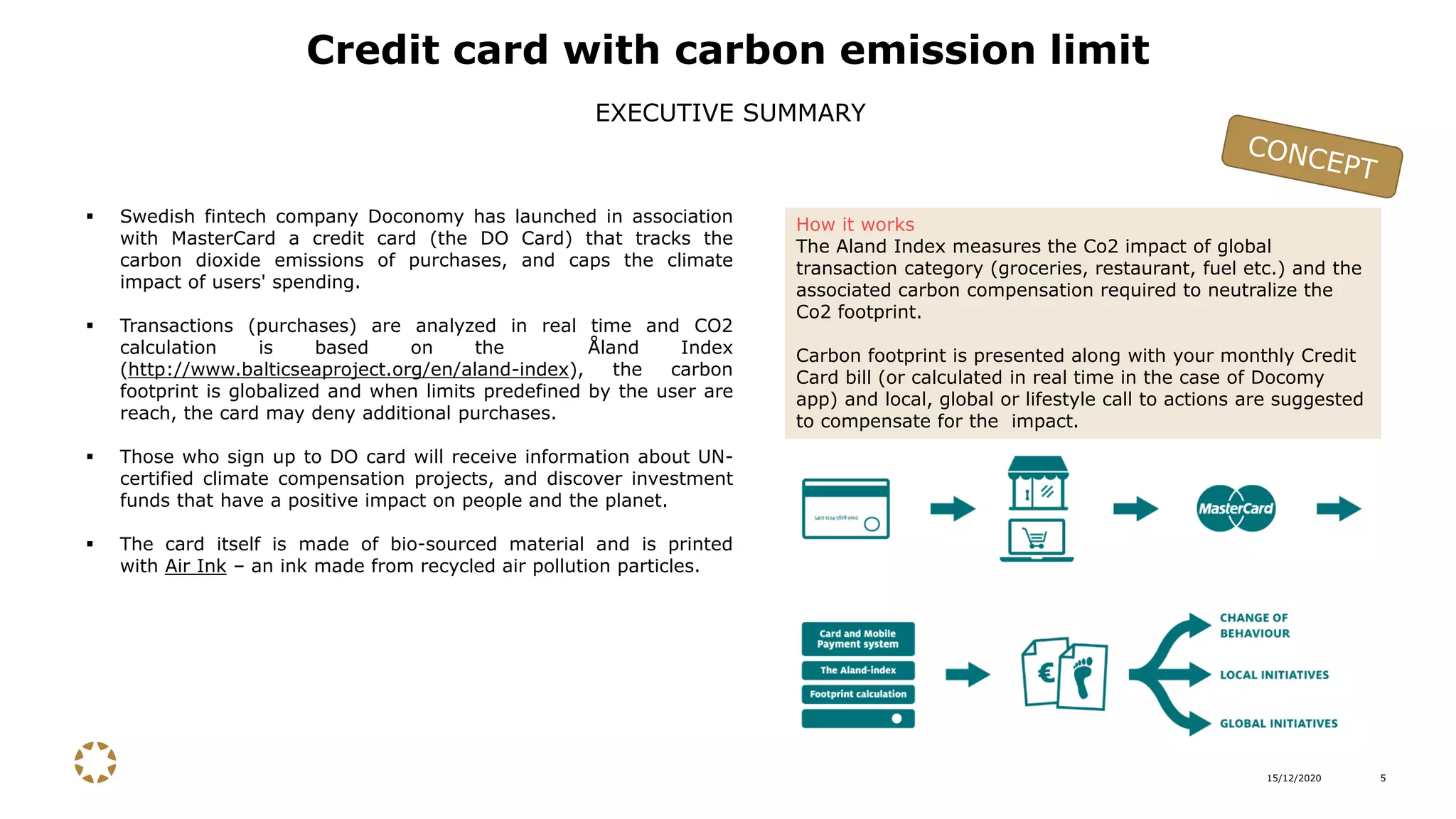

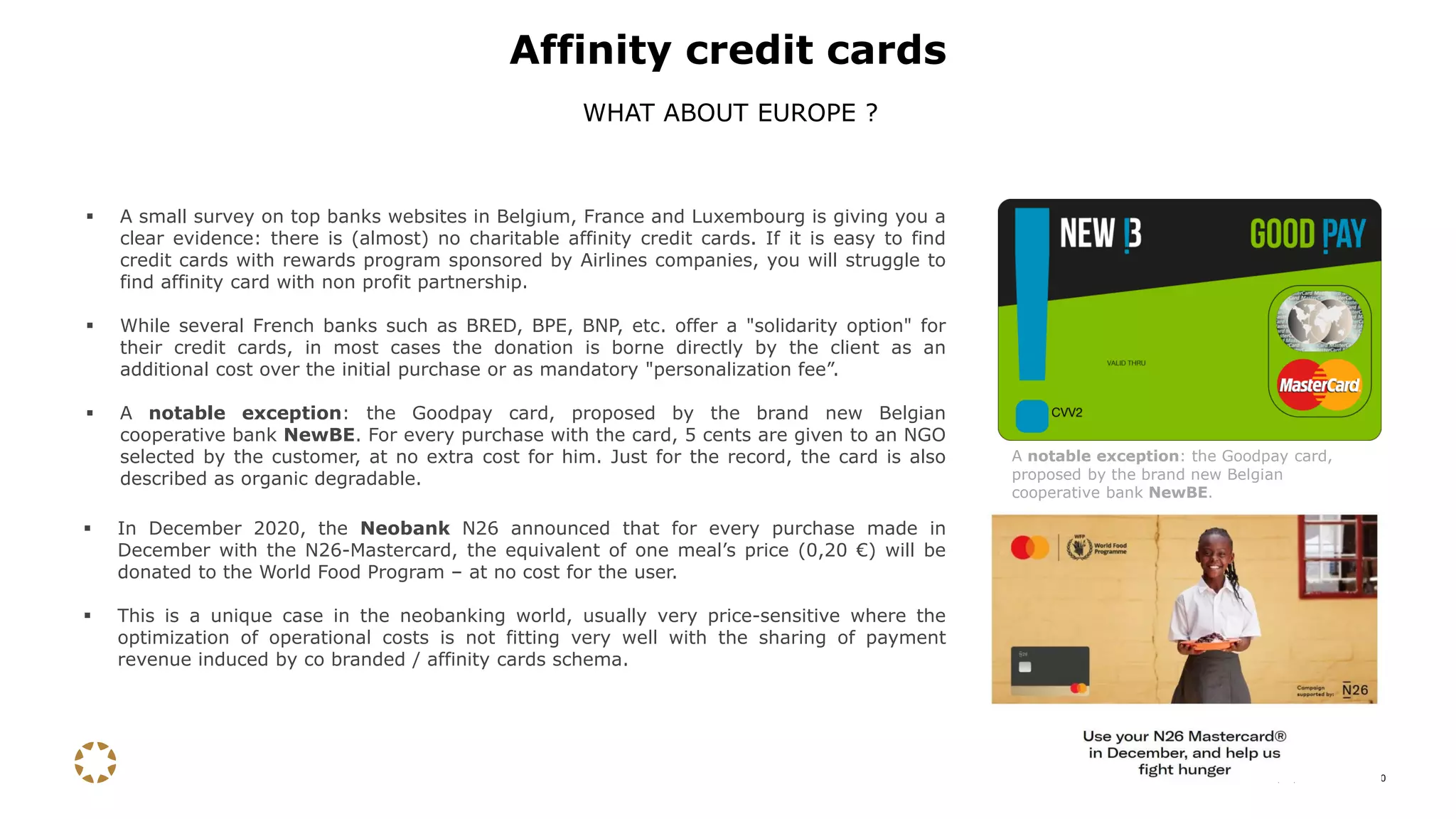

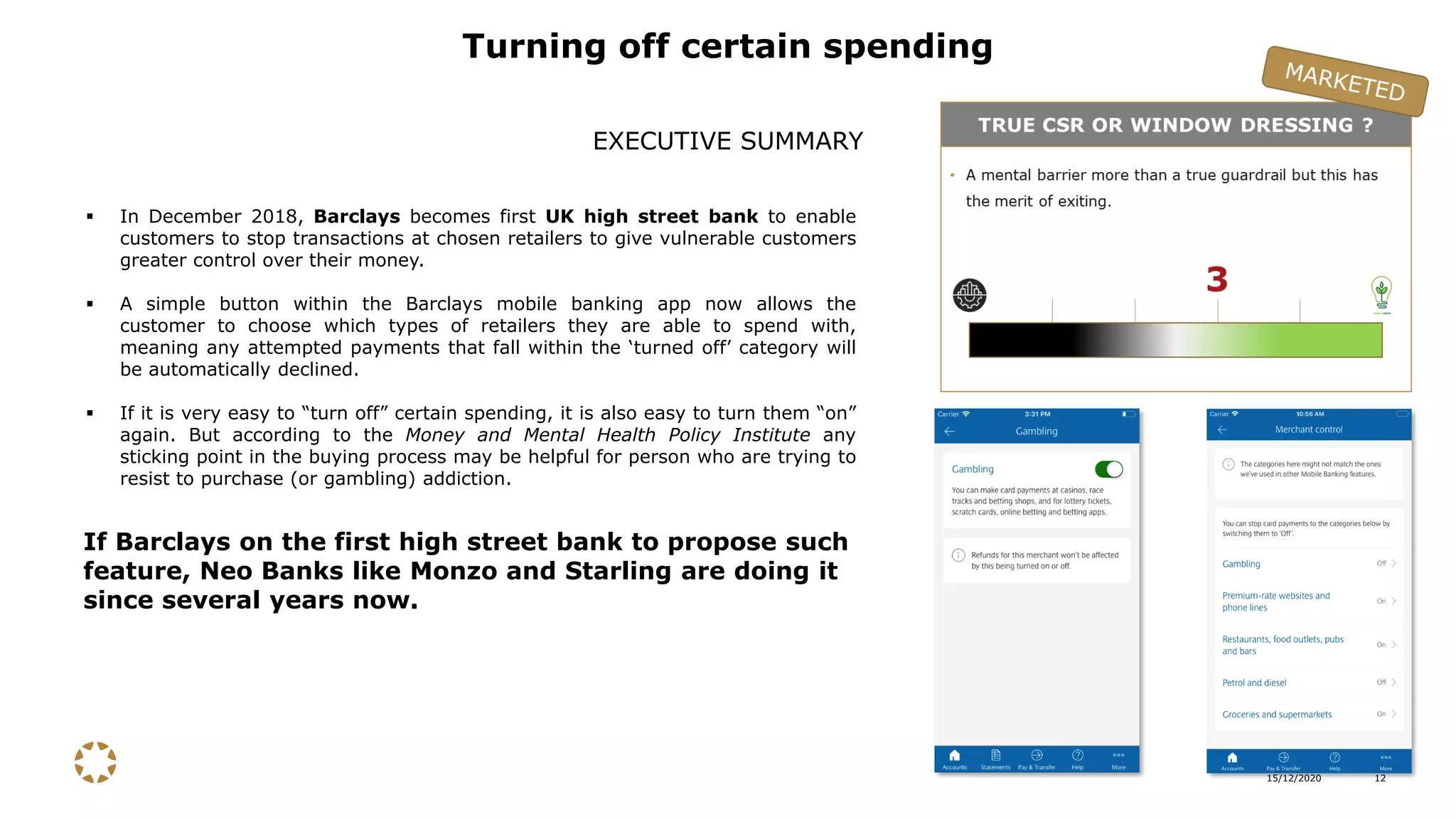

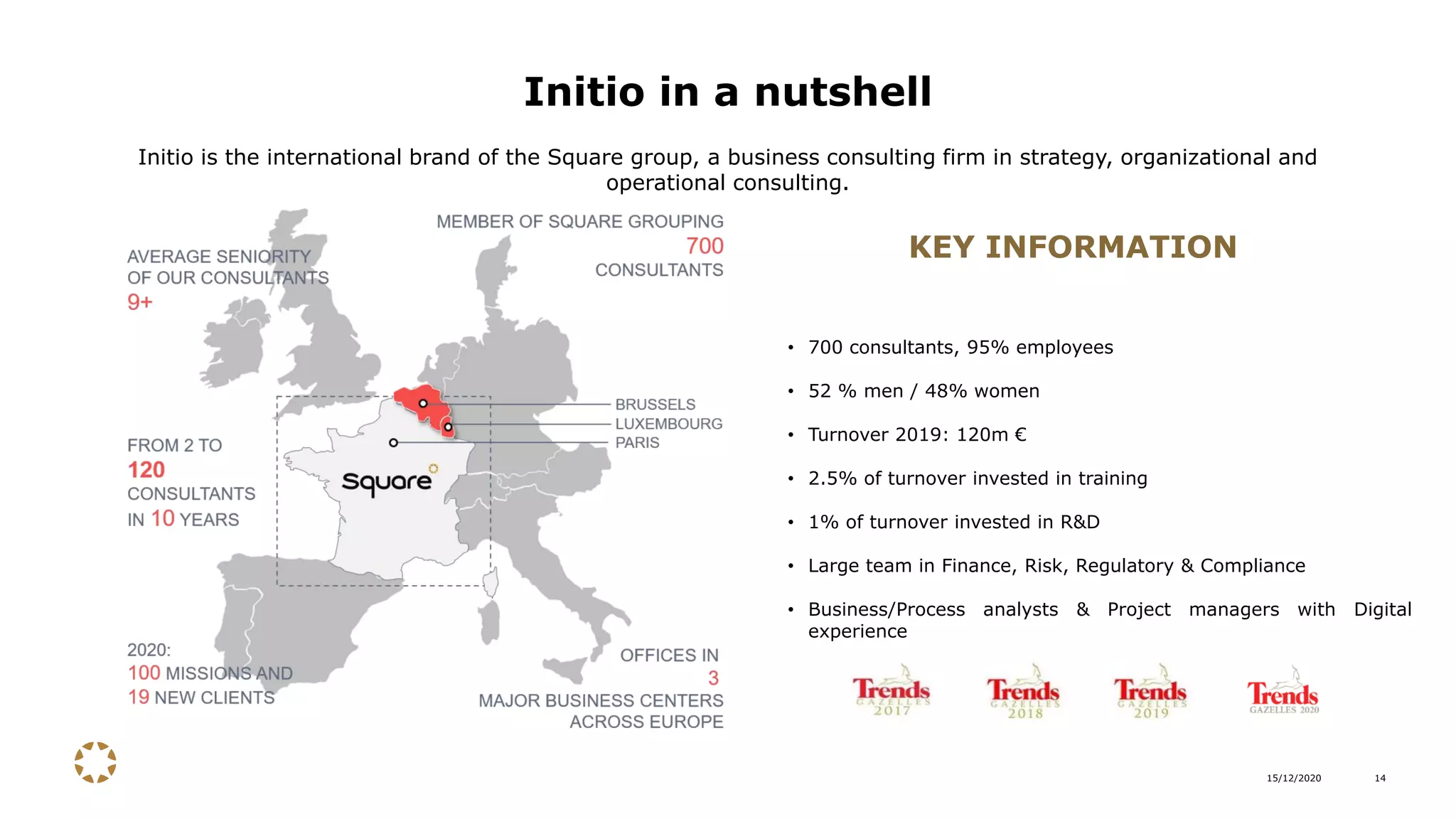

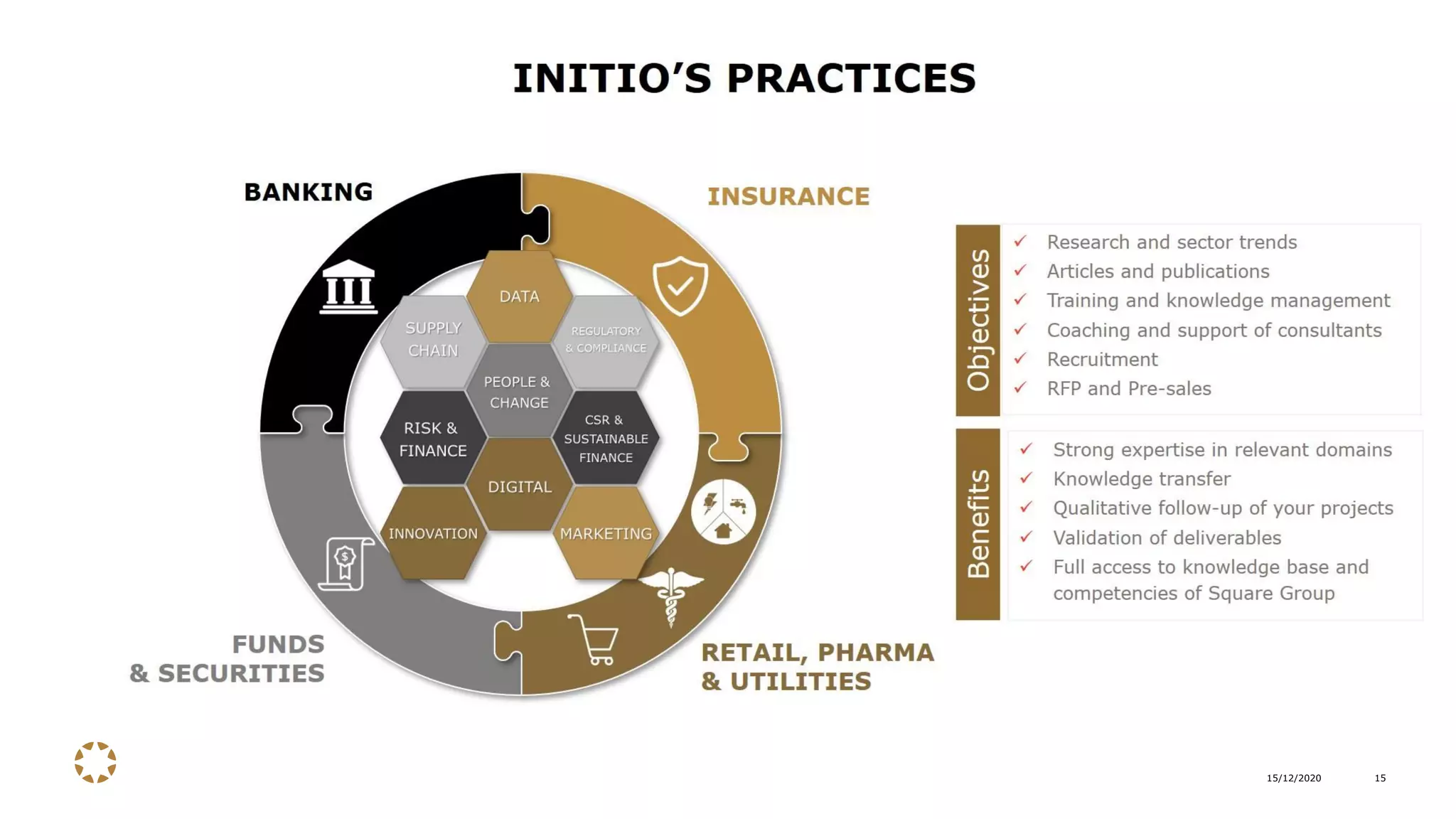

The document discusses two innovative banking products aimed at promoting responsible finance: the 'do card' by Doconomy, which tracks and limits carbon emissions from purchases, and affinity credit cards that automatically donate a portion of spending to charities. It highlights the potential and challenges of these initiatives, such as the do card's current conceptual status and the limited benefits of affinity cards. Additionally, the document examines functionality like transaction restrictions to help manage spending and mentions the role of consulting firm Initio in supporting banking transformation towards sustainable practices.