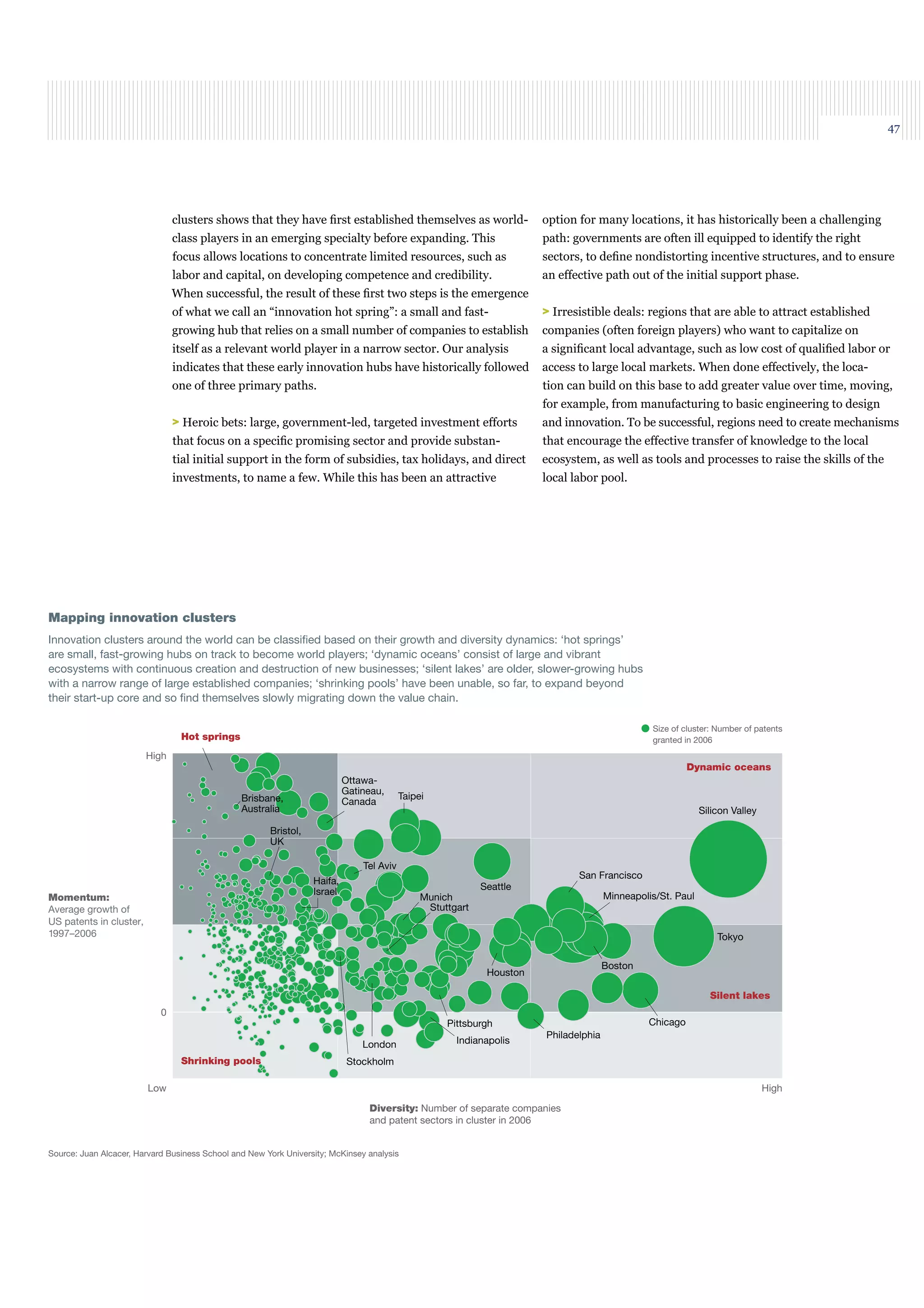

The document discusses factors that are common among successful innovation hubs. It identifies that establishing fundamentals like infrastructure and governance are essential prerequisites. Innovation hubs must then develop a specific sector focus to concentrate resources. Successful hubs historically followed paths of large government investments, attracting established companies, or capitalizing on technical advances through a talent base. As hubs mature, they must broaden their sectors and attract global talent to sustain long-term growth. The availability of a specialized talent pool is the single most important factor for driving innovation across all sectors.