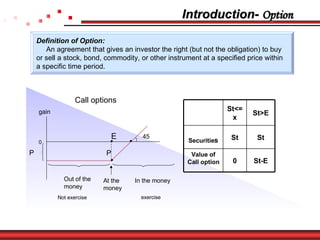

The document summarizes research on when joint ventures result in acquisitions. It finds that acquisitions are more likely when market signals show industry shipments increasing beyond historical trends, indicating rising venture value. Managers use these cues to time exercising their option to acquire. Concentrated industries and ventures in R&D/marketing also see higher acquisition rates. The research suggests managers rationally time acquisitions to changes in perceived venture value rather than reacting to short-term fluctuations.