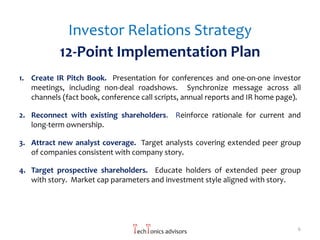

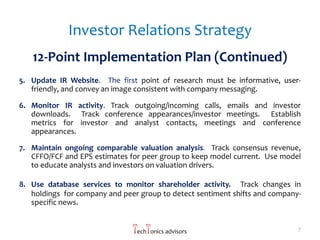

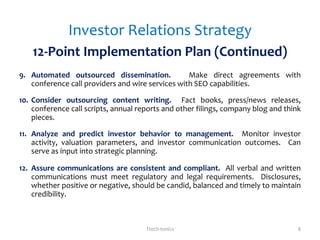

The document outlines a 12-point implementation plan for an investor relations (IR) strategy aimed at effectively communicating a company's story to analysts and investors. Key objectives include creating a consistent narrative, proactive outreach, and providing market intelligence to management. The plan emphasizes the evolving role of IR, requiring comprehensive strategies to engage with the investment community and ensure compliance with regulations.