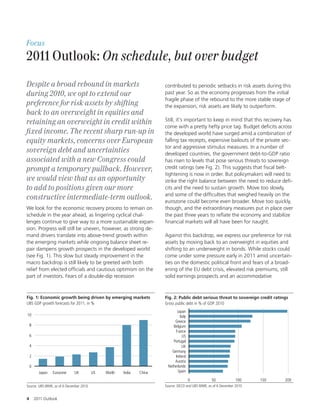

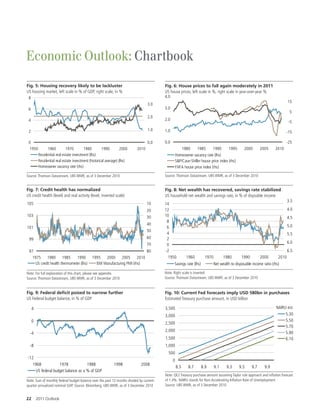

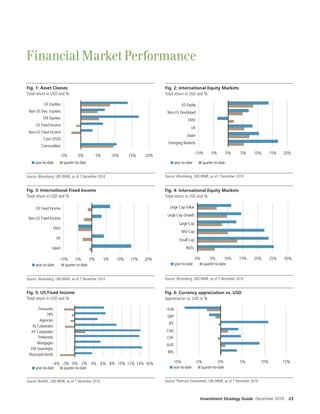

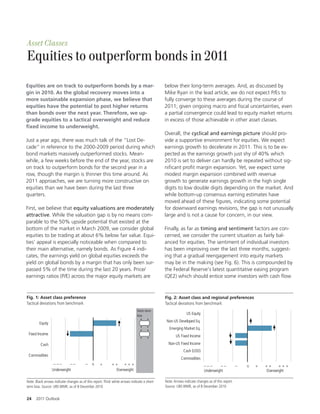

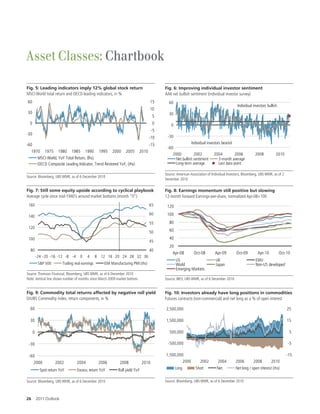

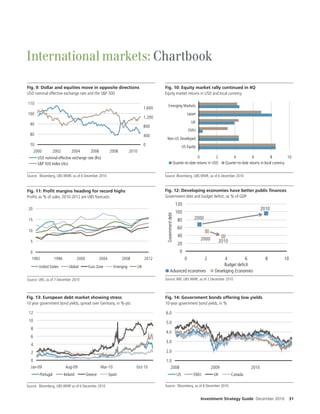

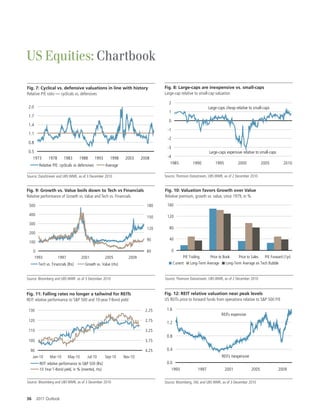

The document provides an outlook on investment strategies for 2011. It finds that while the global economic recovery remains on track, fiscal risks from high budget deficits across developed nations remain a concern. As such, the recovery has been "on schedule, but over budget." The outlook shifts to an overweight position in equities and credits within fixed income, seeing opportunities for risk assets to outperform as the recovery transitions from early to later stages. However, it cautions that high government debt levels pose risks and fiscal belt-tightening will be needed, which could lead to temporary pullbacks in riskier assets.