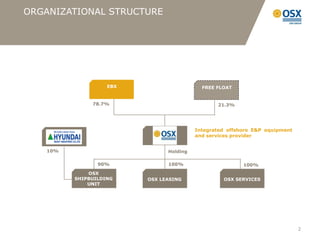

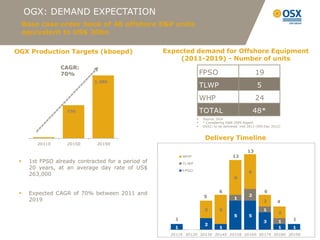

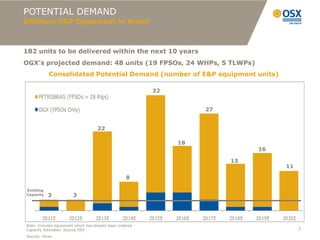

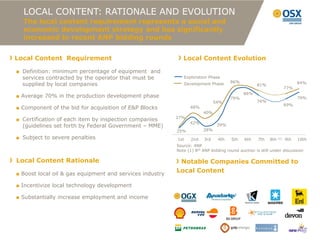

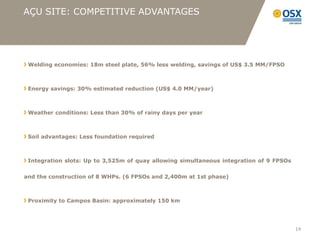

OSX is an integrated offshore oil and gas equipment and services provider owned by EBX Group. It has an order book of 48 offshore units from its main client OGX, equivalent to $30 billion in investments. OSX has a strategic partnership with Hyundai, the world's largest shipbuilder, to build its shipyard in Açu and transfer technology. The shipyard will help meet the growing local content requirements in Brazil's oil and gas industry and address the large expected demand of over 180 offshore units needed over the next decade.