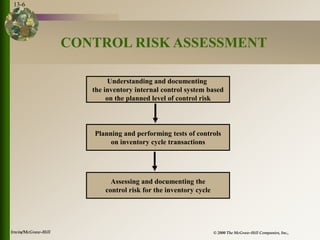

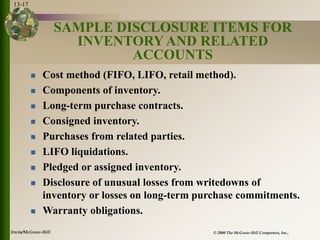

This document discusses auditing procedures for inventory and related accounts. It covers evaluating inherent and control risks, substantive tests of transactions, analytical procedures like comparing inventory metrics to prior periods and budgets, auditing standard costs, observing physical inventory counts, tests of account balances, investigating book-to-physical differences, and sample disclosure items for the financial statements. The goal of the audit procedures is to evaluate inventory balances and related transactions against the objectives of existence, completeness, rights and obligations, and valuation.