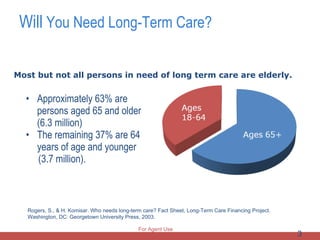

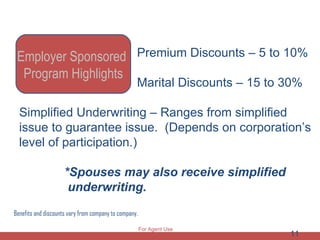

The document explains employer-sponsored long-term care insurance, which provides essential daily assistance for individuals unable to care for themselves due to injury, illness, or cognitive impairment. It highlights the growing need for such insurance, particularly among aging employees, and outlines the benefits for both employers and employees, including tax deductions and enhanced retirement security. The costs associated with this insurance are relatively low compared to its potential benefits, making it a strategic employee benefit for attracting and retaining talent.