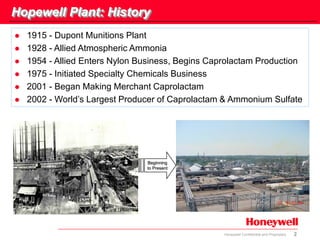

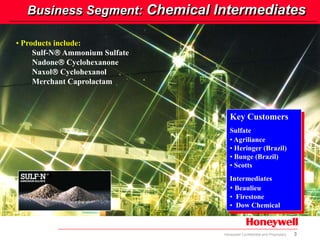

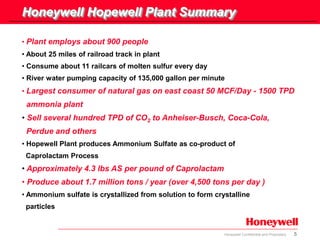

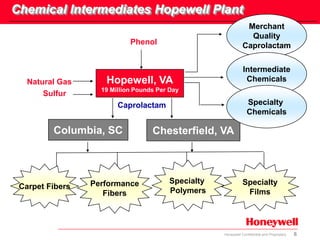

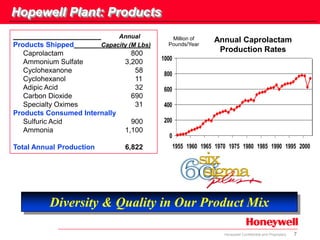

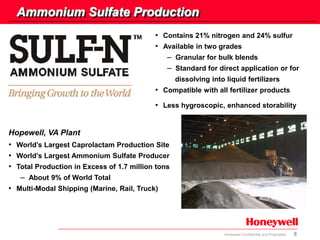

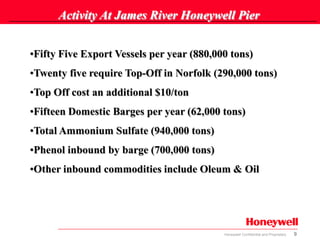

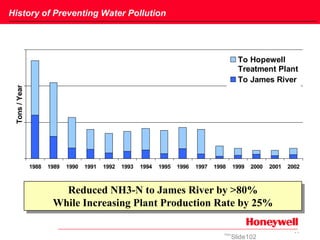

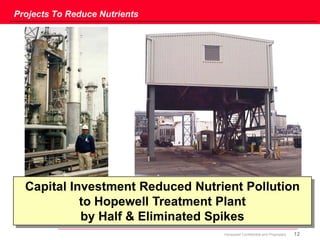

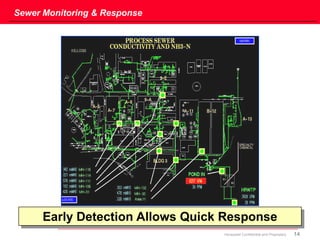

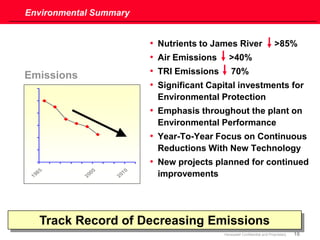

The document provides an overview of Honeywell's Hopewell, Virginia plant and its environmental performance. It describes the plant's history and products, including its position as the world's largest producer of caprolactam and ammonium sulfate. The plant ships over 900,000 tons of ammonium sulfate annually via its pier on the James River. It also discusses projects undertaken to reduce nutrient pollution to the river by over 85% while increasing production. The document highlights the plant's certified wildlife habitat and efforts to prevent water pollution and eliminate hydraulic oil from its loading equipment.