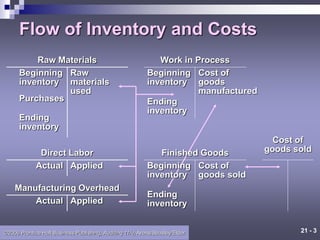

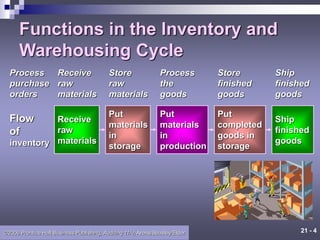

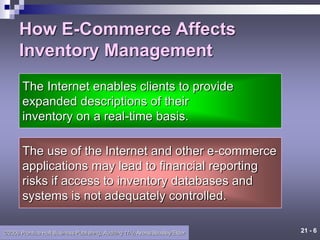

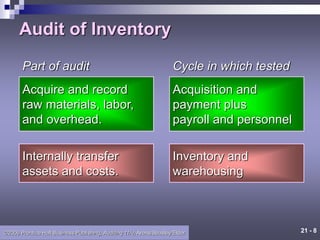

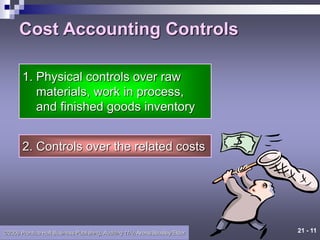

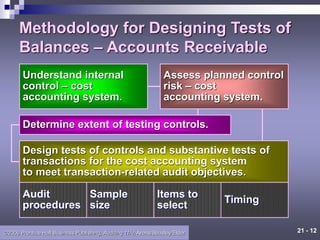

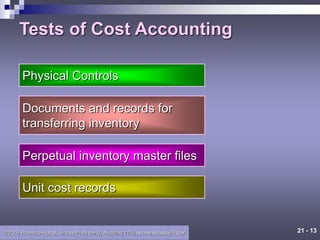

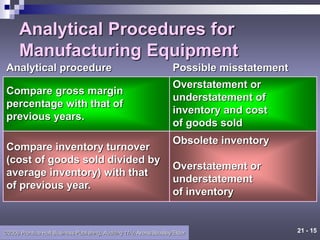

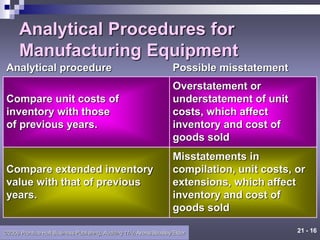

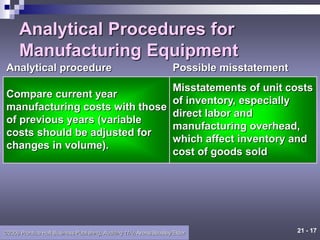

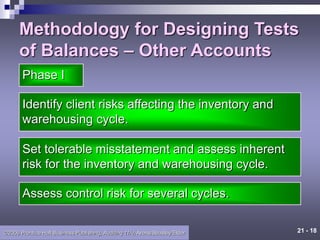

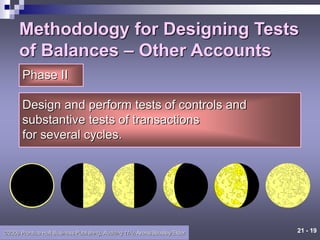

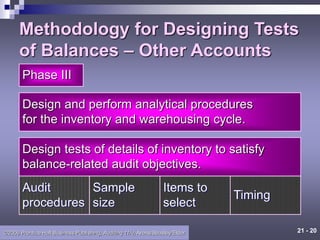

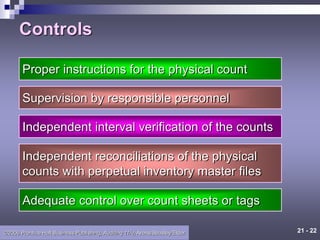

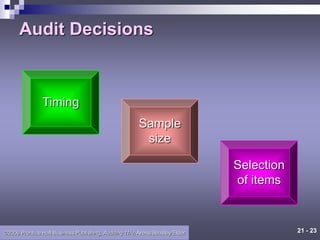

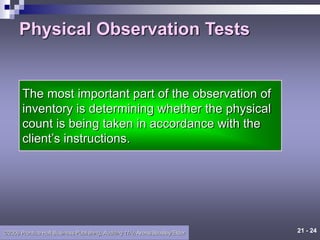

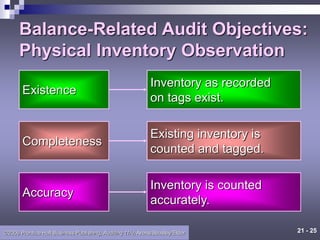

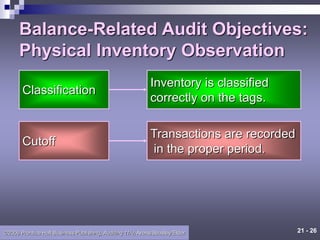

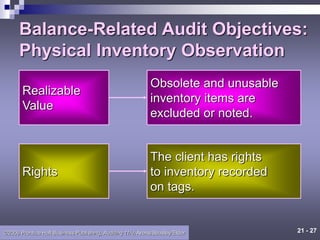

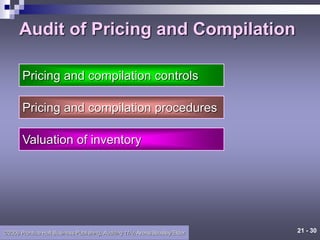

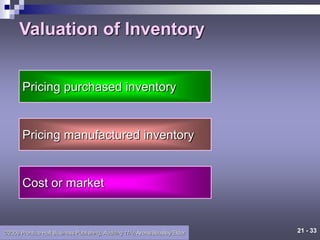

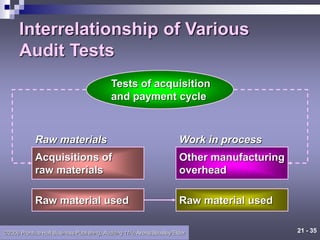

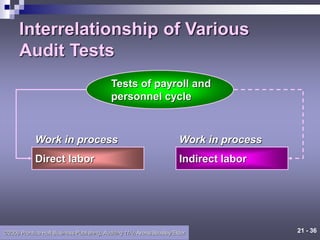

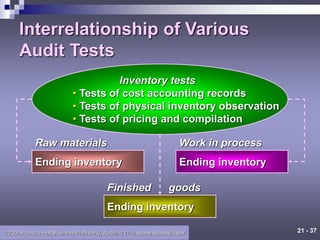

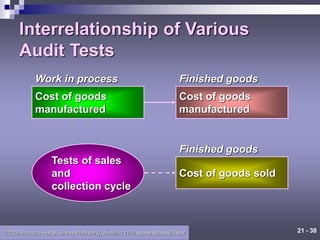

The document discusses the auditing of the inventory and warehousing cycle, outlining key business functions, e-commerce impacts, and audit methodologies. It covers various aspects including physical observation, pricing, compilation, and analytical procedures related to inventory management. Additionally, it emphasizes the importance of internal controls and risk assessment within the auditing process.