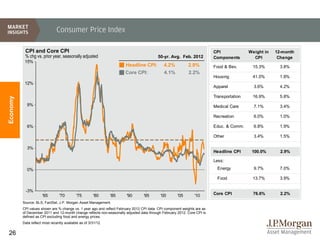

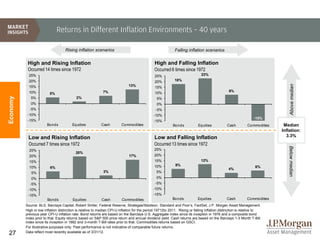

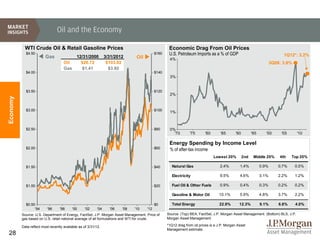

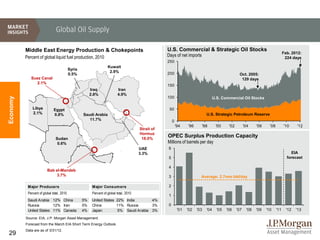

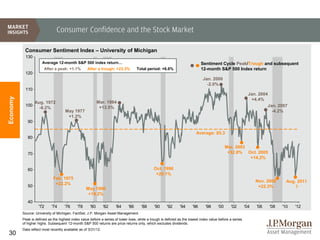

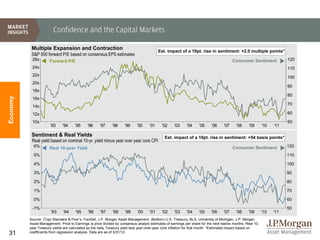

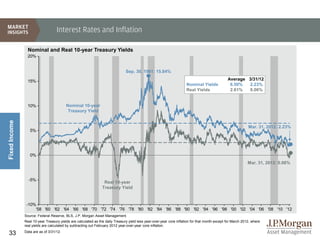

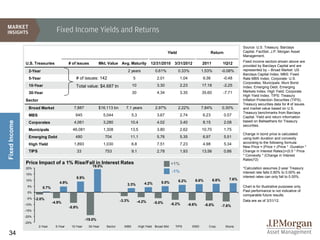

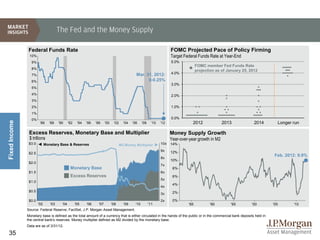

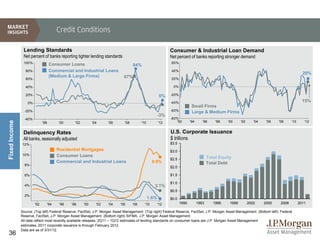

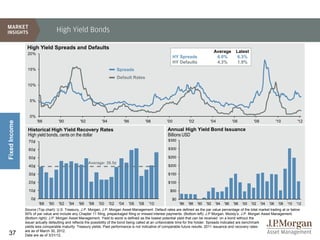

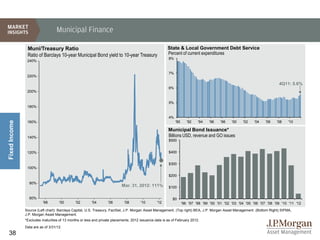

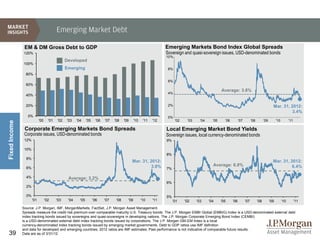

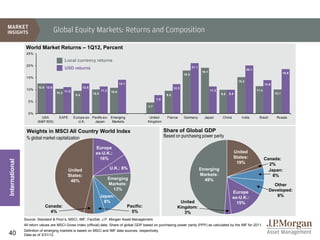

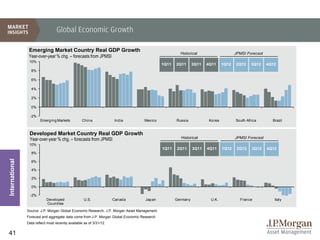

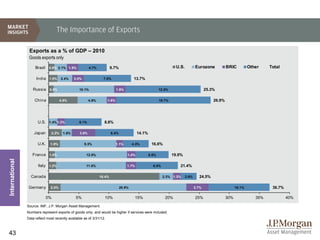

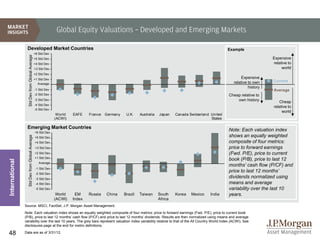

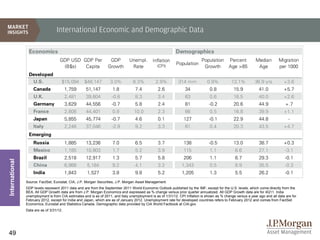

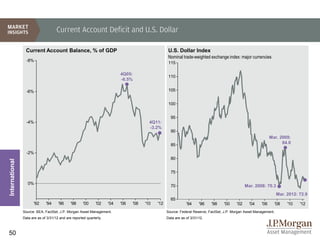

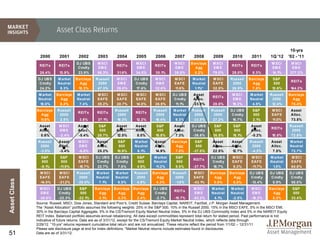

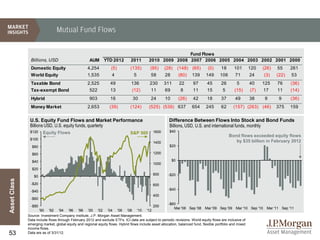

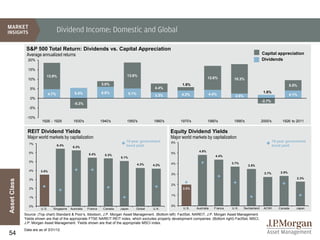

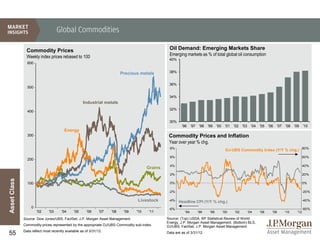

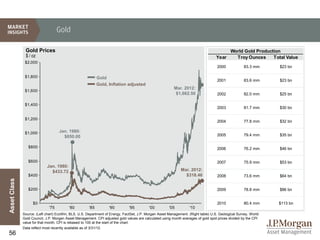

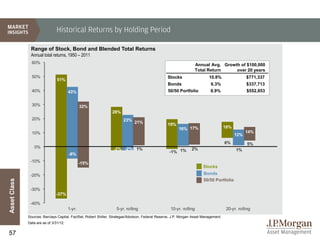

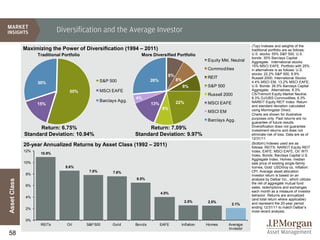

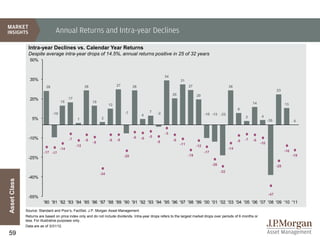

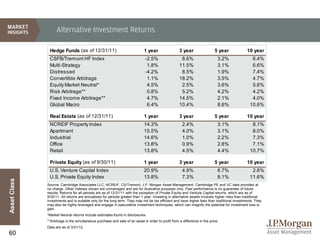

The document is a financial market guide as of March 31, 2012, covering various aspects of equities, fixed income, and the economy. It includes detailed analysis of historical market performance, investment style valuations, and data on returns by sector and asset class. Key insights include the performance of U.S. equity indexes, trends in economic growth, and the implications of monetary policy on investment strategies.