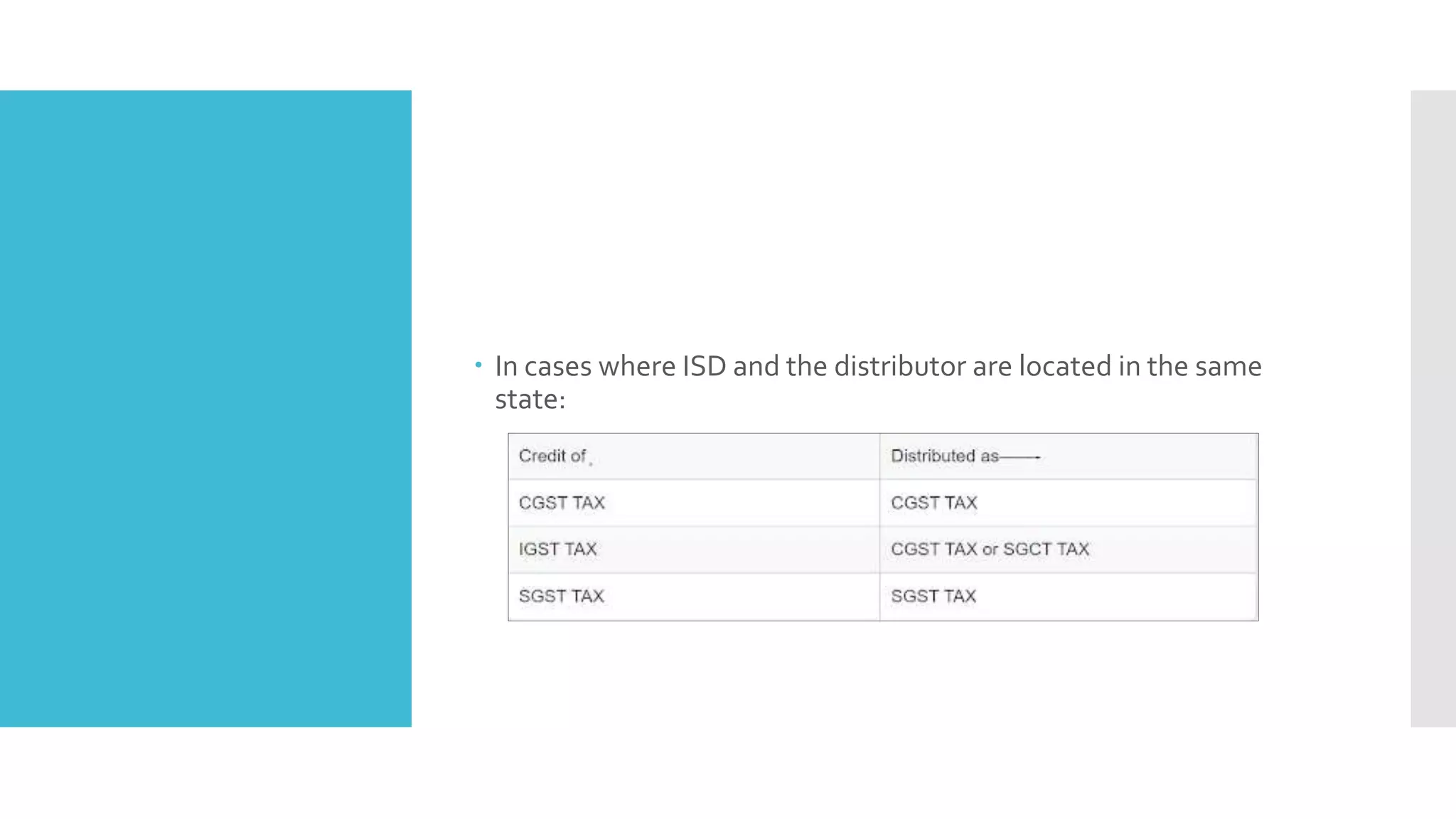

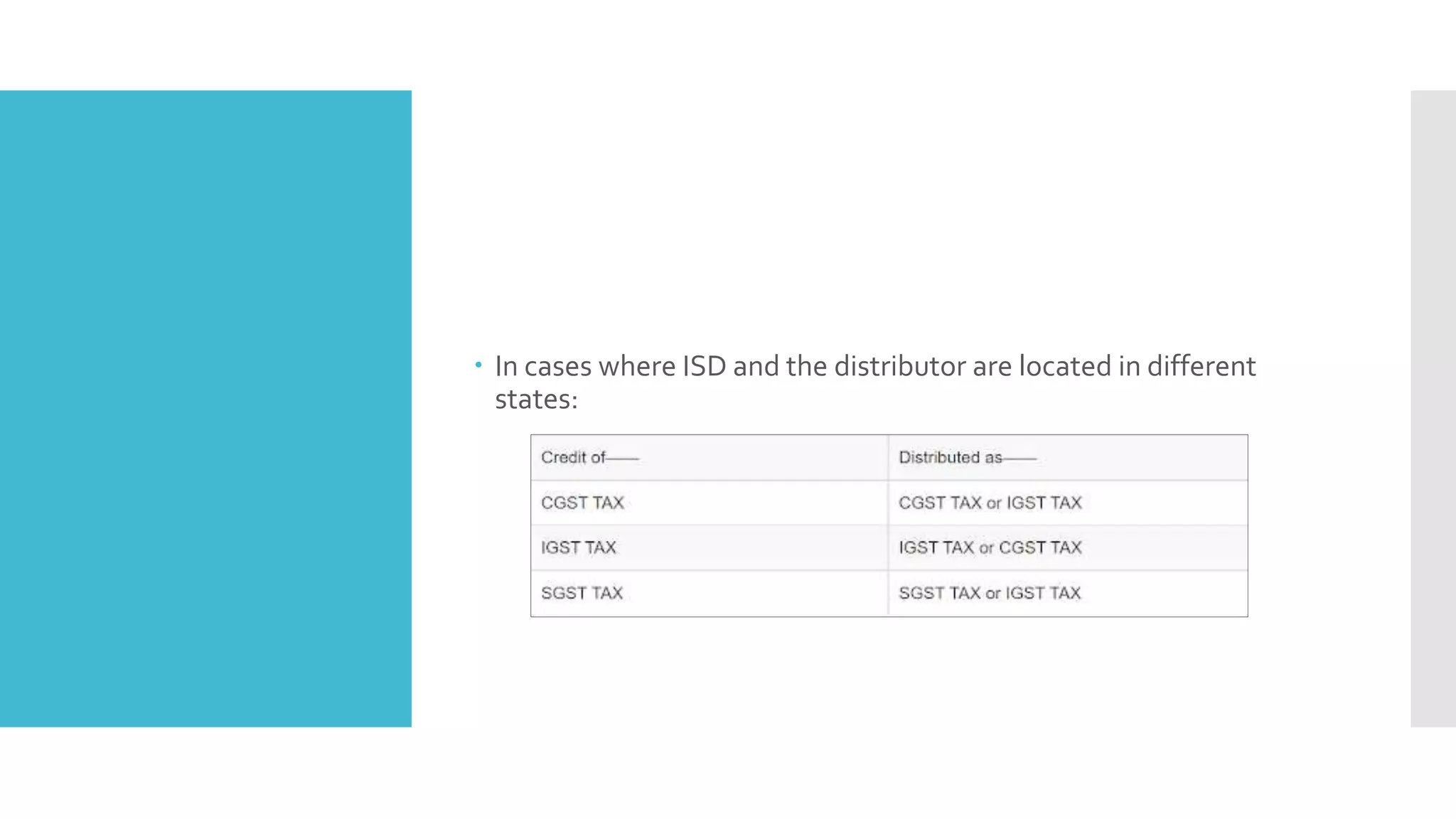

The document explains the concept of Input Service Distributor (ISD) under GST, detailing its importance for businesses with multiple branches to effectively manage and distribute input tax credits. It outlines the definition, registration requirements, and regulations governing ISD, including the proper distribution of credits across branches based on turnover. The document also emphasizes the filing requirements and the distinctions between intra-state and inter-state credit allocations.