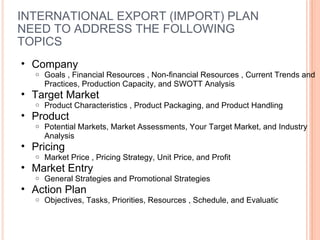

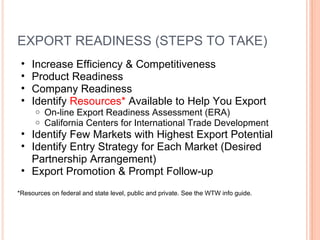

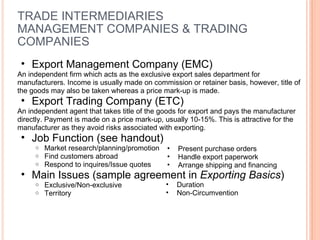

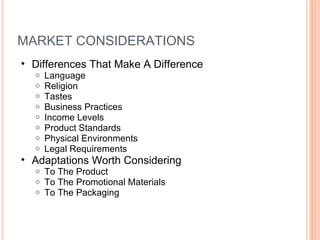

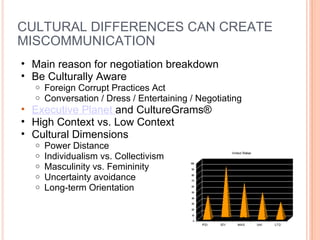

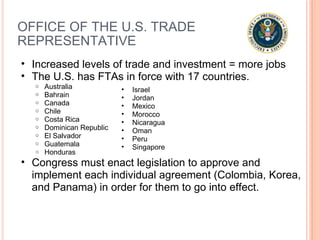

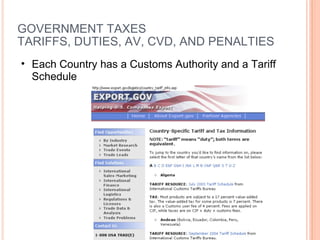

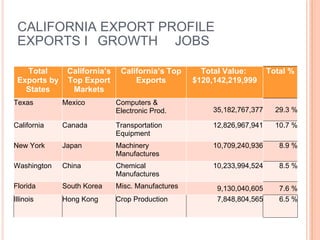

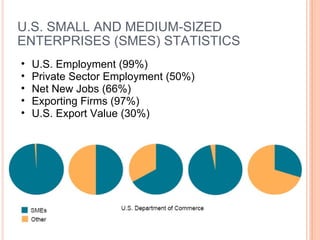

The document provides an overview of exporting and importing from an event hosted by El Camino College Business Training Center. It discusses California's export profile, challenges small businesses face in exporting, stages of export development, and considerations for international trade such as regulations, financing, cultural differences, and distribution channels. Resources to help businesses export such as the International Trade Compliance Institute and Green Export Enabler Program are also summarized.

![CALIFORNIA [UNREALIZED] EXPORT GROWTH POTENTIAL 96% of the World’s Consumers Live Outside the U.S. 66% of the World’s Purchasing Power is Outside the U.S. 85% of California’s Manufactures do Not Export Many Make Exportable Products 60% Sell Only to Canada and Mexico (w/in NAFTA) Many have New-to-Market Export Potential](https://image.slidesharecdn.com/internationaltradeorientationshortversion-1283891785579-phpapp01/85/International-Trade-Orientation-Short-Version-5-320.jpg)