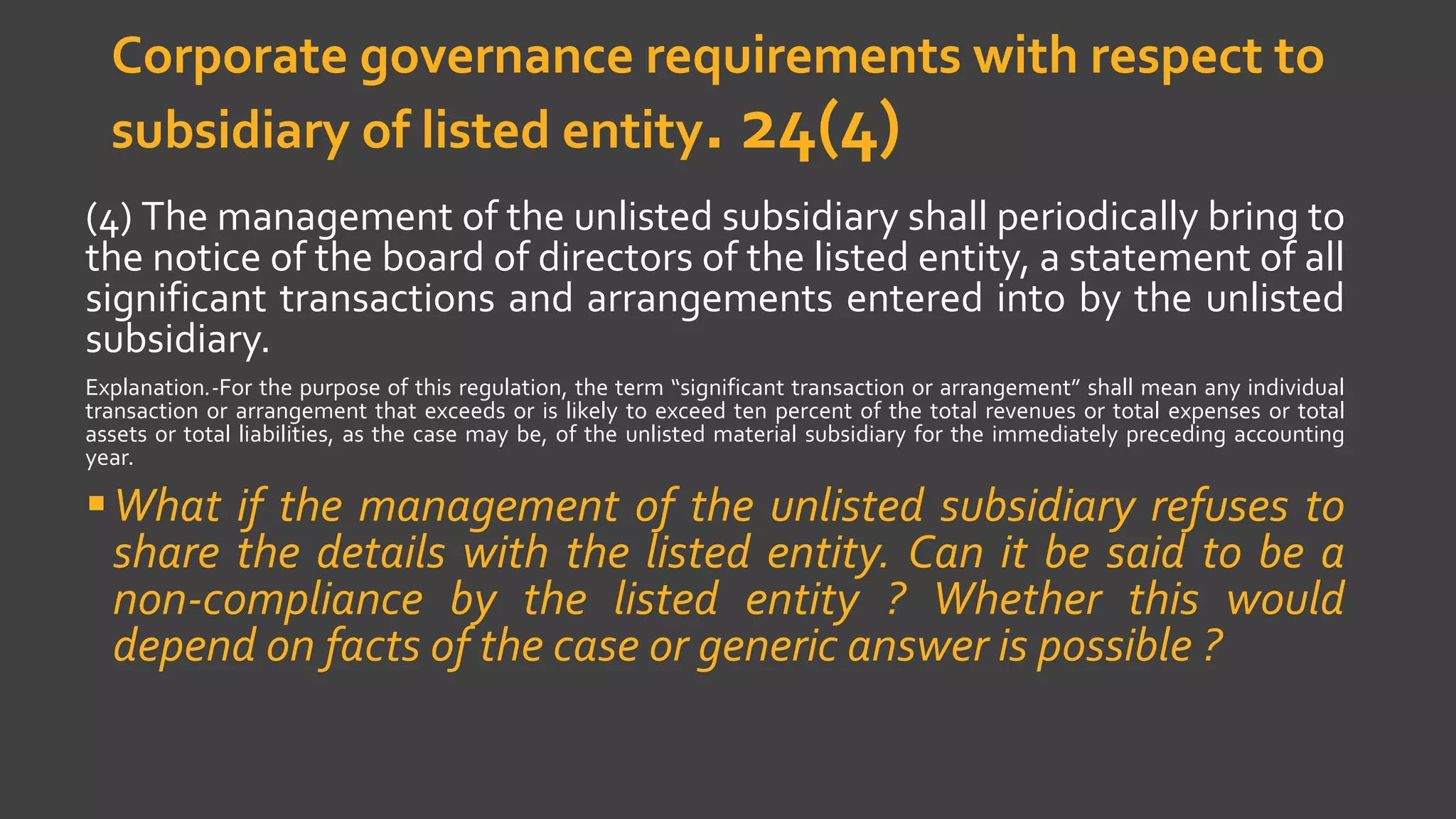

The document discusses the interpretation of securities laws, highlighting the necessity for clear statutory language to avoid ambiguities and litigation. It details key rules of interpretation, including the literal, golden, and purposive approaches, while emphasizing the importance of regulators like SEBI in ensuring compliance. Additionally, it addresses the complexities of insider trading laws and preferential allotments in securities, reflecting on the balance between equity and law in regulatory practices.

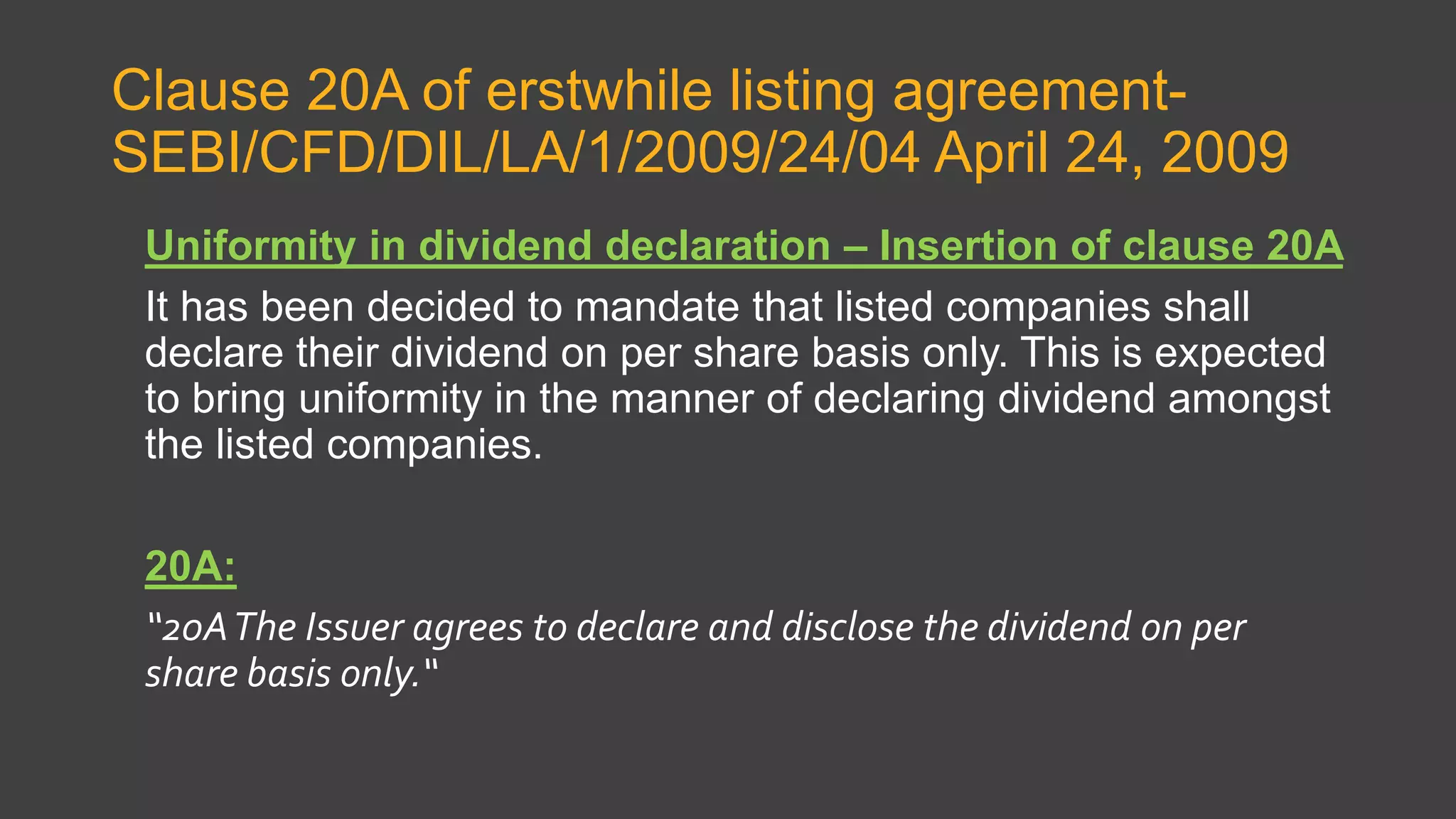

![Adler v George (1964)

Under the Official Secrets Act 1920 it was an offence to

obstruct a member of the armed forces 'in the vicinity' of a

prohibited place.

The defendant was actually in the prohibited place, rather than

"in the vicinity" of it, at the time of obstruction.

The courts had to determine whether “in [the] vicinity of”

included on/in the premises. The court applied the golden rule.

The court said that in the vicinity did include on or in as well. It

would be absurd for a person to be liable if they were near to a

prohibited place and not if they were actually in it. The

defendant’s conviction was therefore upheld.](https://image.slidesharecdn.com/securitieslaws2-170413143353/75/Interpretation-of-Securities-Laws-9-2048.jpg)

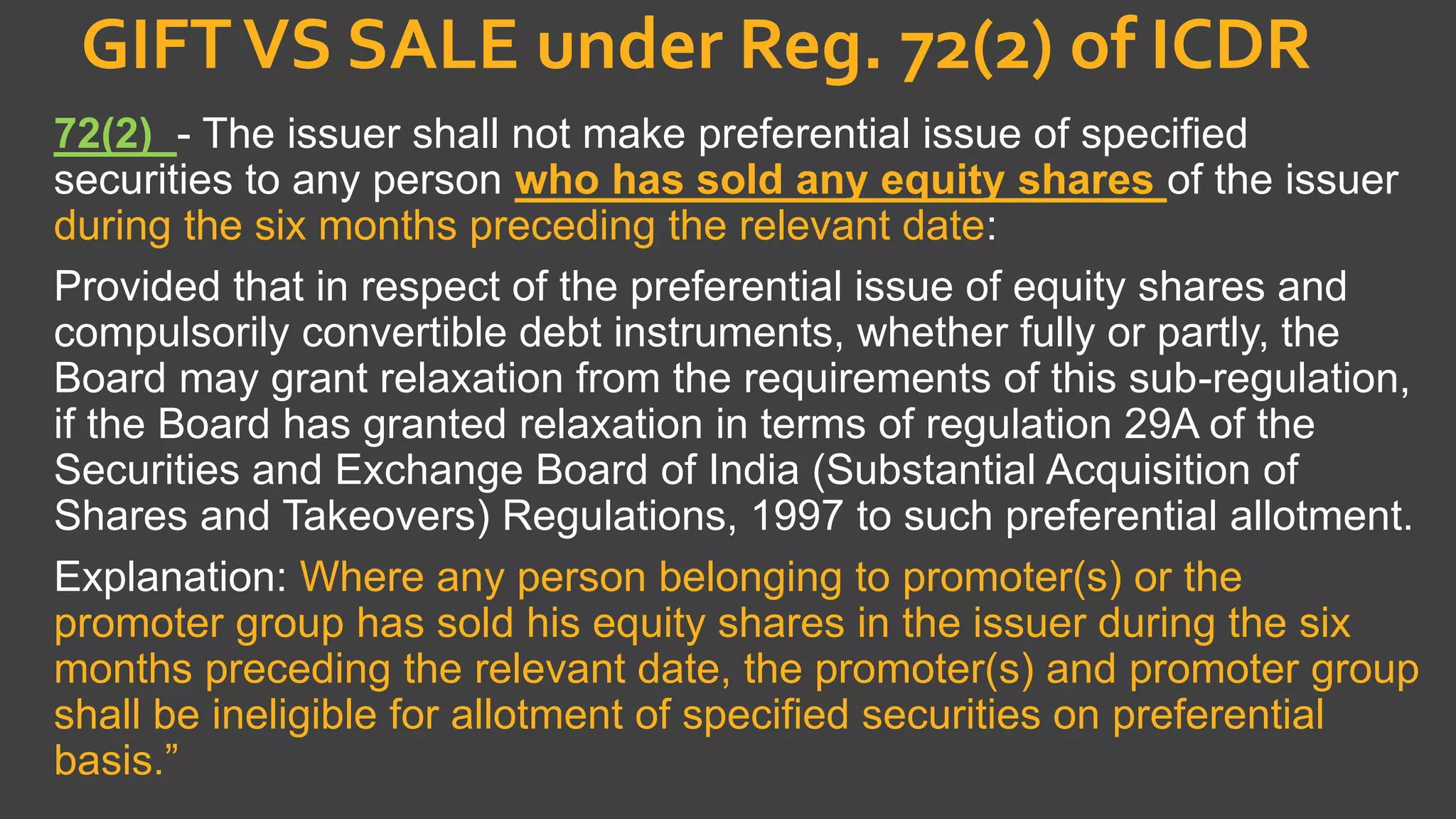

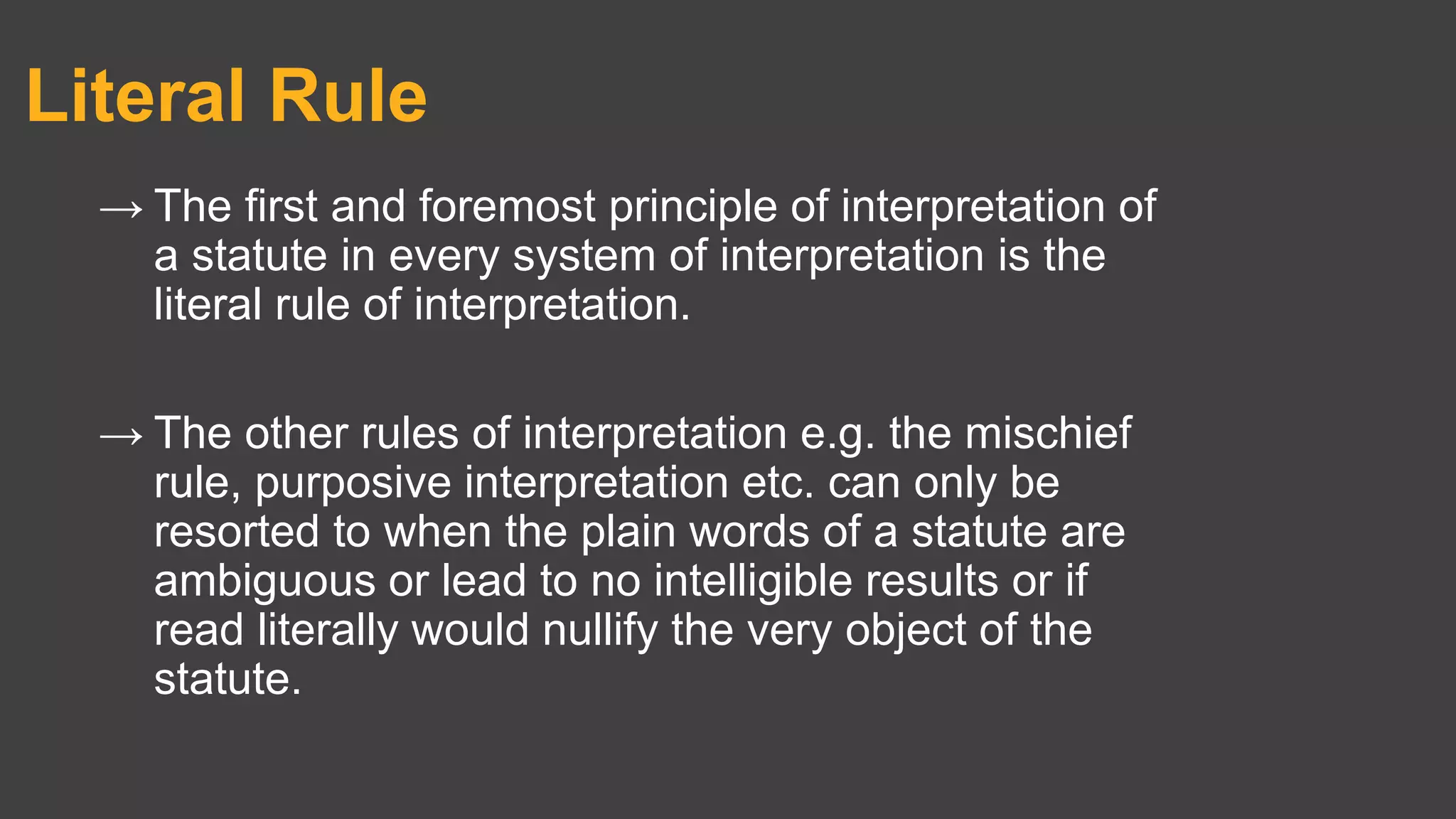

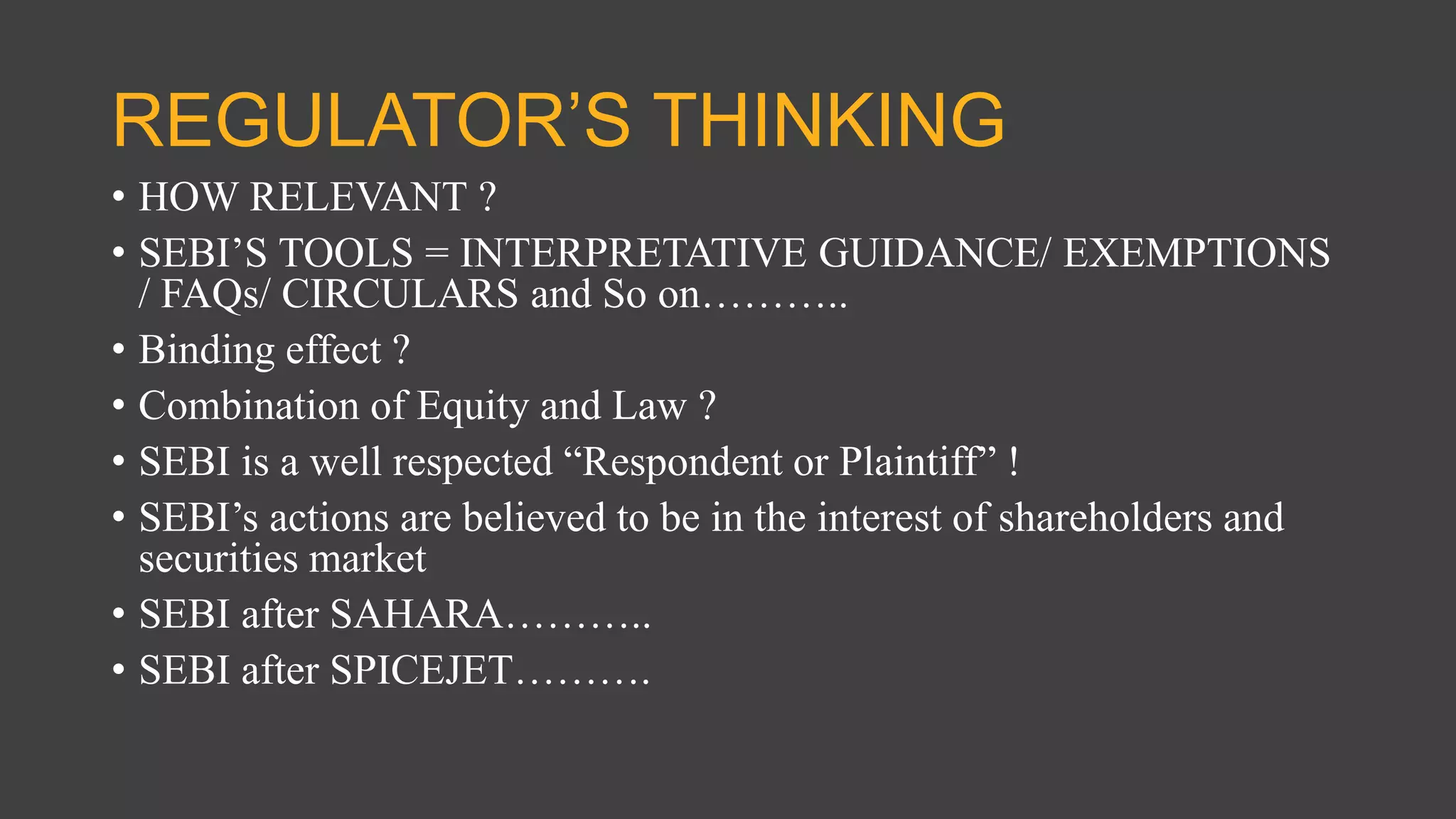

![FAQs comes with disclaimer !

These FAQs offer only a simplistic explanation/clarification of

terms/concepts related to the SEBI (Substantial Acquisition of

Shares and Takeovers) Regulations, 2011 [“SAST Regulations,

2011”]. Any such explanation/clarification that is provided

herein should not be regarded as an interpretation of law nor

be treated as a binding opinion/guidance from the Securities

and Exchange Board of India [“SEBI”]. For full particulars of laws

governing the substantial acquisition of shares and takeovers,

please refer to actual text of the Acts/Regulations/Circulars

appearing under the Legal Framework Section on the SEBI

website.](https://image.slidesharecdn.com/securitieslaws2-170413143353/75/Interpretation-of-Securities-Laws-20-2048.jpg)