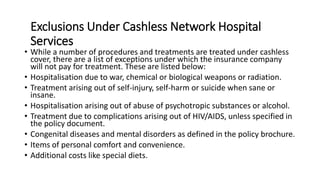

The employee health insurance policy covers medical benefits for insured individuals including employees, spouses, children, dependents and parents. It provides cashless hospitalization at network hospitals and covers ancillary charges such as ambulance costs. When filing a claim through a cashless network hospital, the insured must notify the insurance company in advance for planned surgeries or within 24 hours of emergency admission to authorize cashless treatment. The policy also provides reimbursement for follow up checkups with specialists.