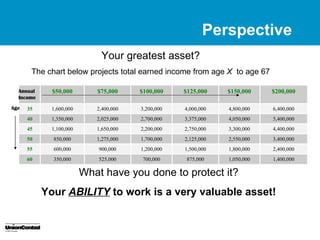

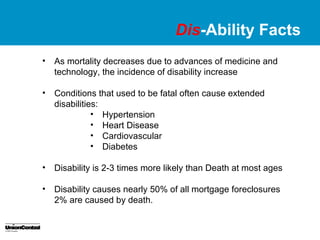

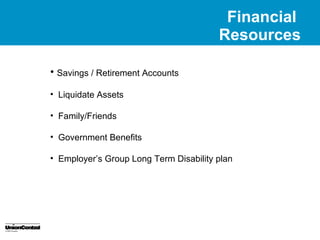

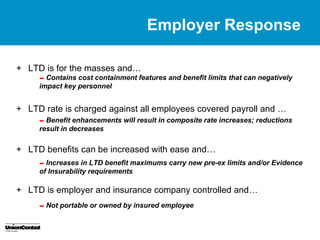

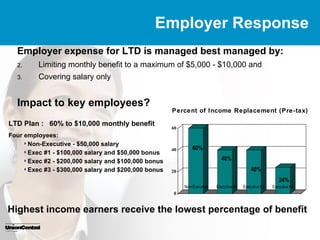

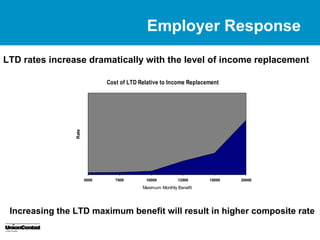

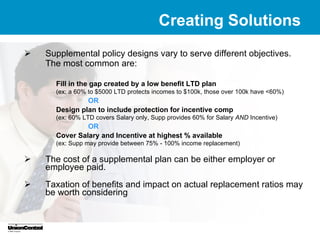

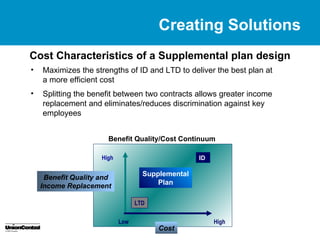

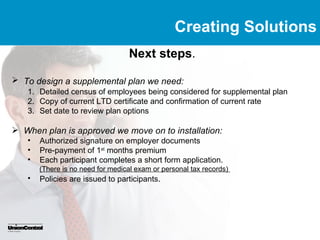

The document discusses the importance of supplemental disability insurance for key employees, detailing financial implications and employer responses. It highlights the prevalence of disability as a risk to income and proposes solutions through group long-term disability (LTD) supplemented by individual policies tailored to meet specific employee needs. The next steps include gathering employee data and current policy details to design and implement an appropriate supplemental plan.