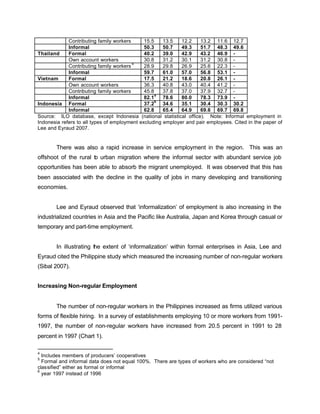

This document summarizes a presentation given by Jorge V. Sibal at the 10th National Convention on Statistics in the Philippines in 2007. The presentation discussed measuring and defining the informal sector in the Philippines and trends in Asia. It provided definitions of the informal sector from the ILO and Philippines, and described common characteristics like composition, activities, organization, problems, and lack of government assistance.