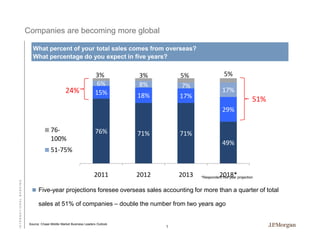

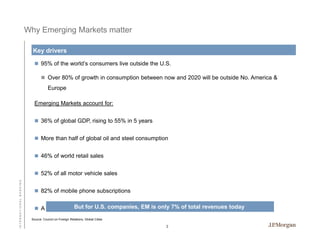

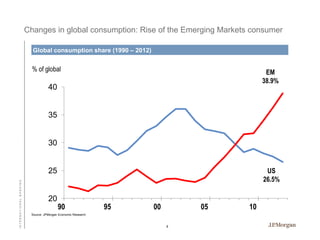

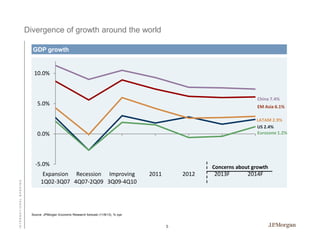

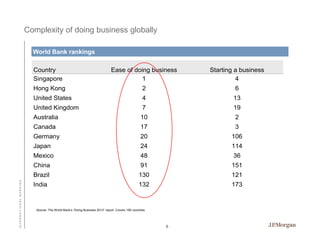

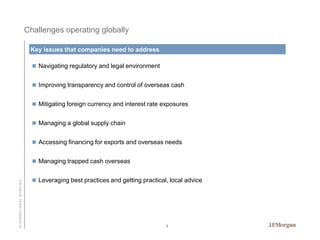

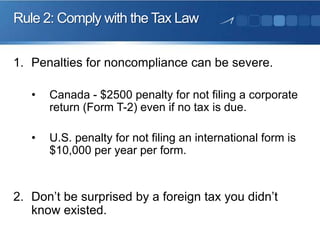

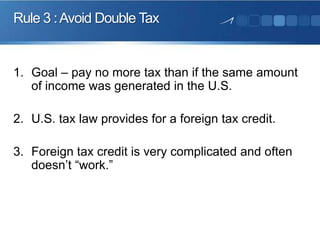

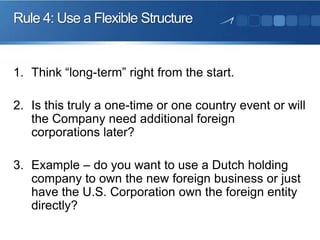

The document presents an international tax update emphasizing the growing trend of U.S. companies expanding globally, with a forecast indicating that over 50% of firms expect more than a quarter of their sales to come from overseas. It outlines the complexities and challenges of international business, including compliance with varying tax laws, structuring options, and emerging market dynamics. Various country-specific tax updates and challenges are addressed, highlighting the importance of effective tax planning in a globally competitive environment.