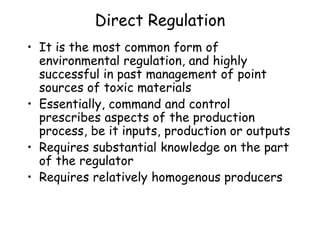

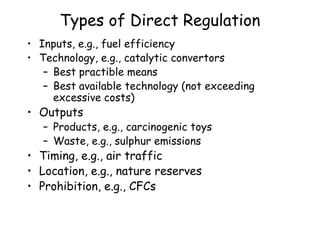

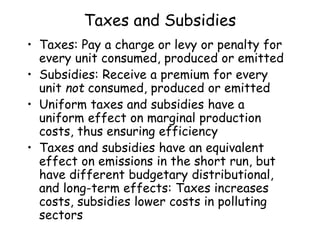

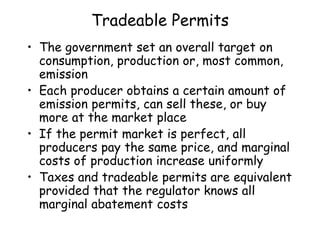

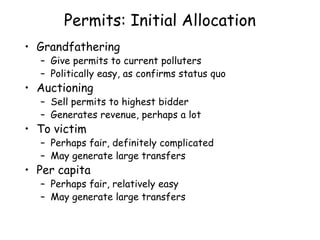

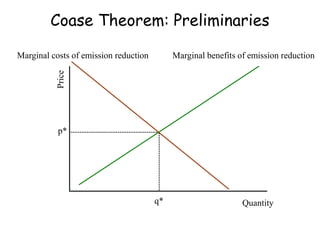

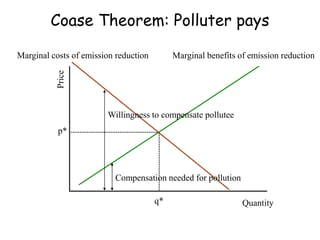

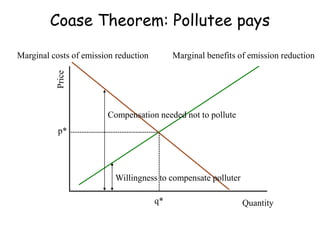

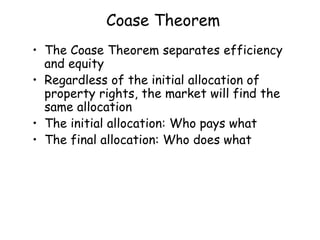

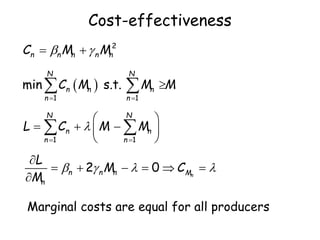

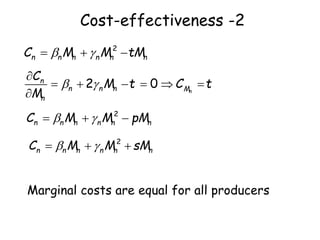

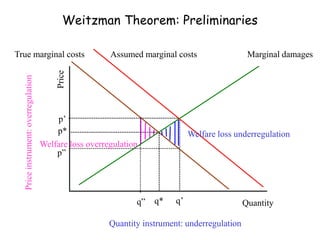

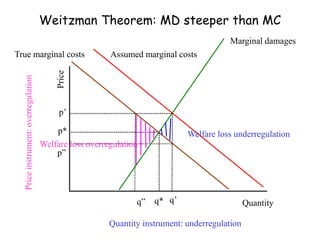

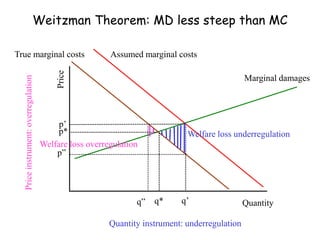

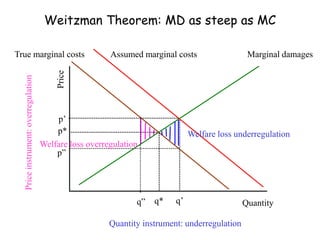

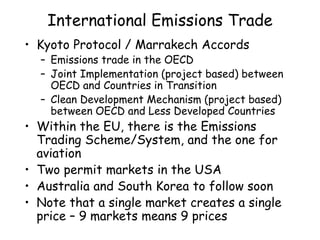

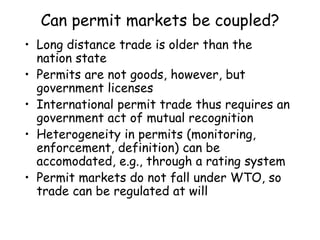

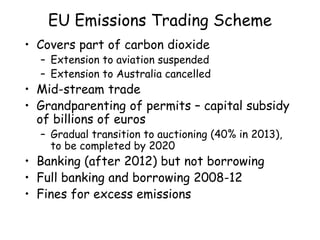

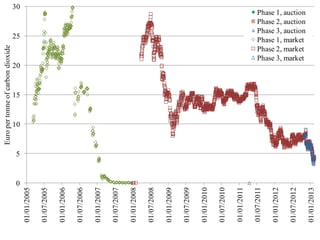

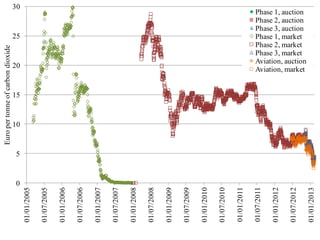

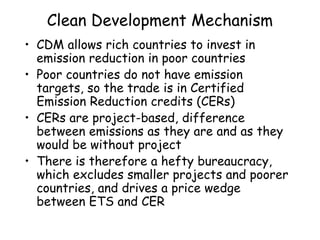

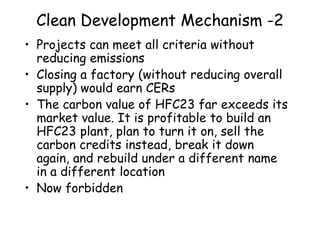

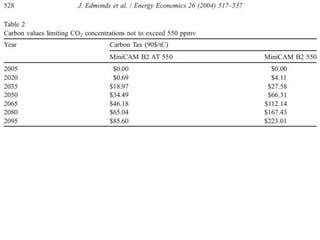

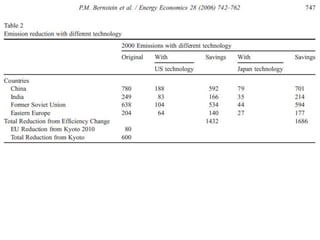

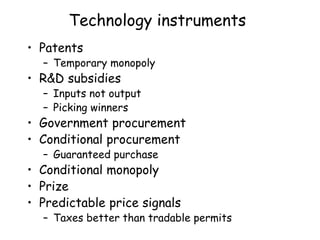

The document outlines various climate change policy instruments, focusing on direct regulation, taxes and subsidies, and tradeable permits. It discusses the Coase theorem, cost-effectiveness of market-based instruments, and the Weitzman theorem's implications on choosing between price and quantity instruments for regulation. Additionally, it highlights challenges and issues within international emissions trading and technological progress in addressing climate change.