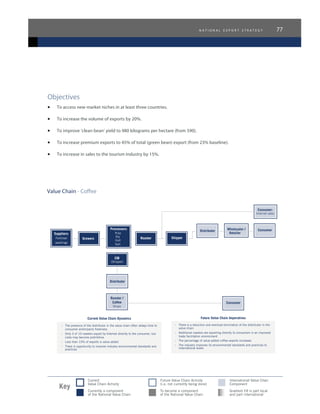

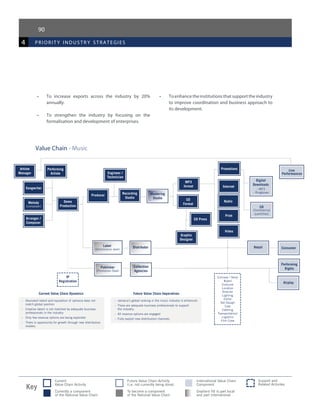

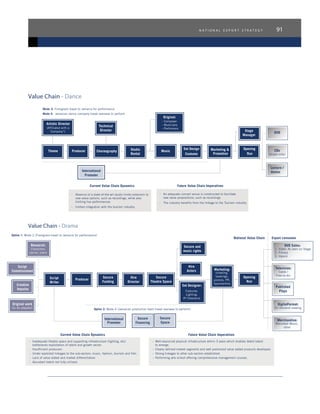

This document provides an overview of Jamaica's National Export Strategy. It discusses Jamaica's goal of achieving export-led growth and improving its export performance. It outlines Jamaica's assessment of its global competitiveness and identifies strengths, weaknesses, opportunities and threats. The document also describes the process used to develop the strategy, including prioritizing key industries. It highlights cross-cutting industry strategies and provides detailed strategies for priority industries such as agro-processing, aquaculture, coffee, education and others. Finally, it discusses strategy management, including institutional support and monitoring.