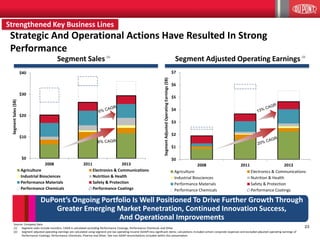

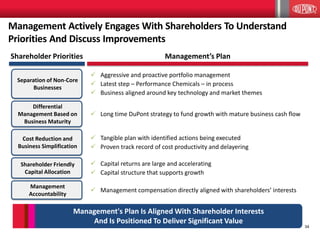

Management's plan is delivering results for shareholders by executing on a strategy to achieve higher growth and higher value. The strategy focuses on innovation, global reach, and operational priorities to advance strategic priorities in key areas like agriculture and nutrition, bio-based industrials, and advanced materials. Management has implemented portfolio changes, productivity initiatives like "Fresh Start" to reduce costs, and returned significant capital to shareholders. The track record since 2009 includes a total shareholder return of 253% that demonstrates management's plan is working to continue driving strong growth for DuPont.