Embed presentation

Downloaded 21 times

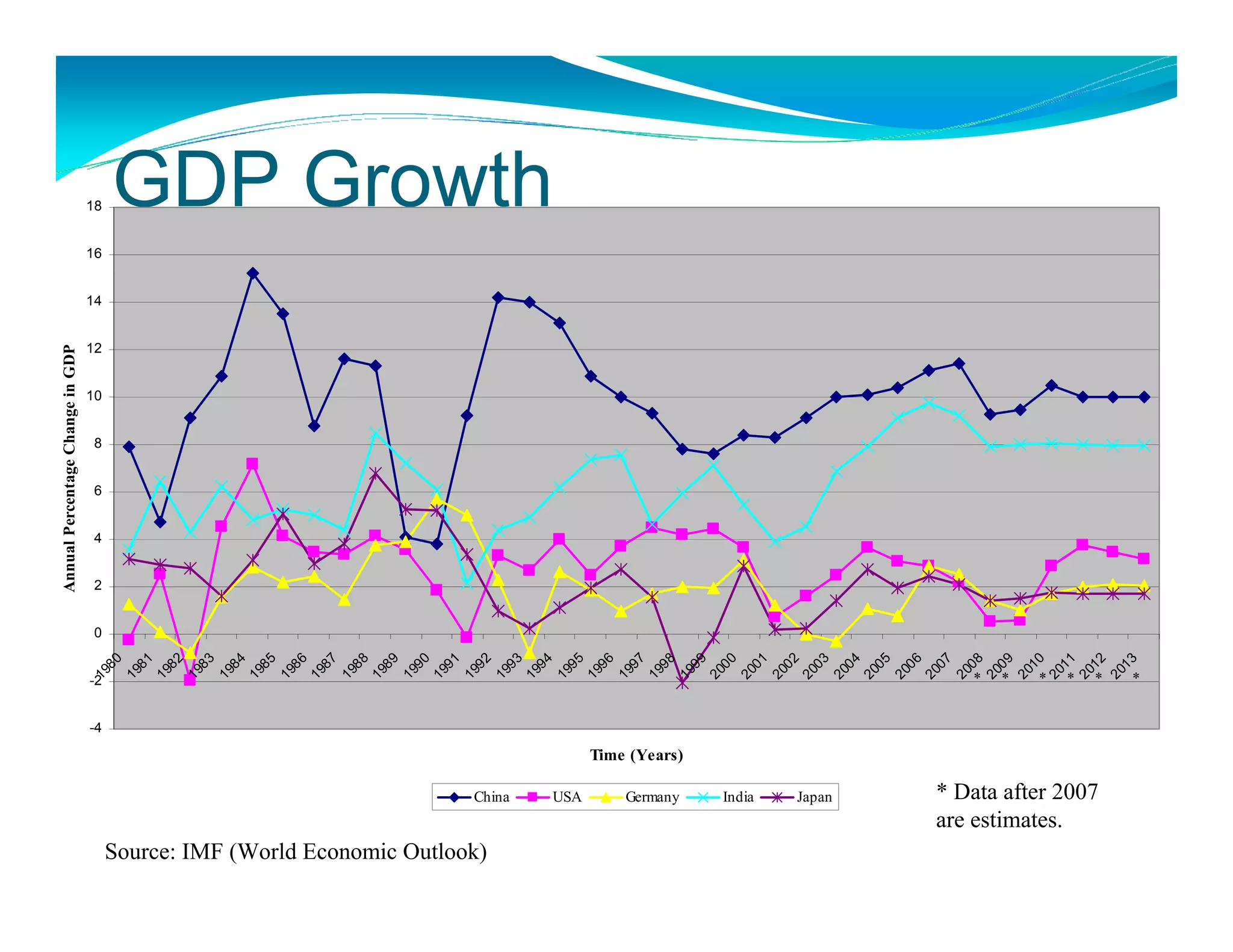

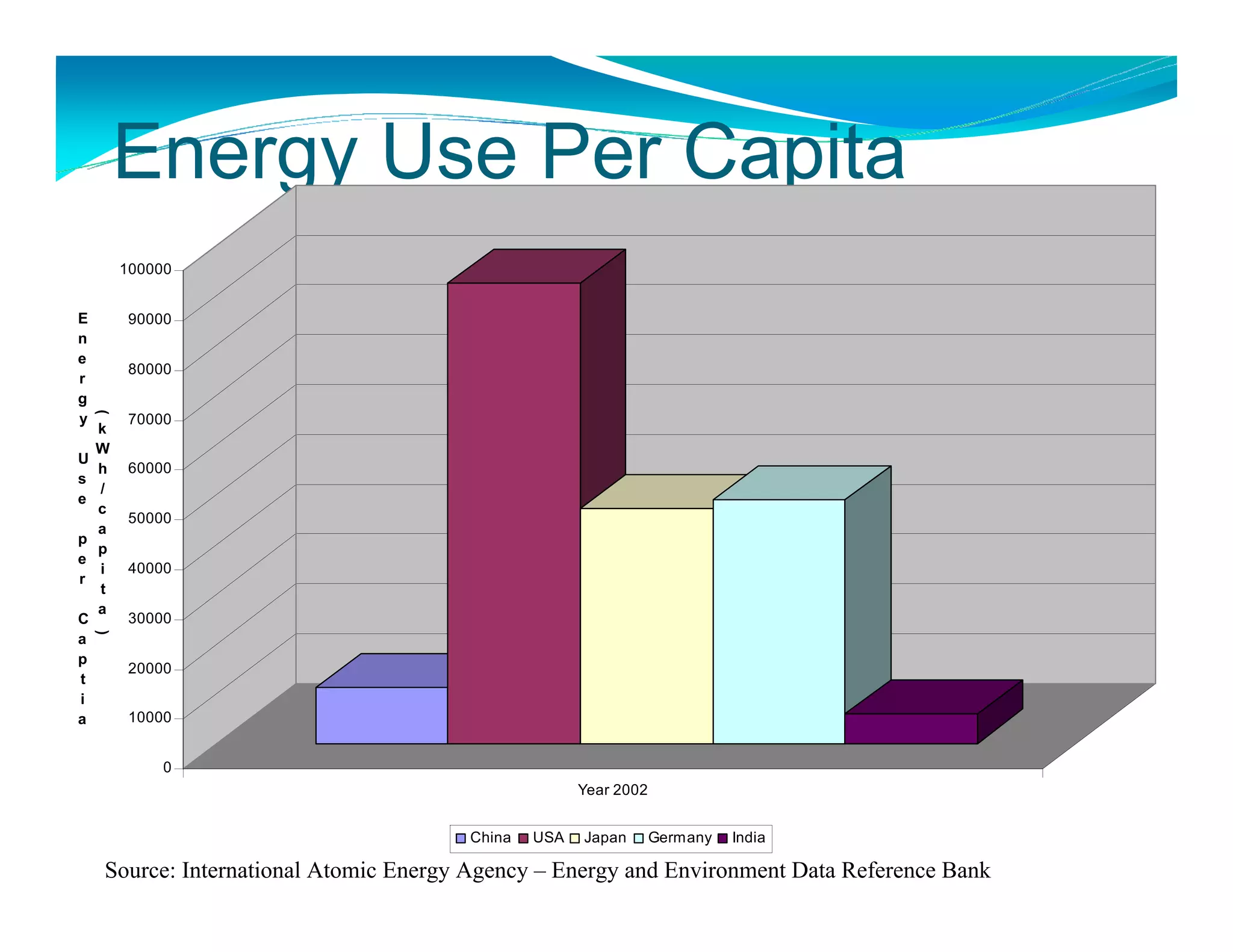

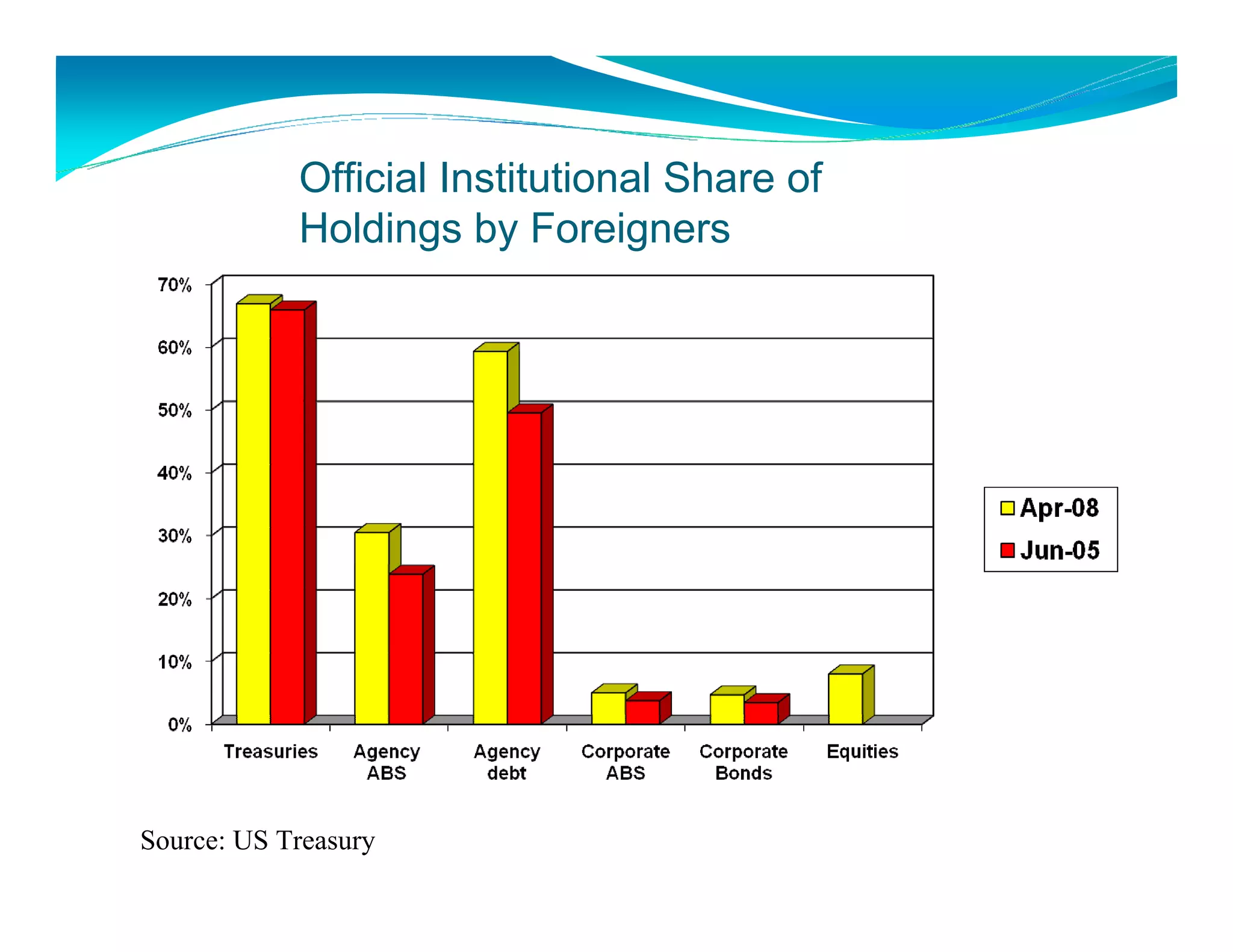

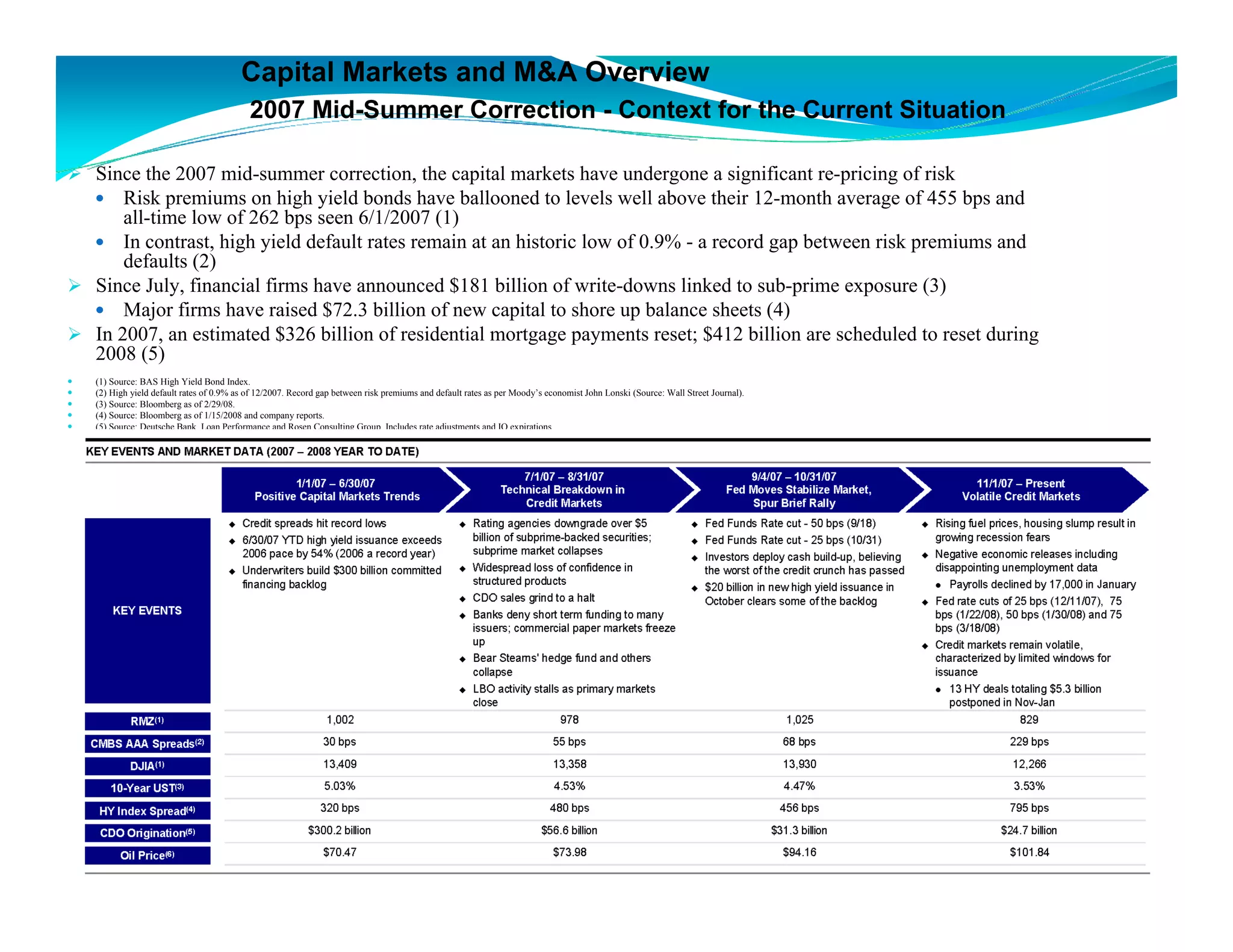

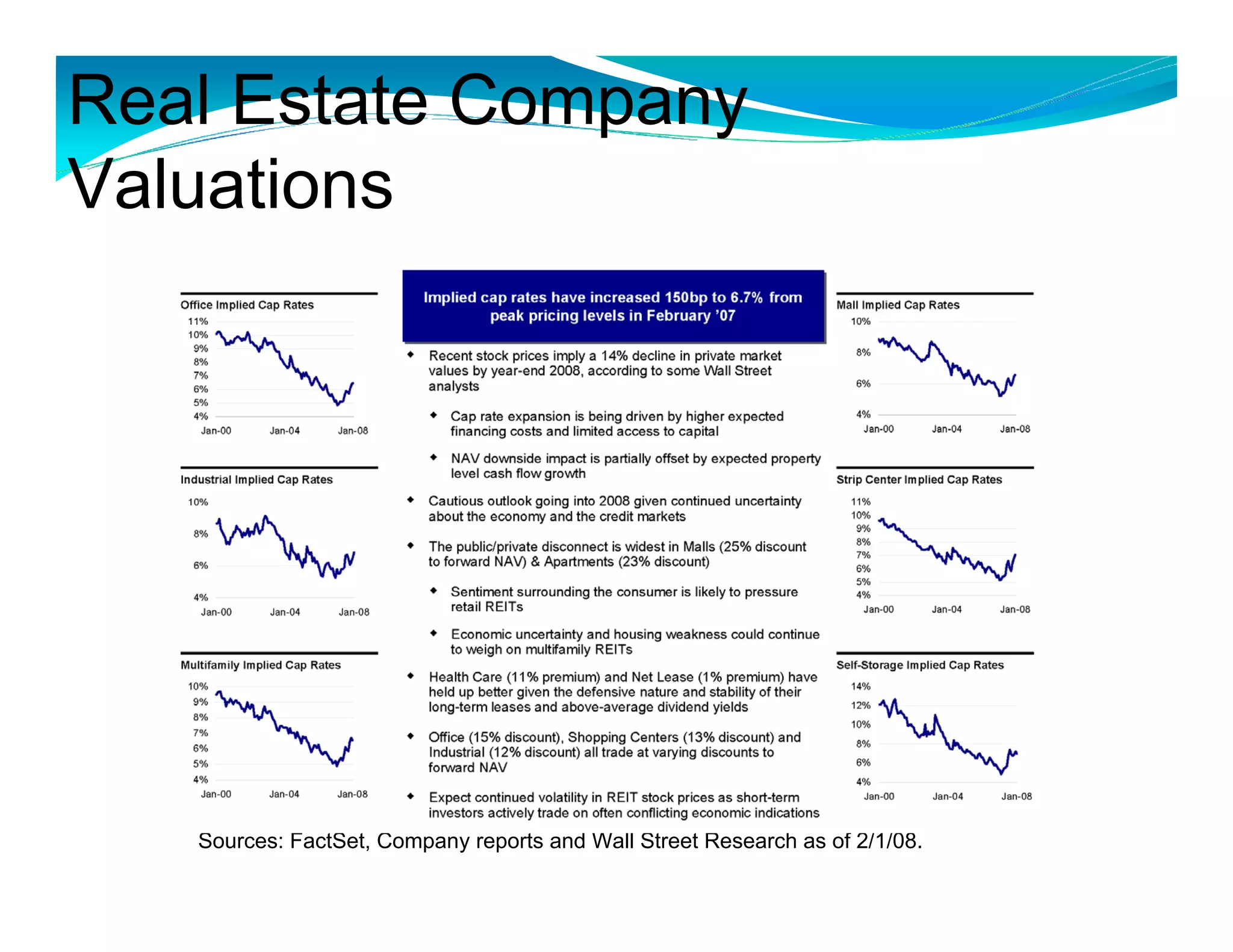

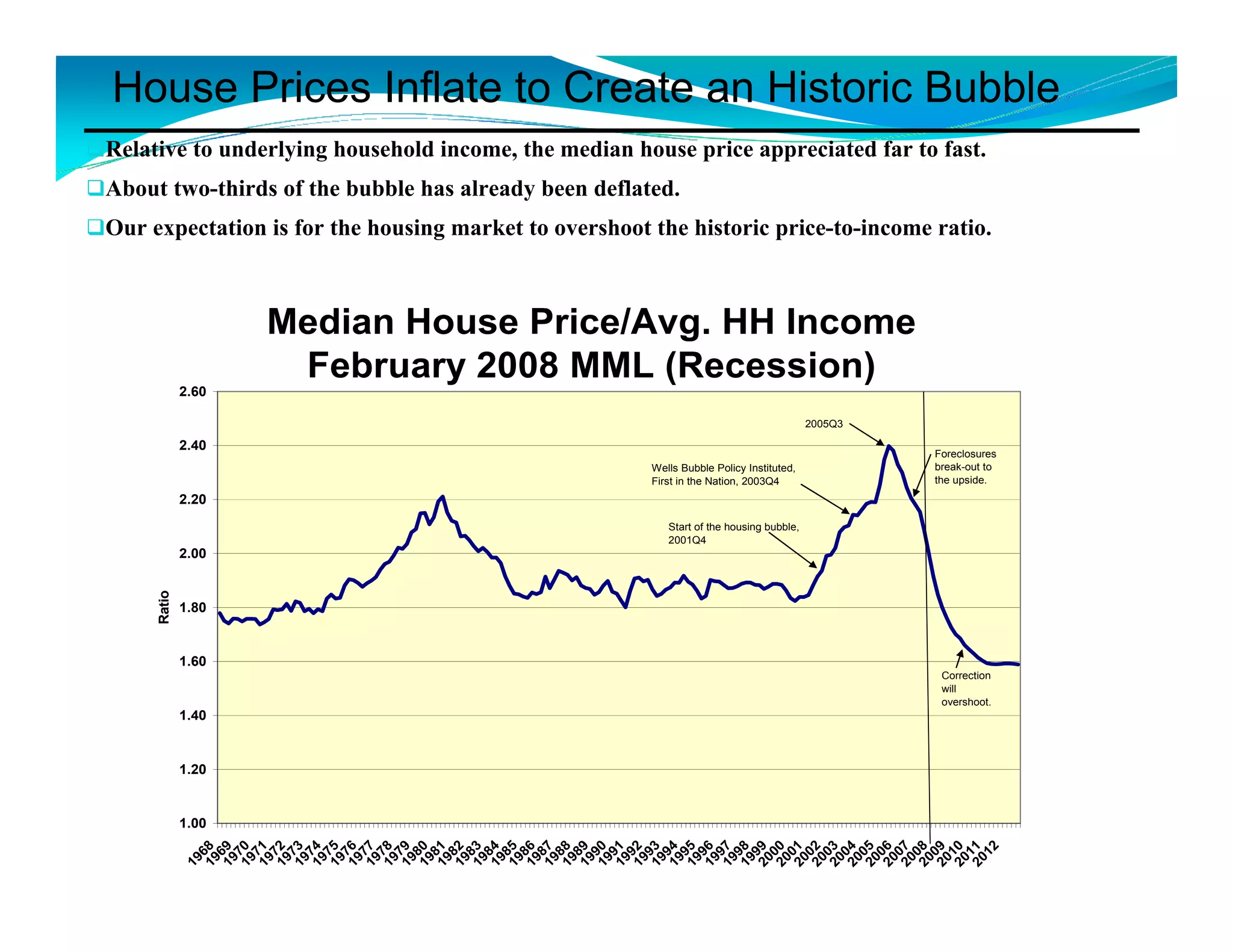

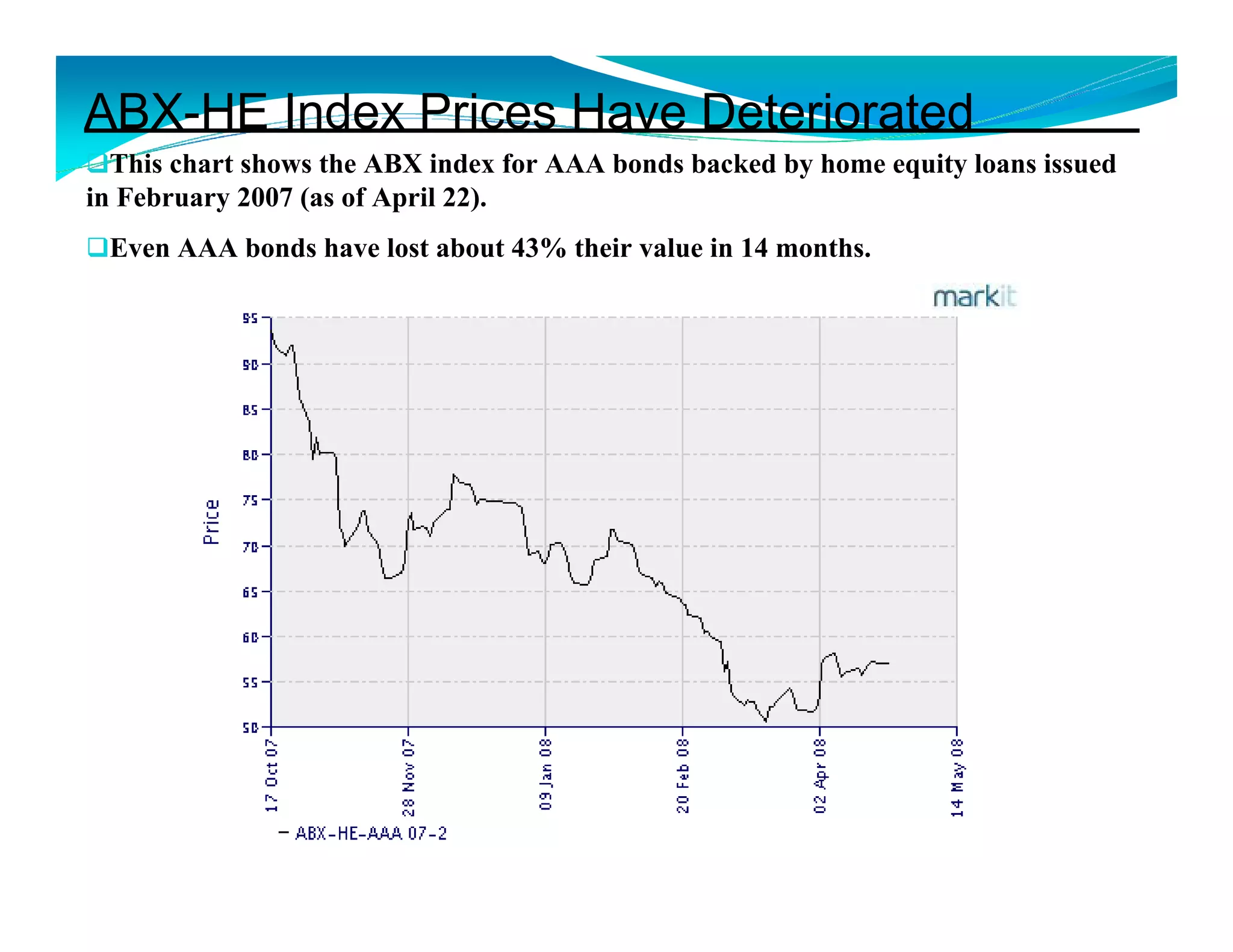

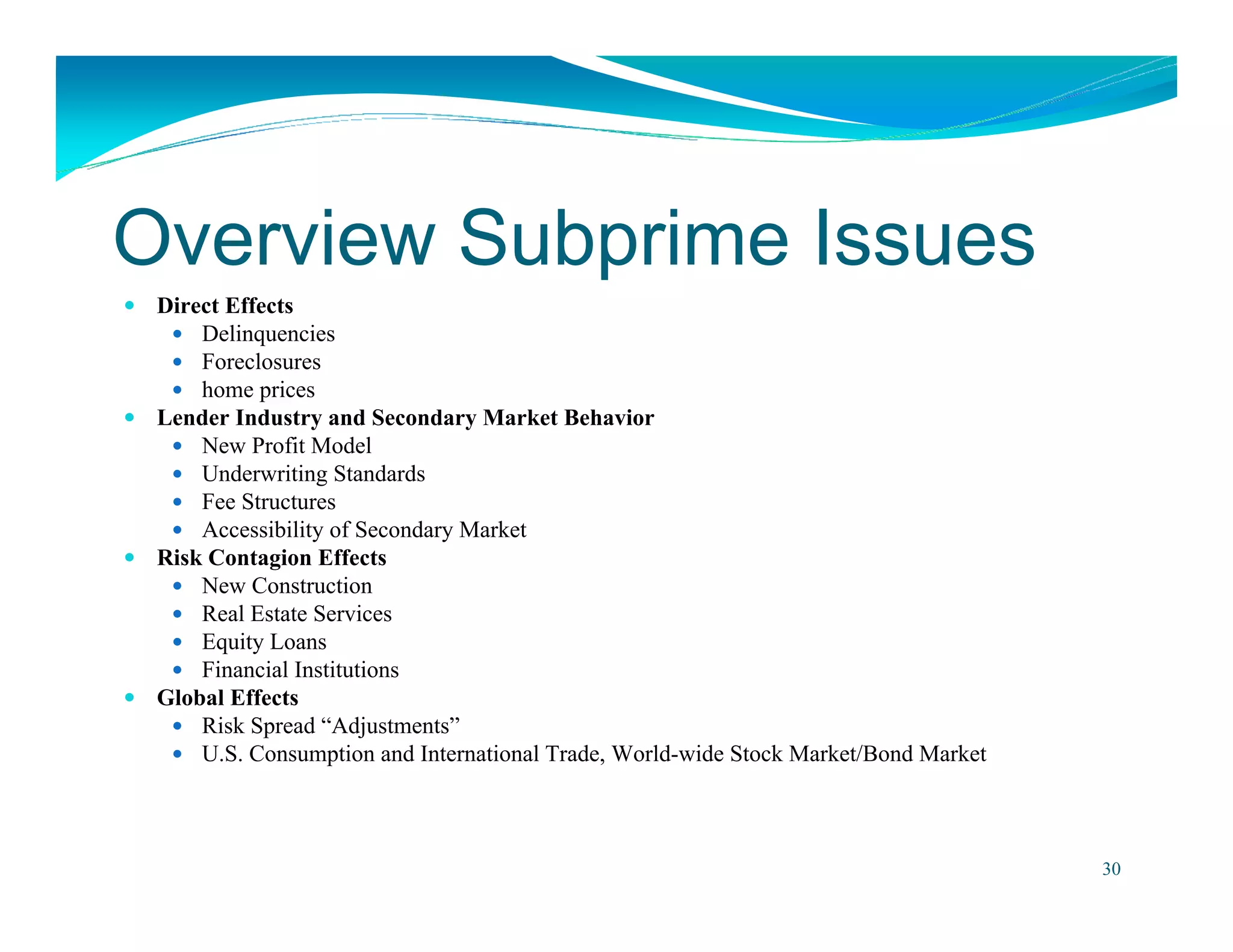

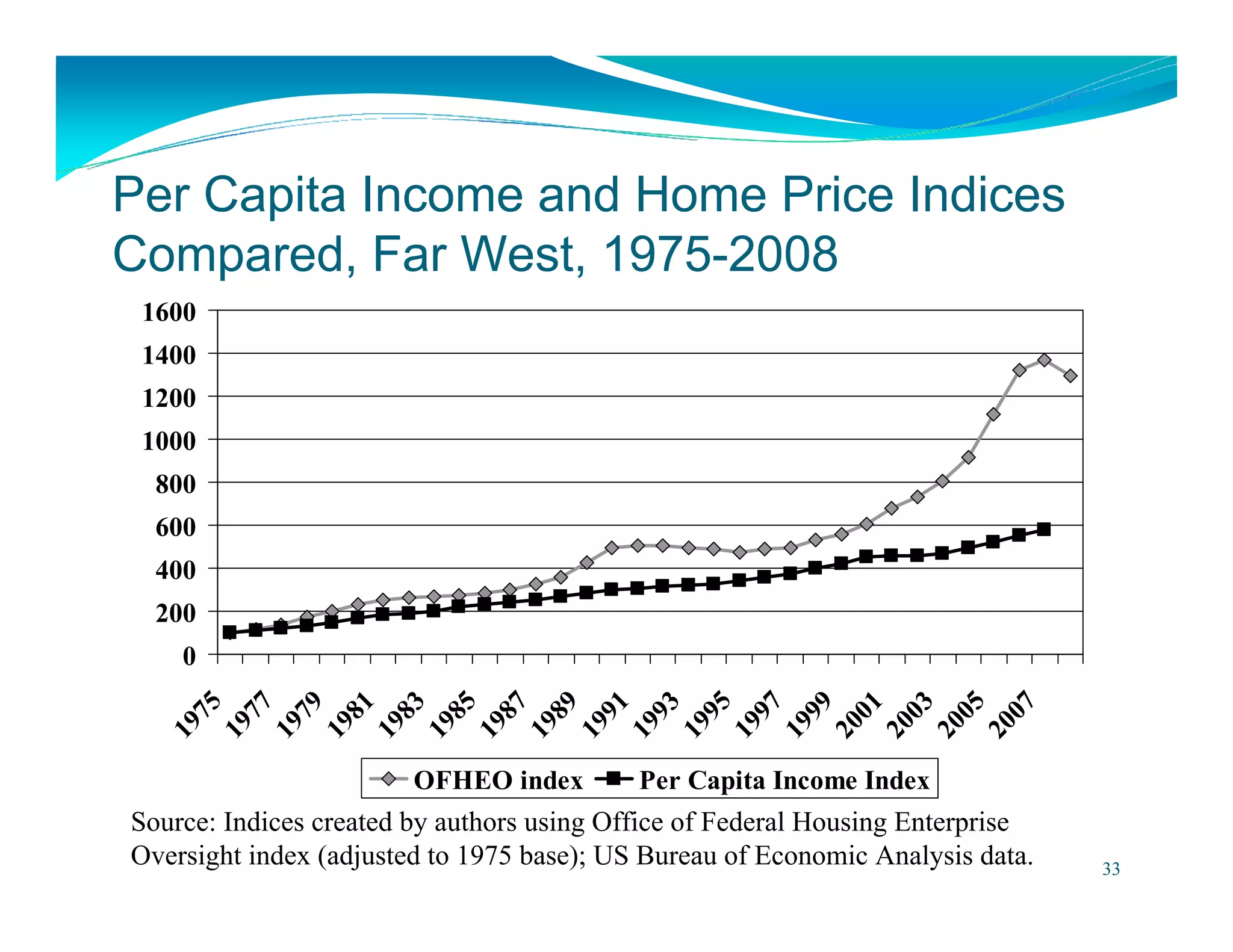

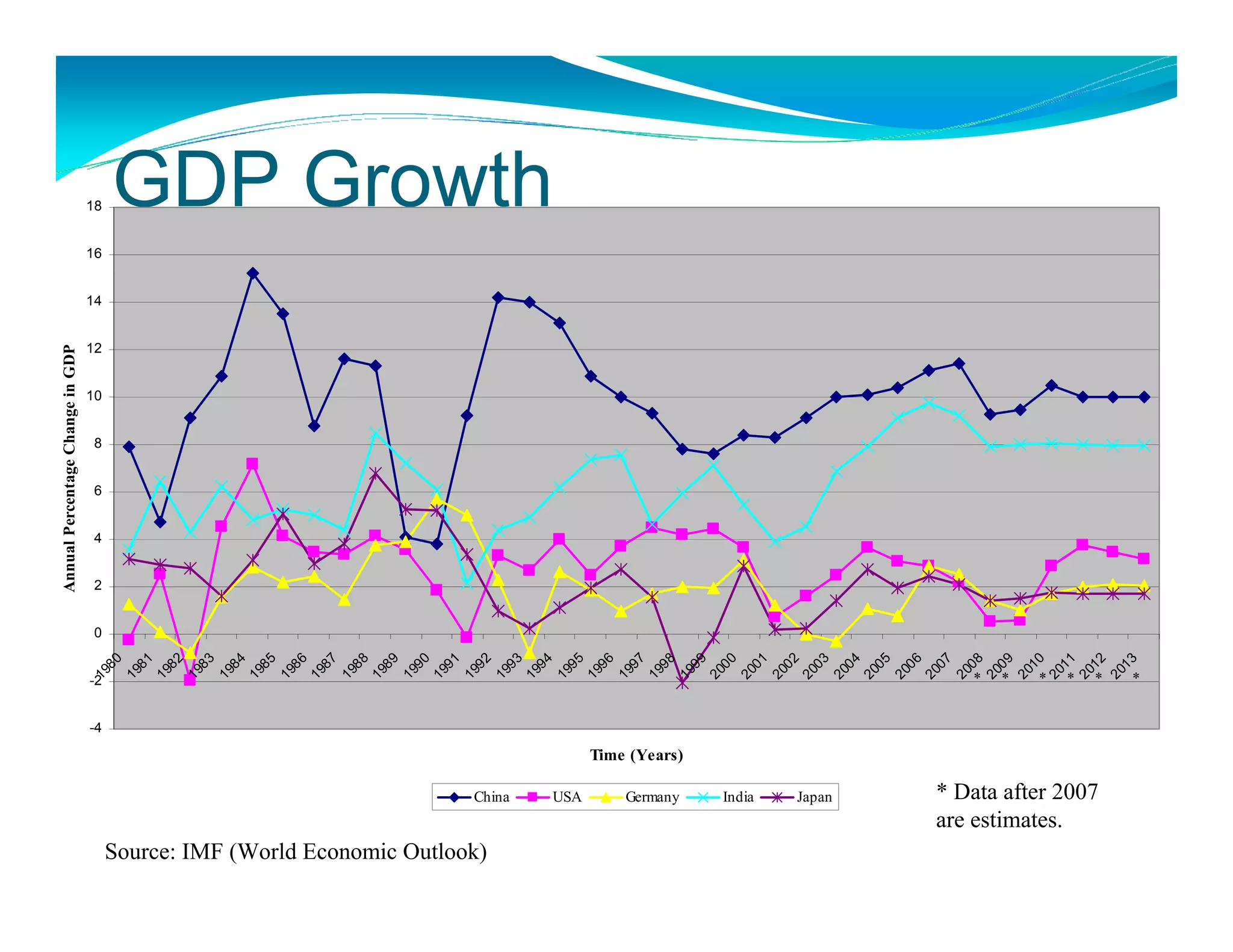

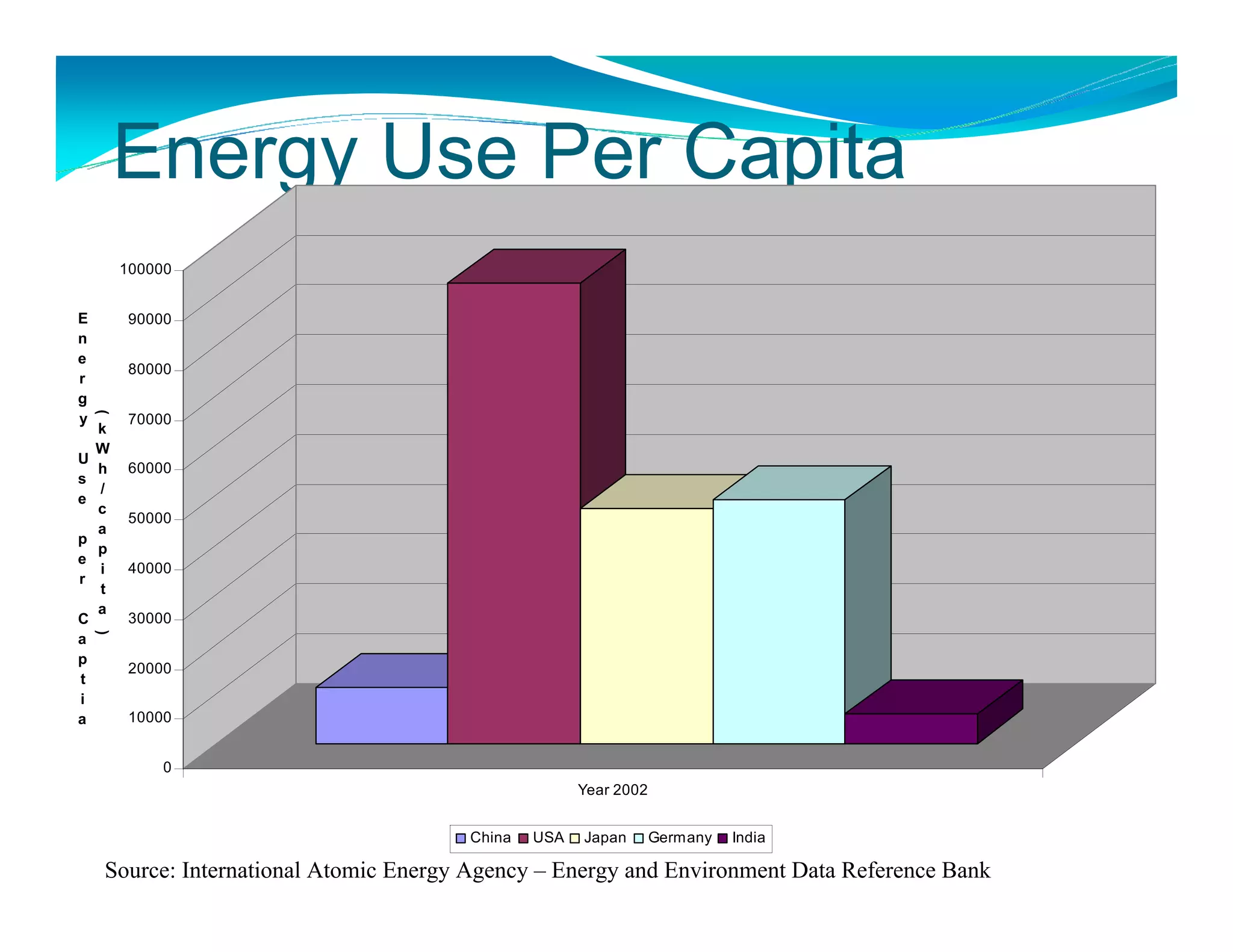

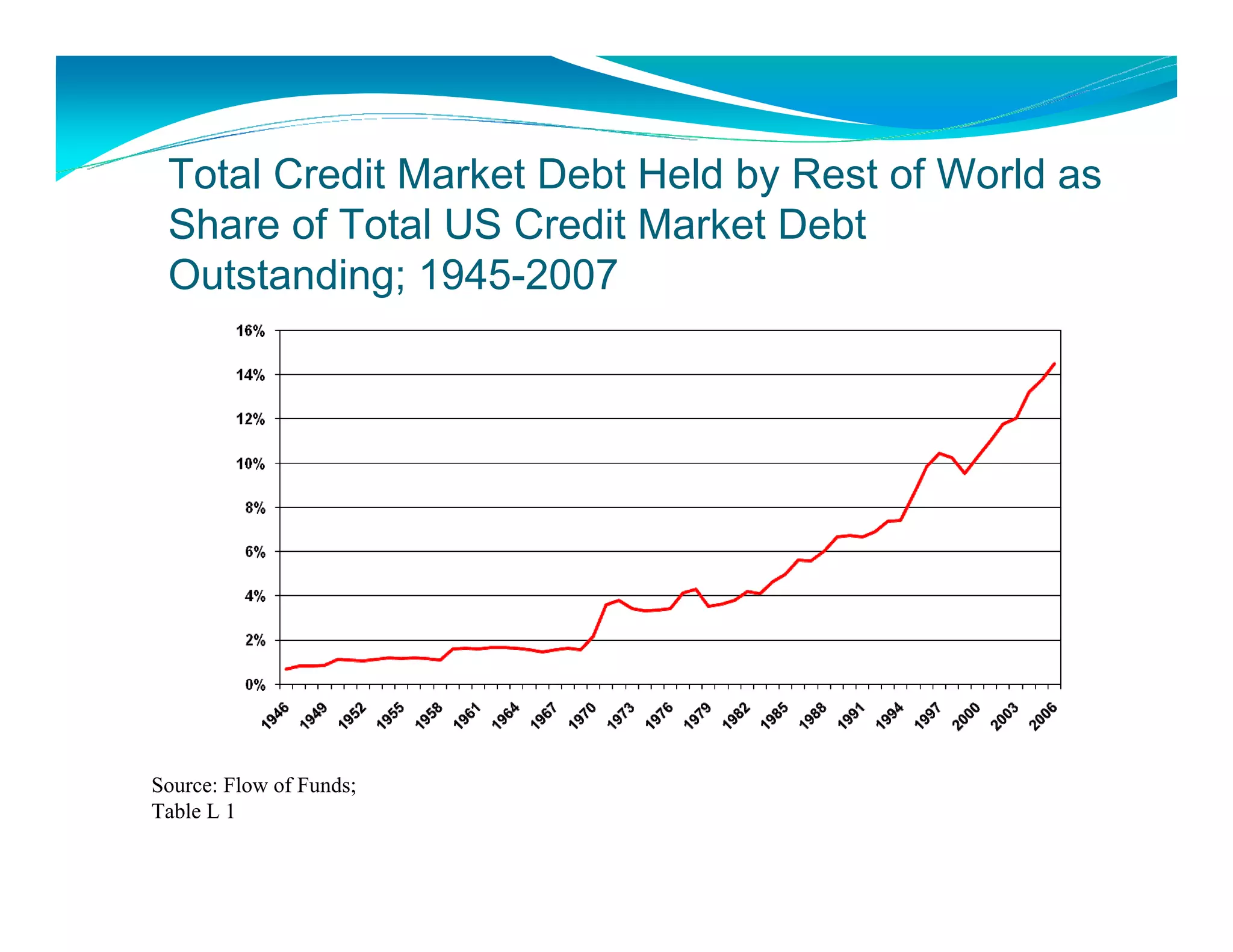

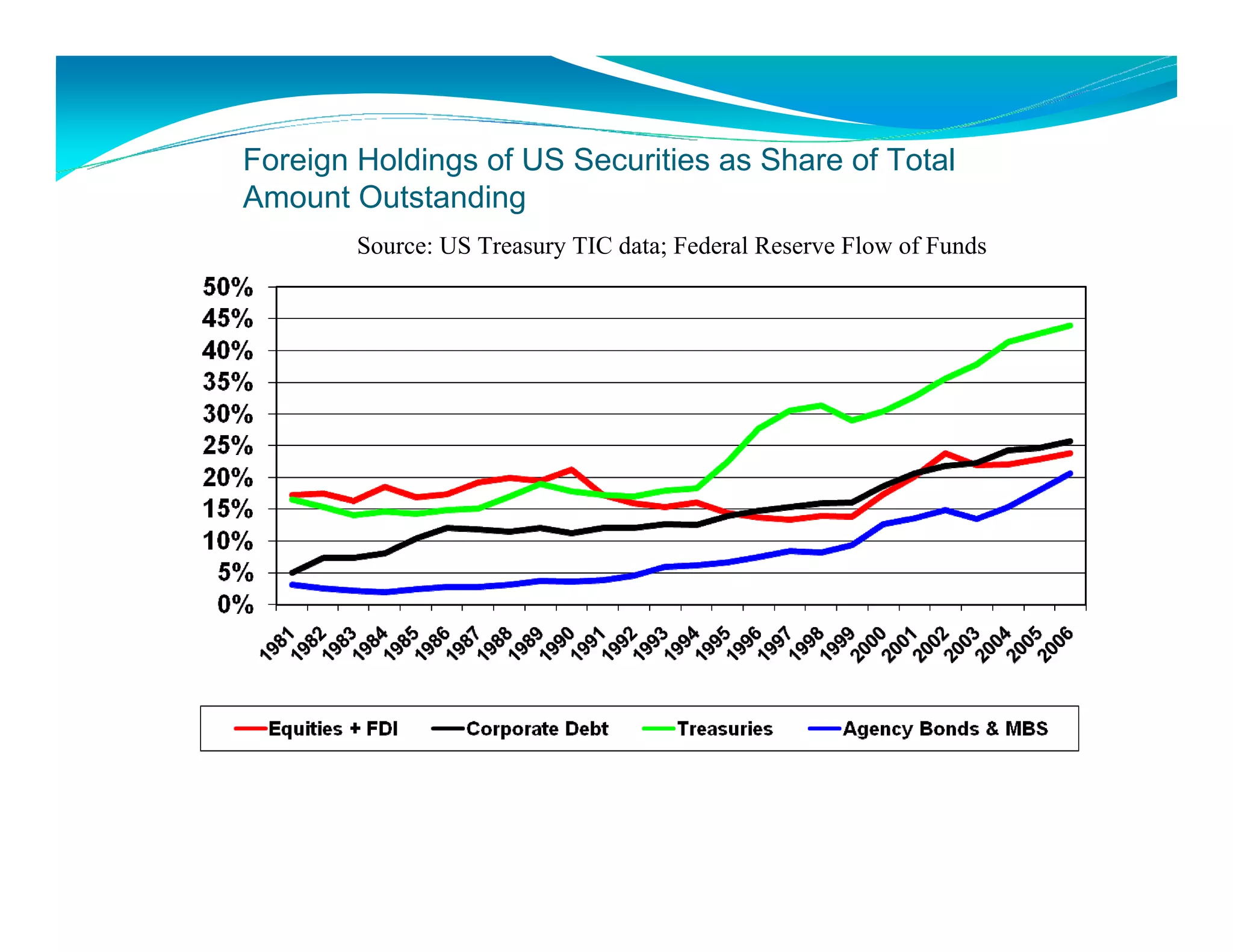

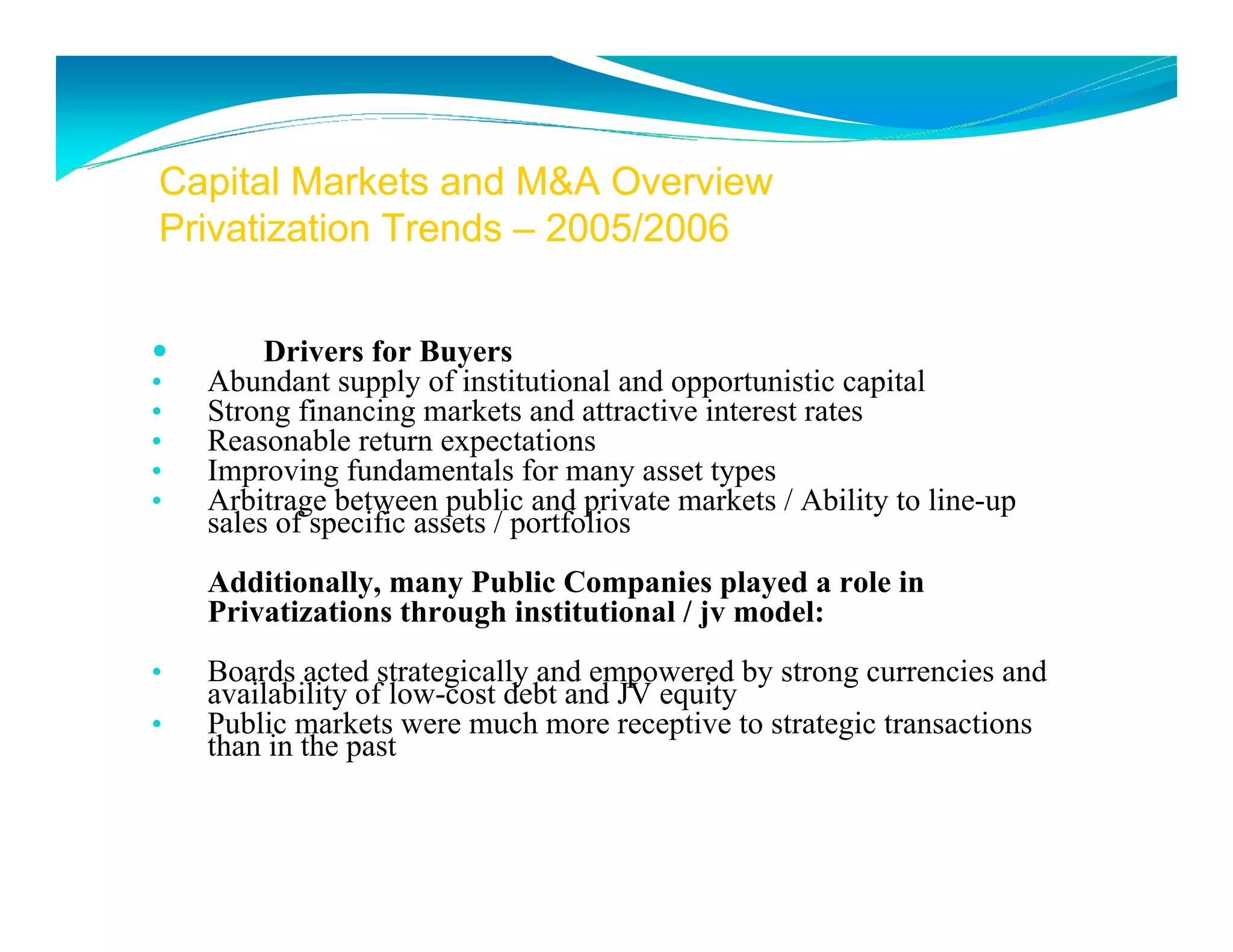

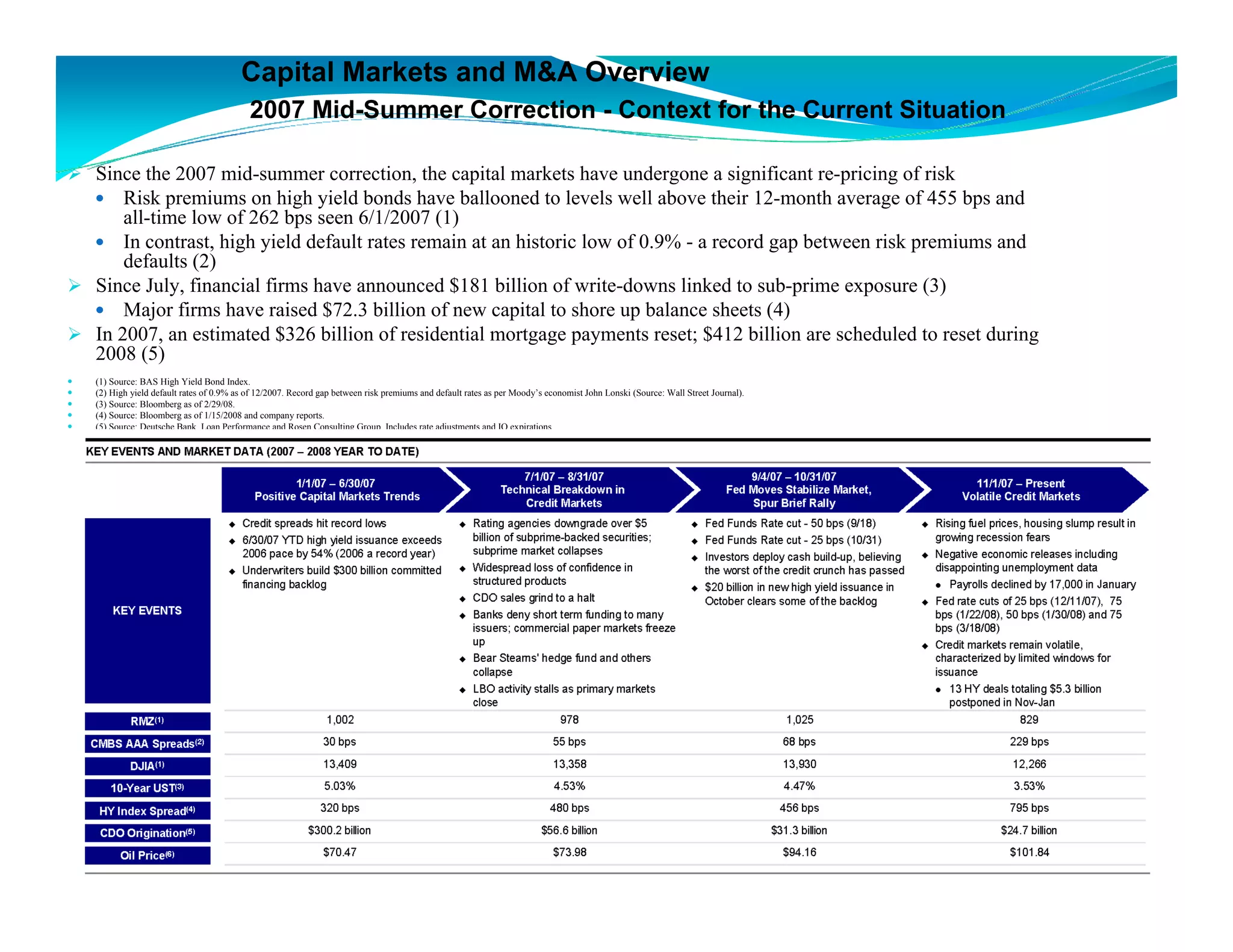

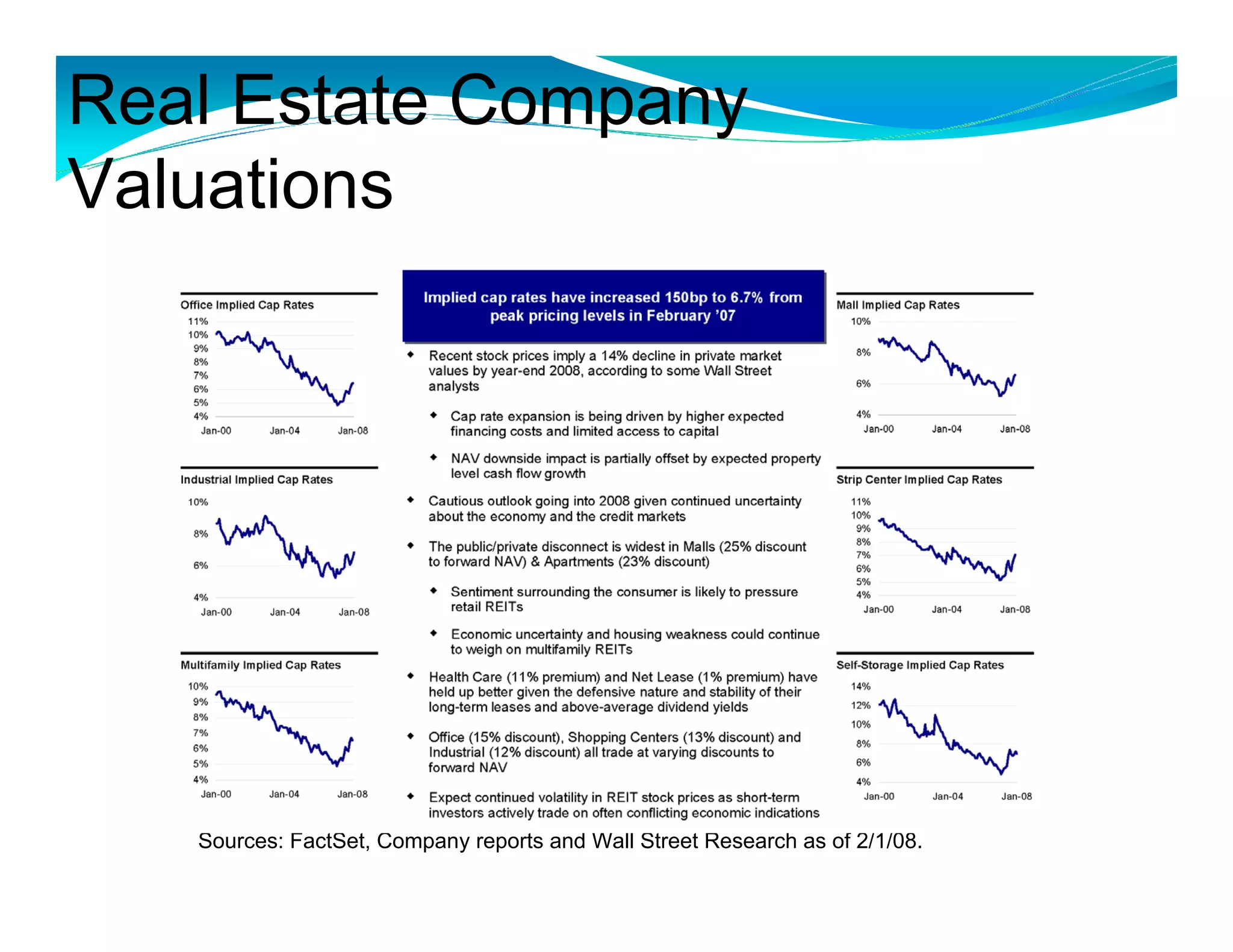

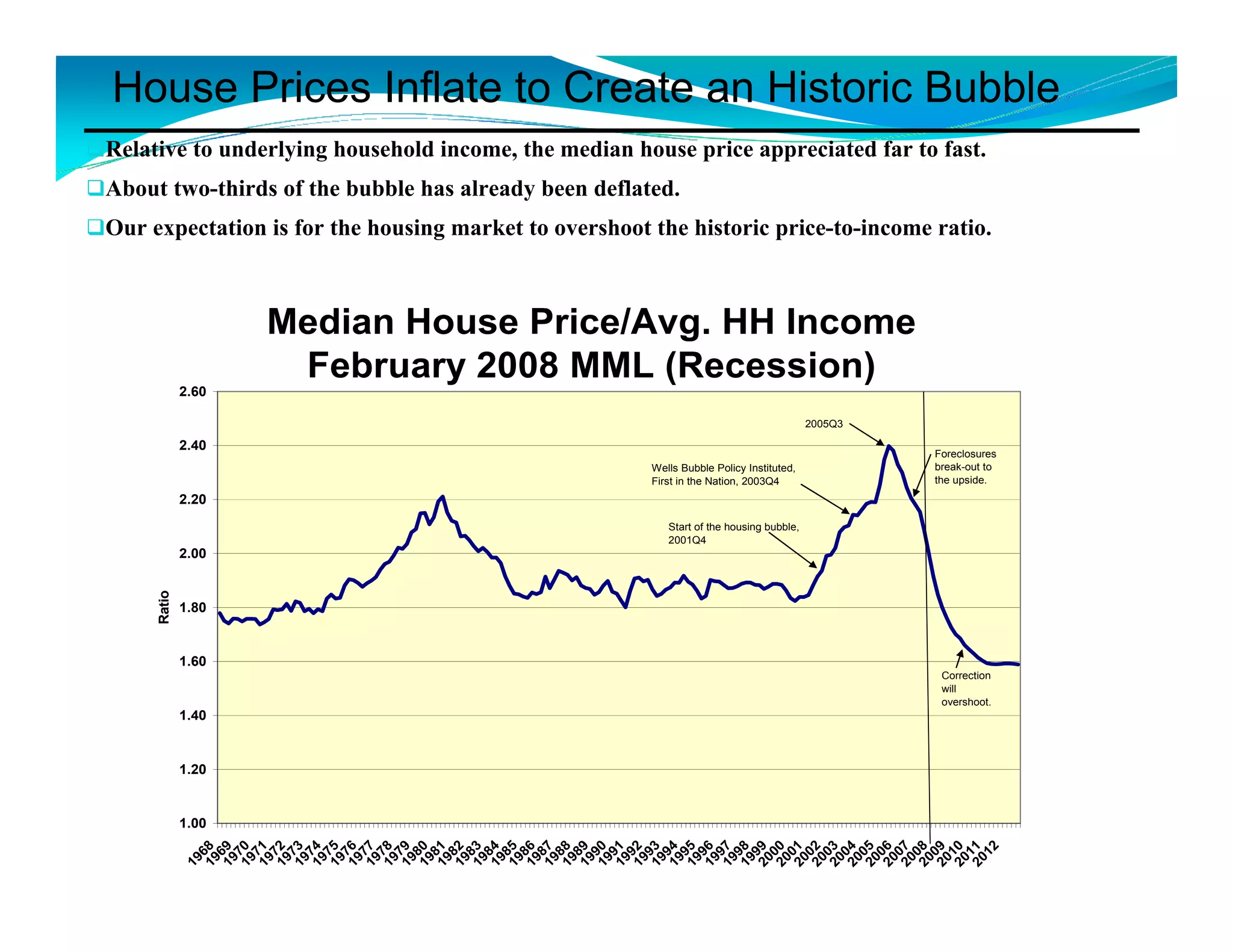

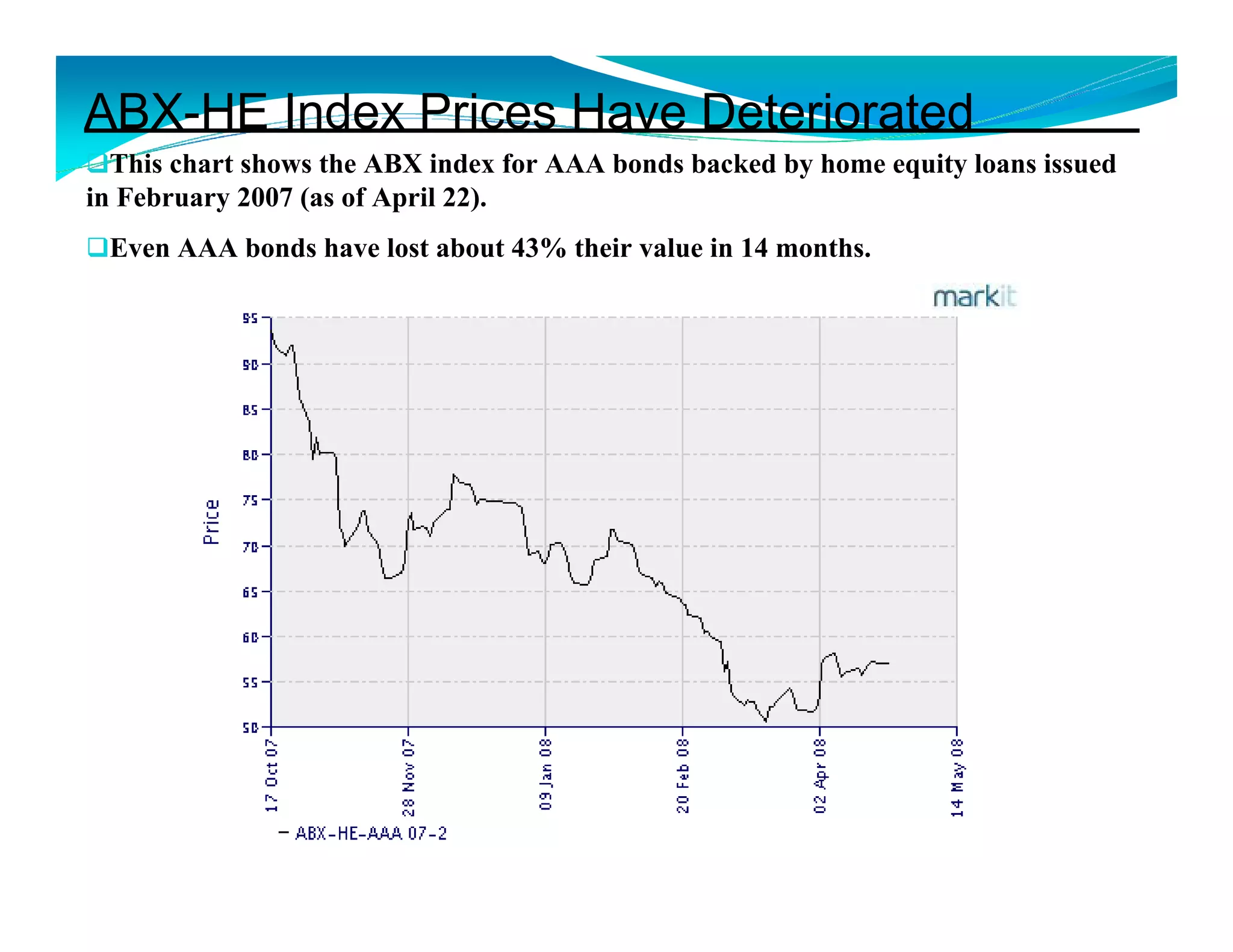

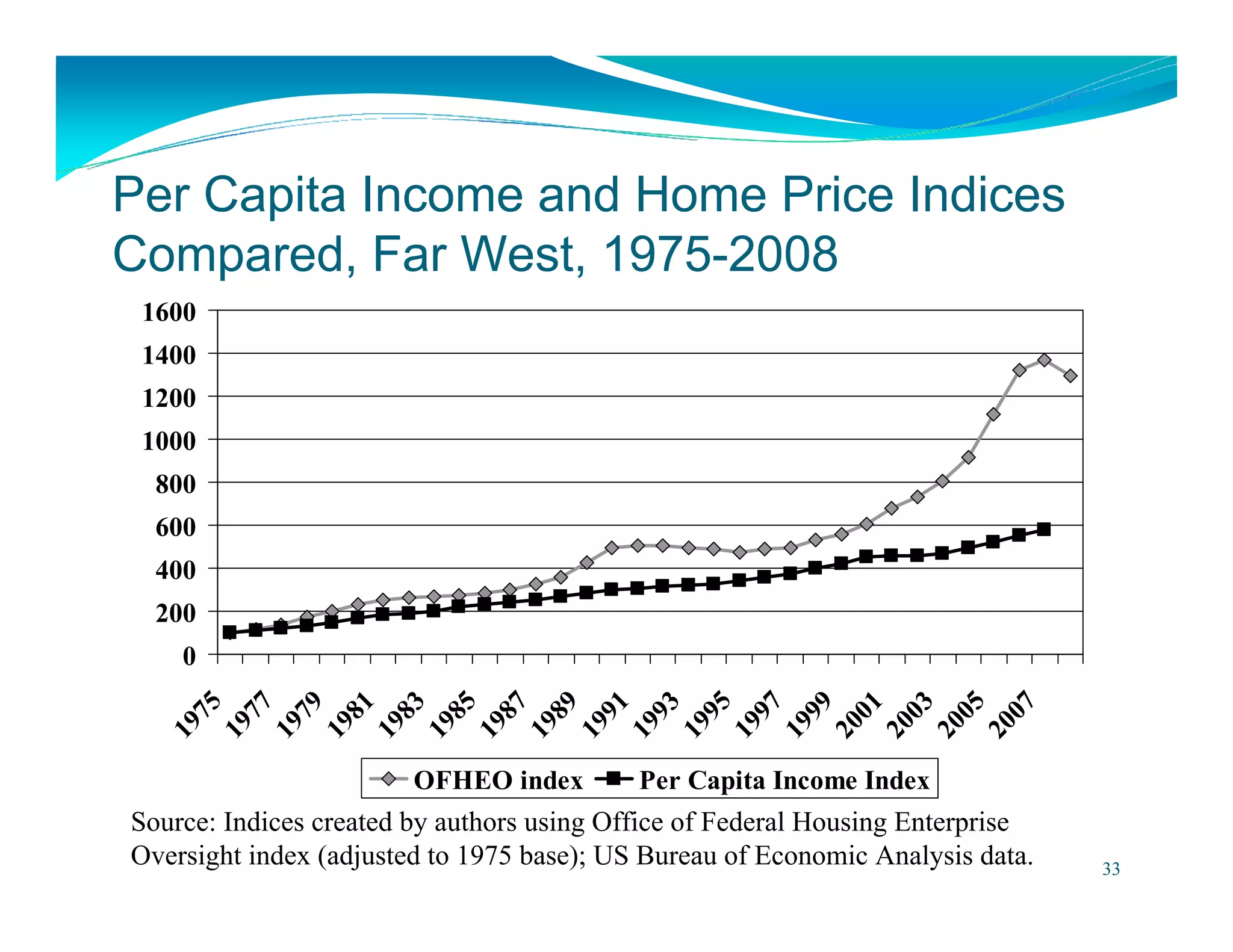

This document summarizes Robert H. Edelstein's presentation on long-term and short-term economic issues. The presentation discusses fundamental drivers of the global economy like competition and globalization. It analyzes growth in countries like China, India, and the US. It also examines issues like the US economy, capital markets, the subprime crisis, housing prices, and elements needed for short-term and long-term resolution of financial crises.