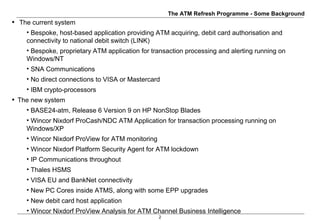

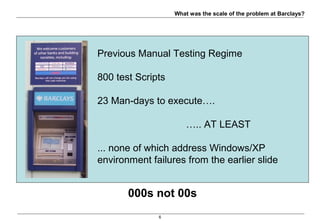

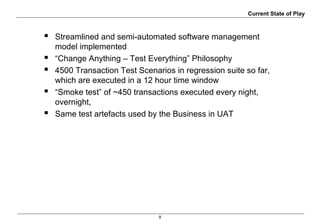

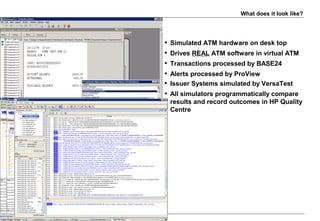

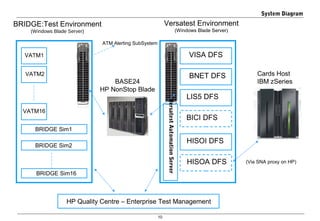

The document discusses the ATM Refresh Programme initiated by Eurostar, detailing the transition from a bespoke ATM system to a new, advanced platform designed to improve performance and reduce costs. It highlights the importance of implementing a continuous testing and quality assurance approach in managing ATM systems, emphasizing a 'change anything – test everything' philosophy. The investment in new testing tools and simulators aims to enhance speed and reduce risks in ATM operations while supporting broader training and integration across Barclays' network.