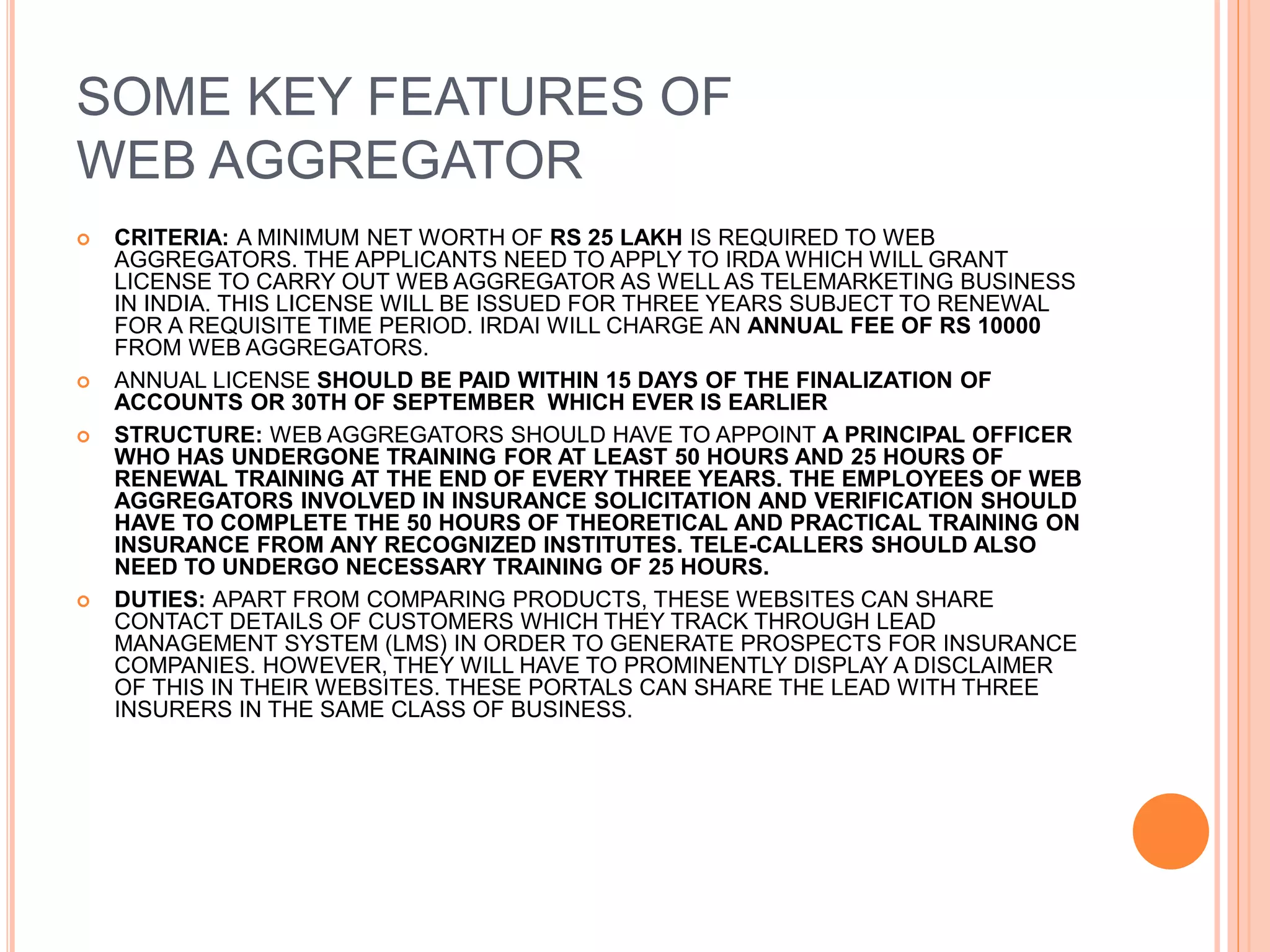

Web aggregators compile insurance policy information from various sources and companies and present it on their website. This allows potential buyers to easily compare policies. IRDAI regulates web aggregators and has defined their permitted activities such as displaying policy comparisons and transmitting customer leads to insurers. To be licensed as a web aggregator, entities must meet requirements such as a principal officer trained in insurance and a minimum net worth. Licensed web aggregators can then perform services like comparing products and generating customer prospects for insurance companies.