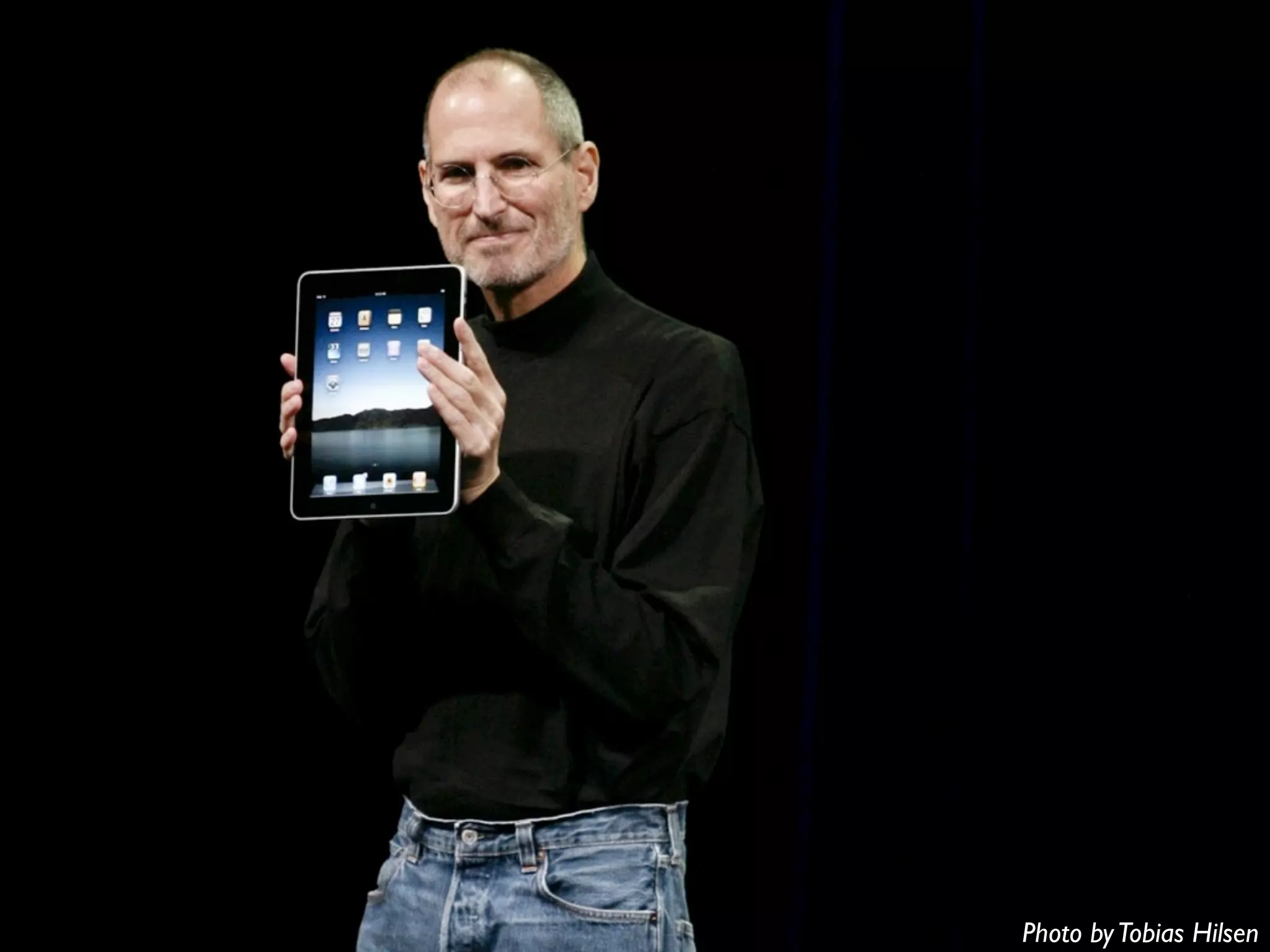

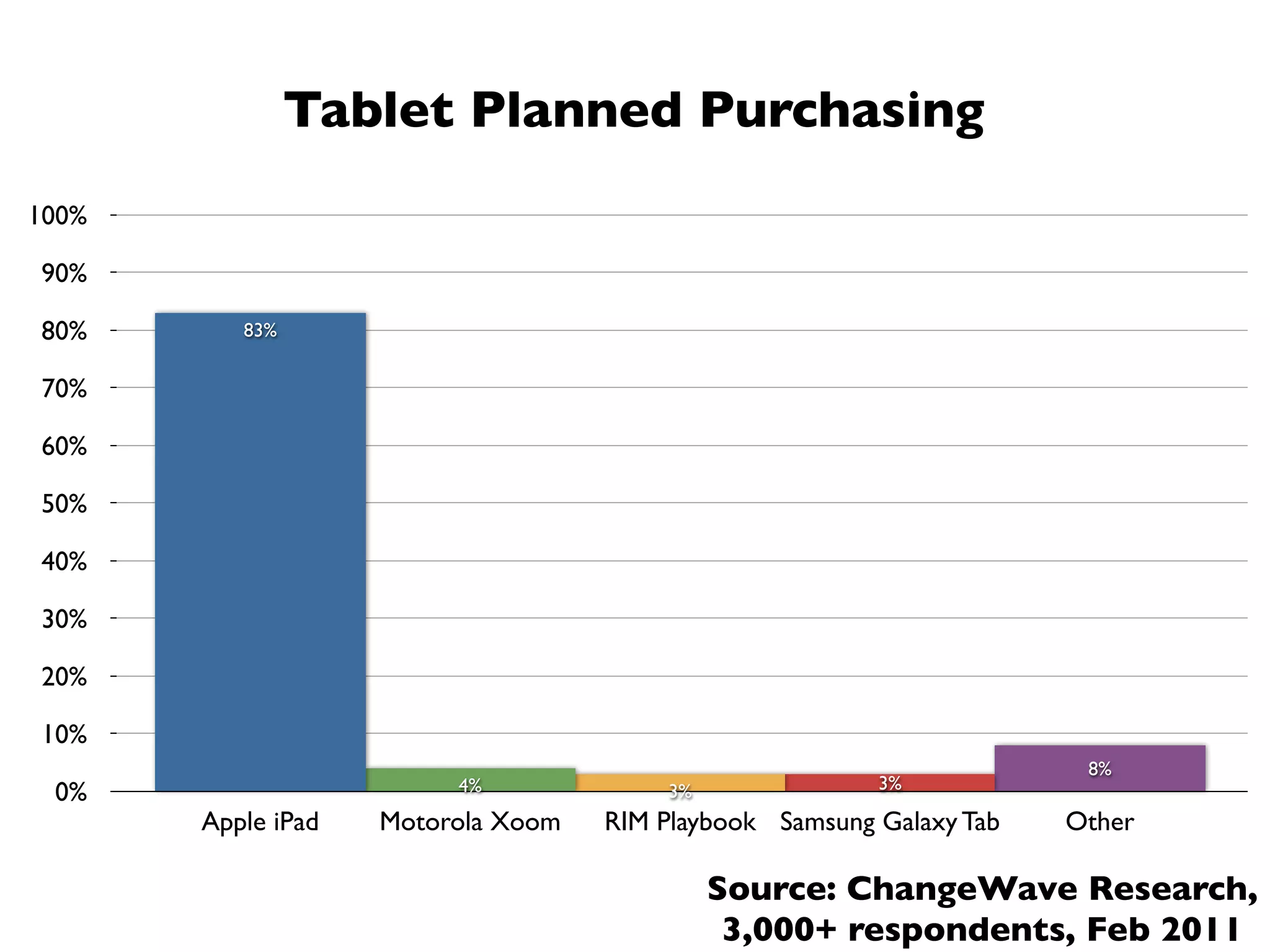

Raven Zachary gave a presentation at the Web 2.0 Expo on March 30, 2011 summarizing his experience using the iPad for the past year. Some of the key points from his presentation included:

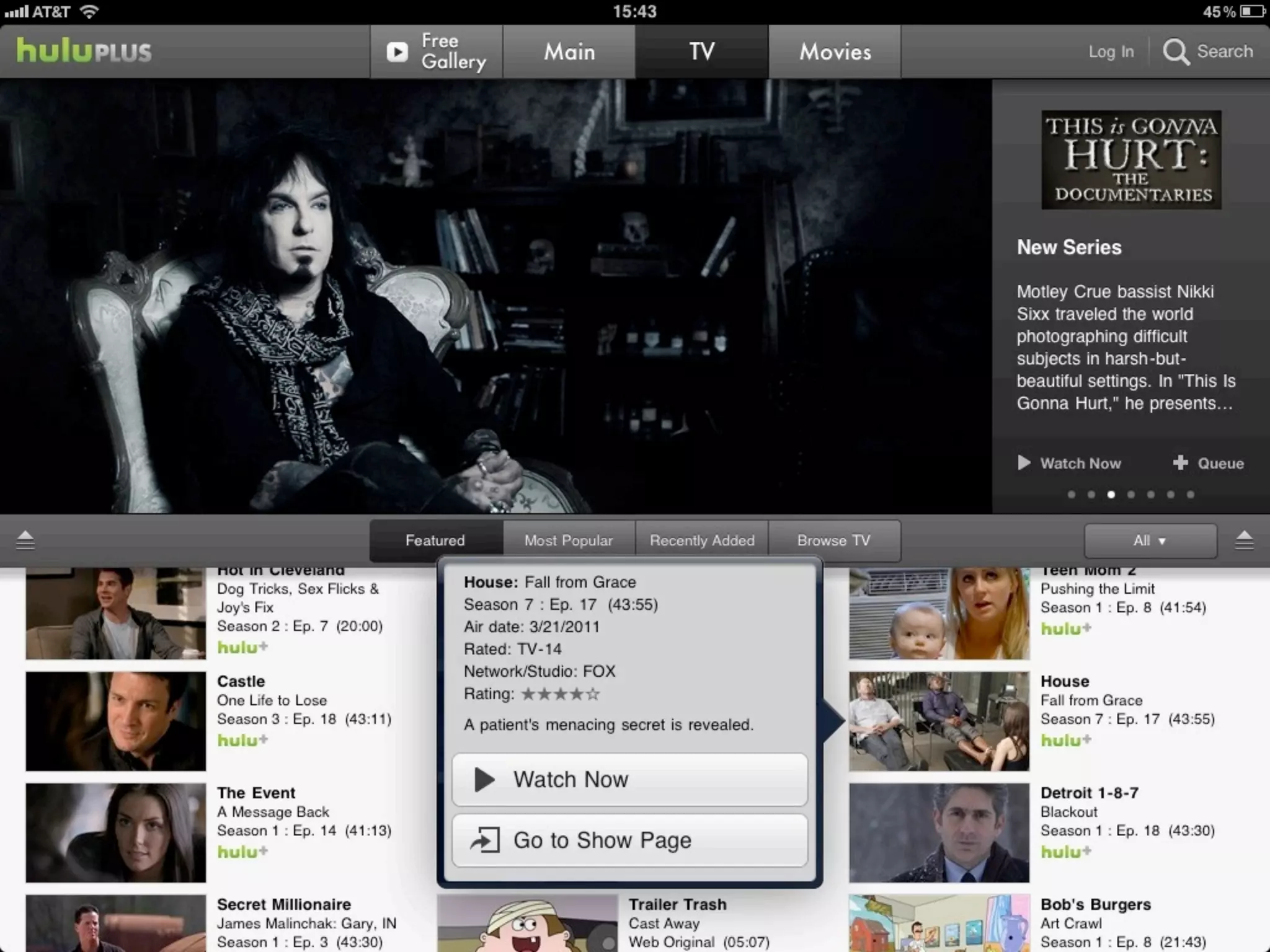

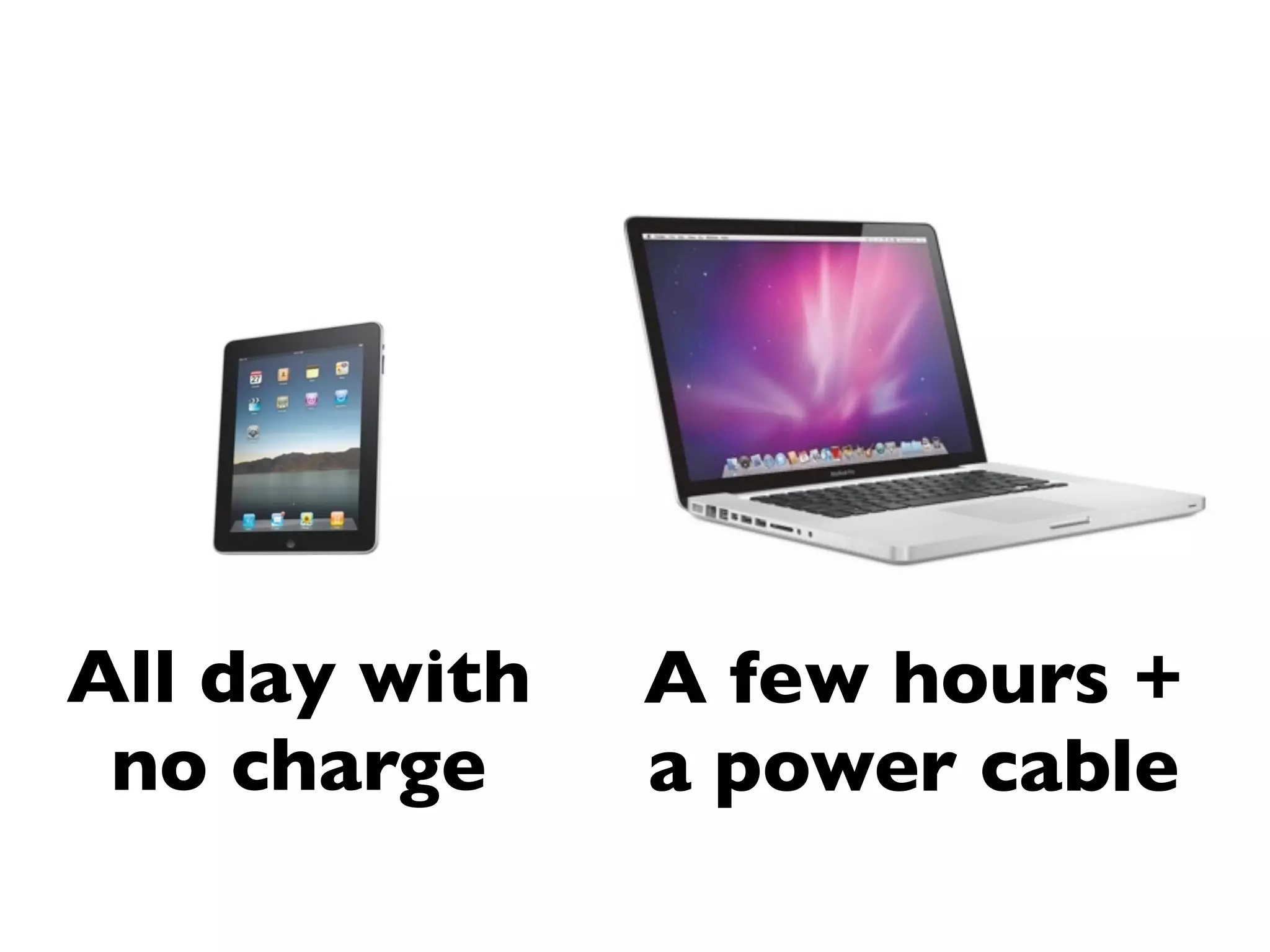

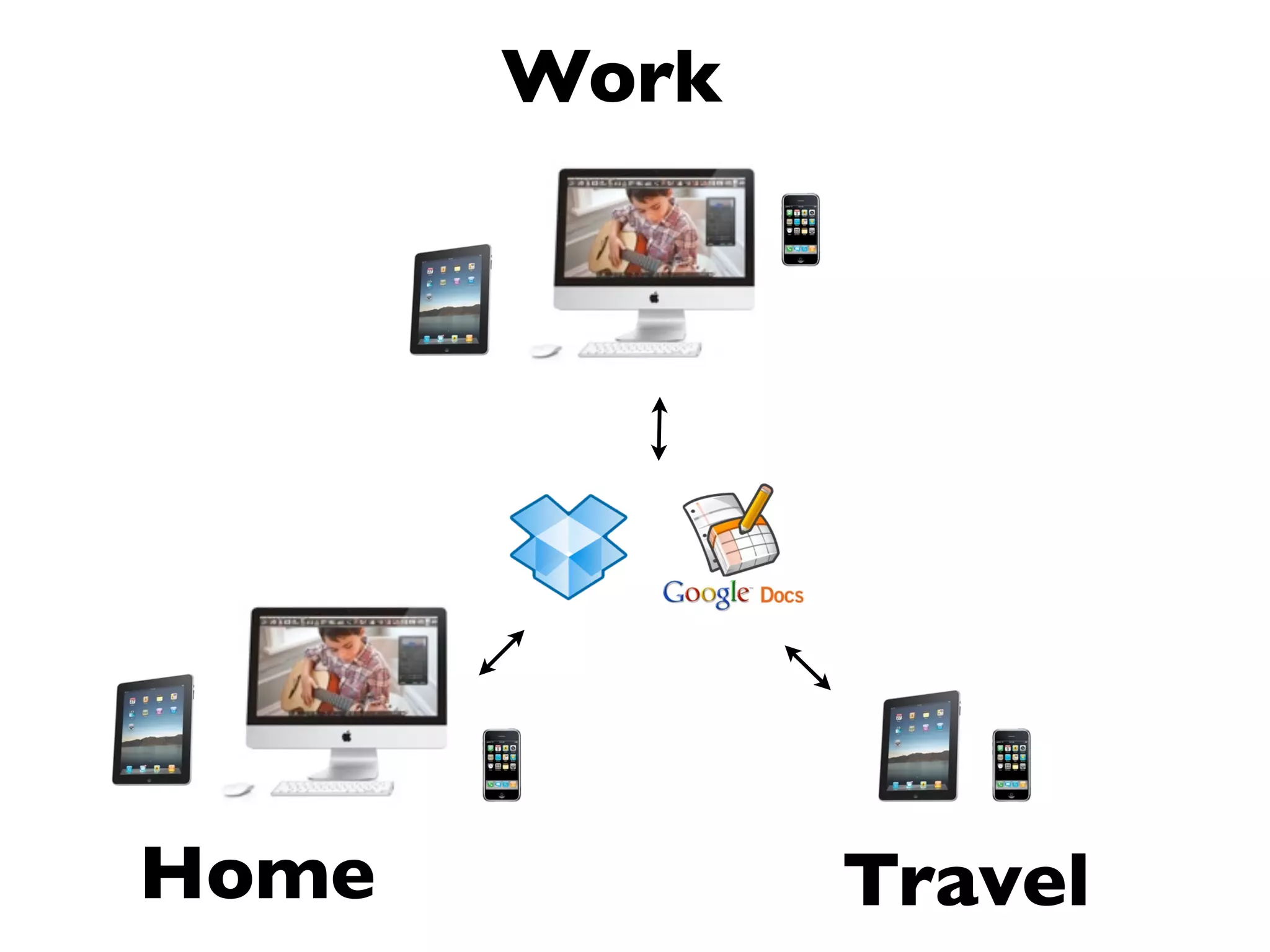

- The iPad has replaced his laptop for many tasks like email, web browsing, and media consumption due to its portability. However, it has not replaced his desktop computer.

- Developing apps directly on the iPad poses limitations compared to using a desktop.

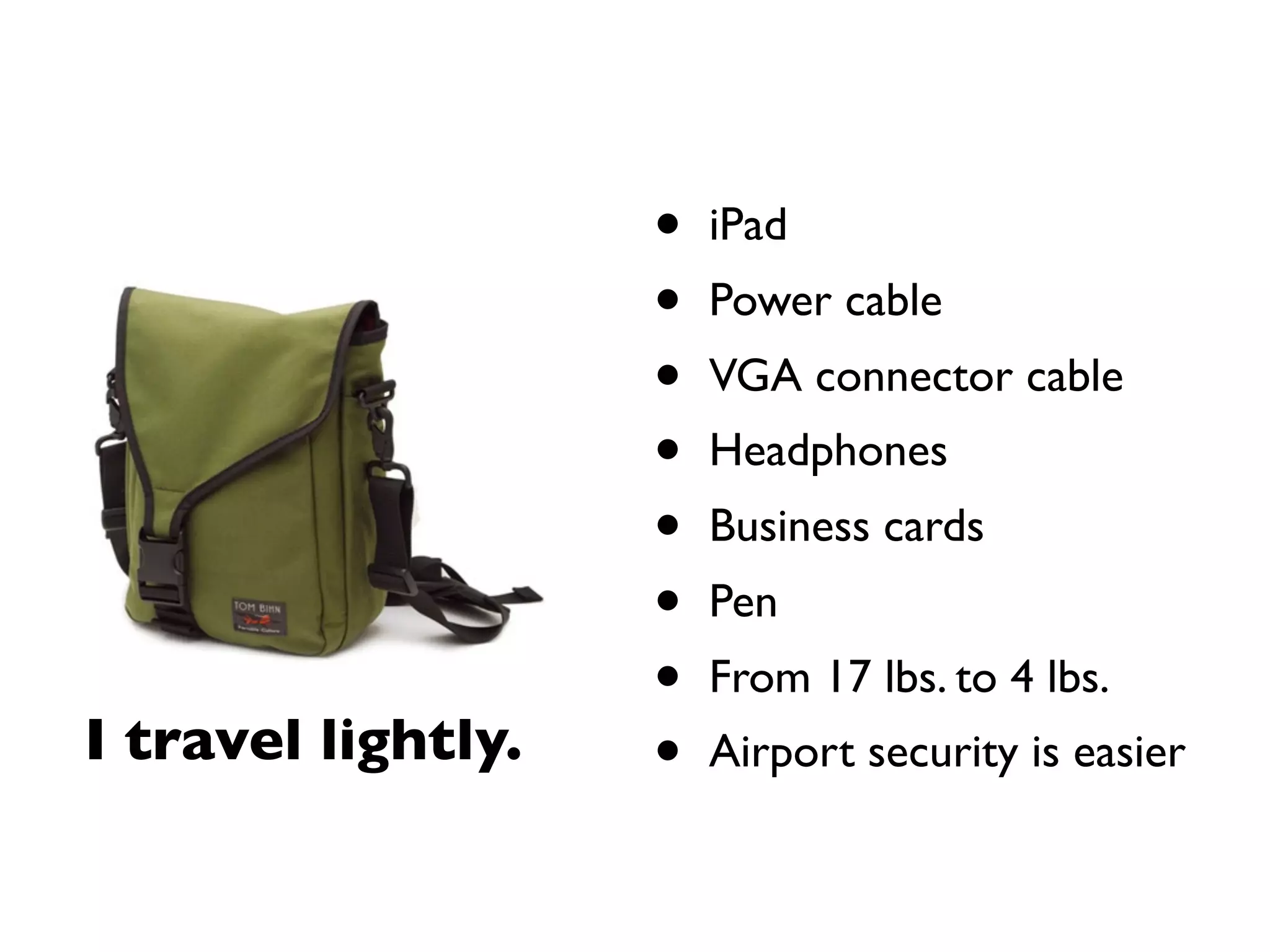

- The iPad works well for travel since it is lighter than a laptop and easier to use in airport security lines.

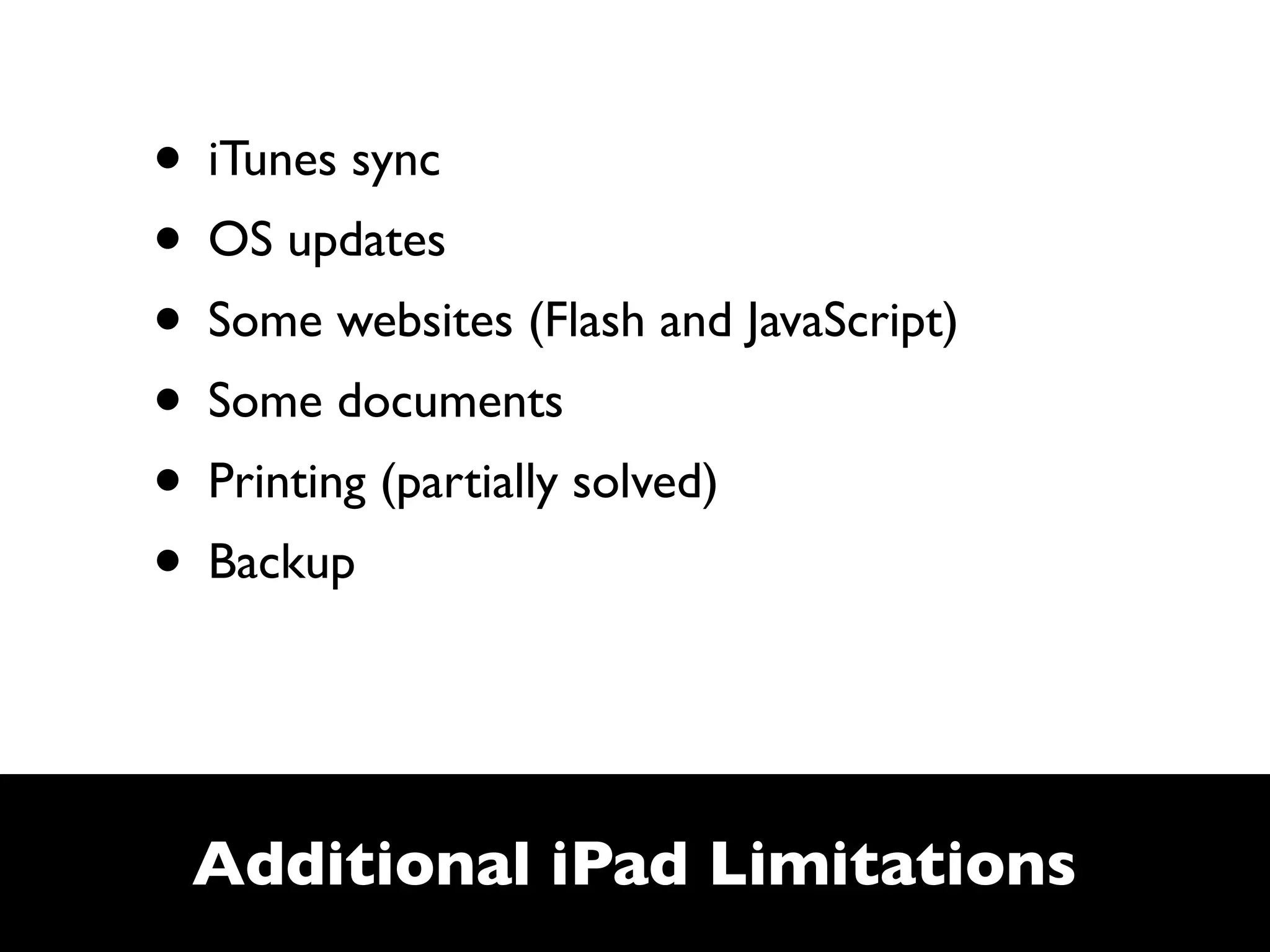

- While the iPad has limitations like lack of Flash support, printing capabilities, and backup options, it fulfills many of his