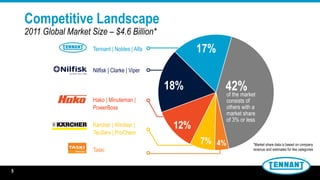

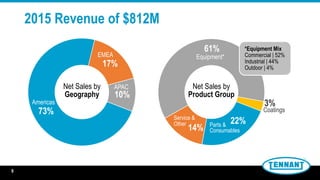

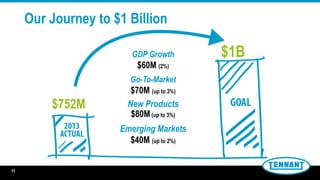

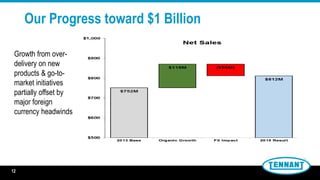

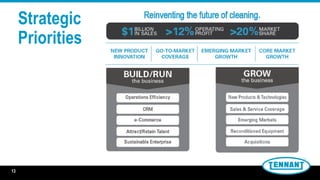

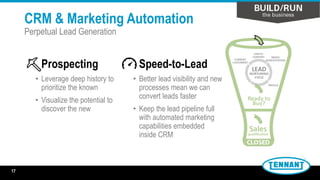

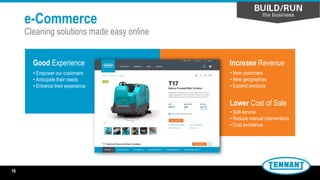

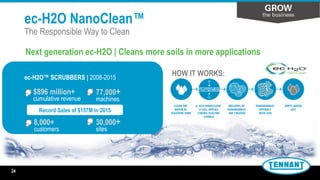

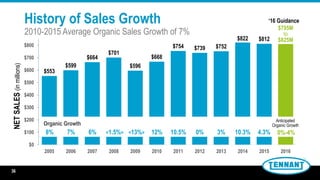

Tennant Company provides an investor presentation summarizing its business and growth strategy. The company aims to reach $1 billion in sales through organic growth initiatives like new product development and expanding into new markets. Tennant has a diverse portfolio of cleaning equipment and technologies and sees opportunities in areas like emerging markets, e-commerce, and acquisitions. It is focused on operational efficiency and talent retention to support its vision of leading the cleaning industry through sustainable innovation.