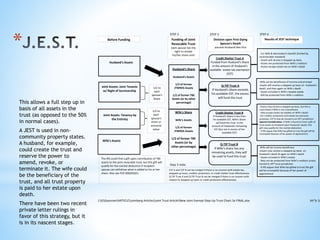

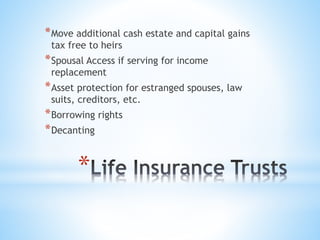

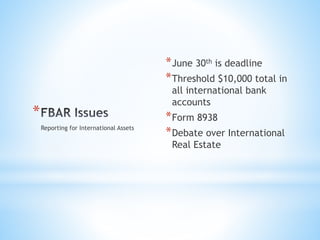

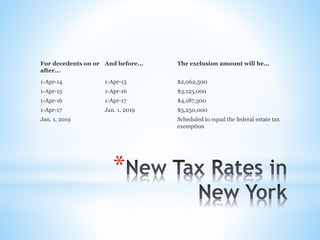

The document discusses advanced strategies for estate planning, focusing on the implications of increased federal exemption and the intertwining of income tax and estate planning. Key topics include the benefits of joint exempt step-up trusts (JEST), the role of grantor trusts for income tax planning, and various trust structures to optimize tax outcomes for the surviving spouse and heirs. Additionally, it addresses the impact of tax law changes on asset transfers, capital gains, and potential pitfalls in estate management, particularly for non-citizen spouses and international assets.