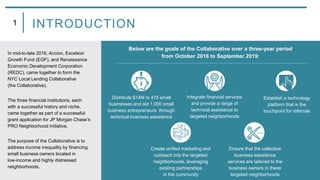

The interim progress report details the NYC Local Lending Collaborative formed by Accion, Excelsior Growth Fund, and Renaissance Economic Development Corporation to improve financial access for small businesses in low-income neighborhoods. Goals include distributing $14 million to 475 businesses over three years and enhancing collaborative capabilities, though partners face challenges in aligning individual and collective goals, communication, and decision-making. Key recommendations focus on improving project management, clarifying goals, and empowering sub-committees for better ownership and effectiveness in executing the collaborative's initiatives.