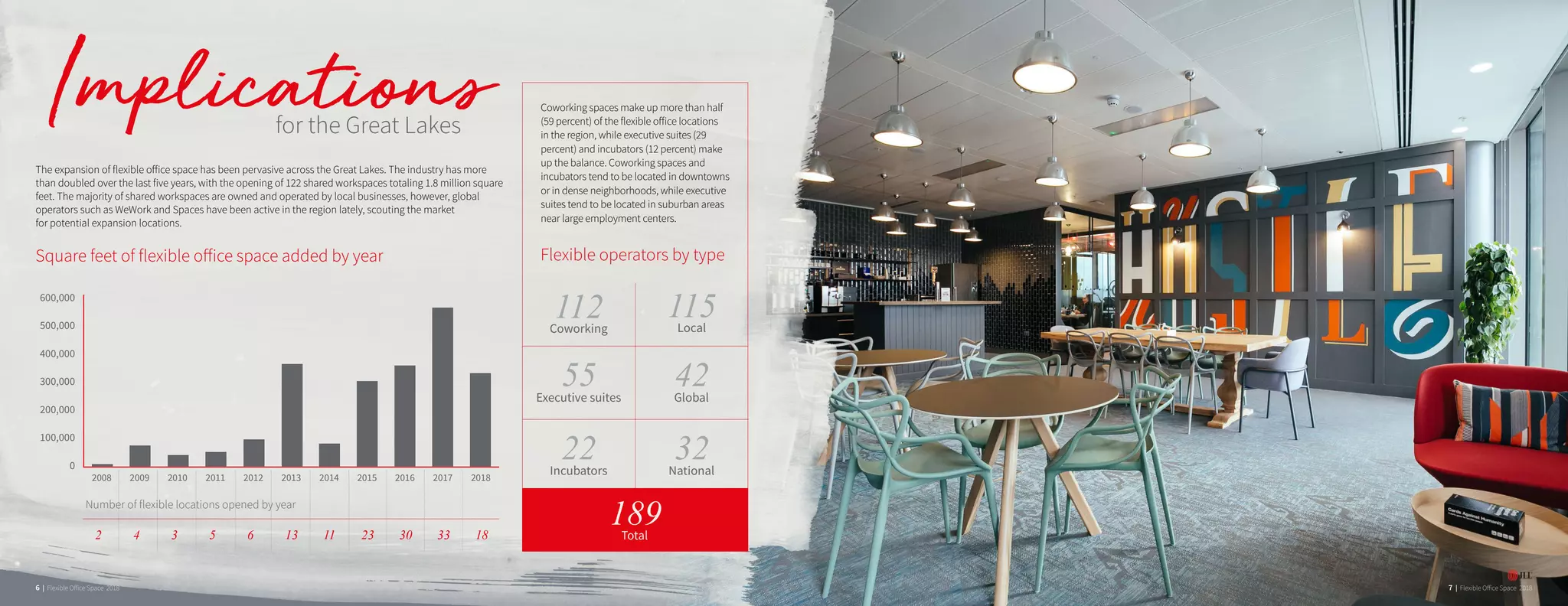

The report discusses the rapid growth and adoption of flexible office spaces, highlighting that corporations increasingly use shared workspaces for cost efficiency and to adapt to changing market conditions. The flexible office market is becoming significant in the Great Lakes region, with notable growth in coworking spaces and major operators like WeWork. Despite market expansion, signs of saturation are limited, driven by strong corporate demand and varied flexible space solutions.