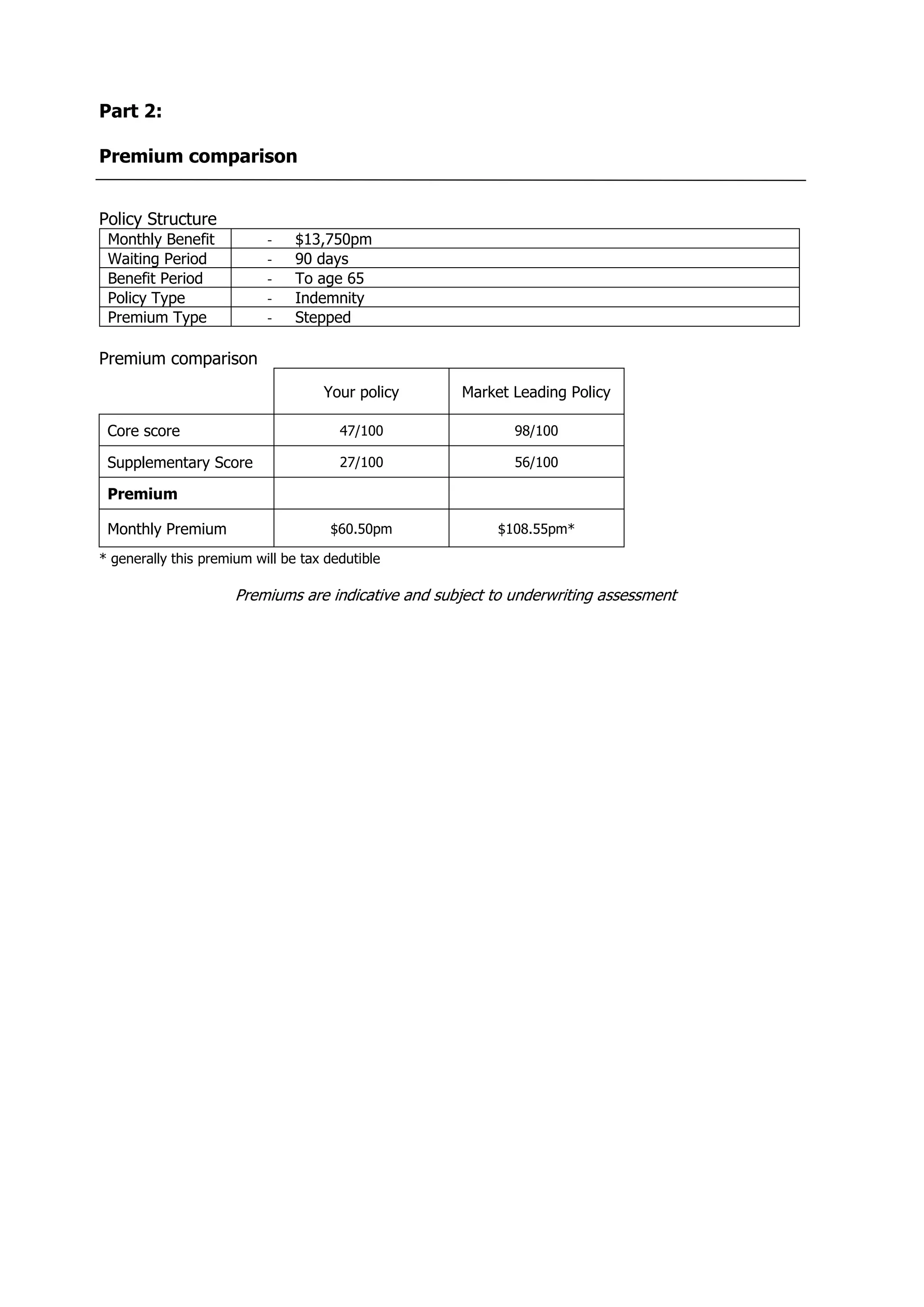

This policy comparison report evaluates the differences between the client's current income protection insurance and leading market options, focusing on policy definitions and premium costs. Key components such as coverage, exclusions, and definitions of disability are compared, with ratings provided for core and supplementary features. The report emphasizes that the information is general advice and suggests consulting with an adviser for personalized decisions.