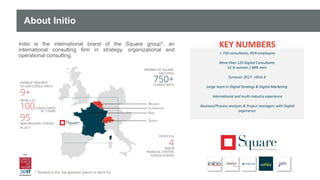

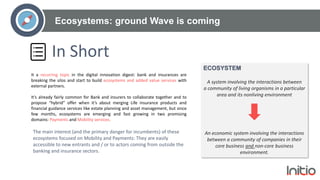

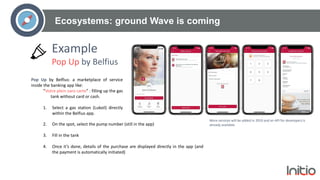

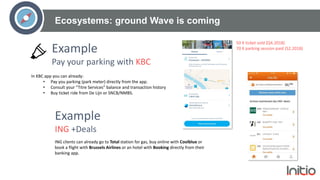

The document summarizes key trends and innovations in the banking and insurance sectors, focusing on the emergence of ecosystems that enhance customer experience through technology and partnerships. It discusses developments such as biometric contactless payments, Barclays' feature for managing spending at specific retailers, and the creation of added-value services by financial institutions. Overall, it highlights the need for traditional banks and insurers to adapt to digital trends to maintain customer engagement and remain competitive.

![CUSTOMER

EXPERIENCE

SUMMARY

This quarterly-produced document is an illustrated condensed of few but most relevant and inspirational trends or innovations in Finance / Banking

/ Insurances.

It was created for internal knowledge sharing purposes and to promote the digital culture among consultants and business managers.

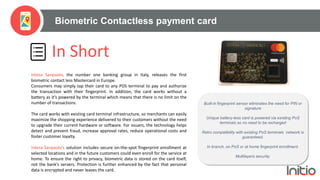

[Payment] Biometric contactless payment card Italy

ECOSYSTEMS [Ecosystems] Beyond Banking & Insurance Belgium / Worldwide

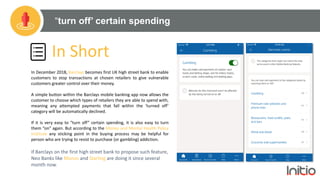

[Payment] “Turn off” certain spending United Kingdom

CUSTOMER

CENTRICITY](https://image.slidesharecdn.com/initiodigitalinnovationdigest11q42018-190114120033/85/Initio-Digital-Innovation-Digest-11-Q4-2018-2-320.jpg)

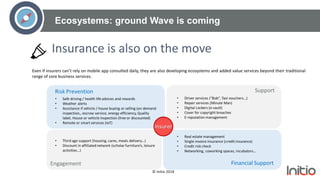

![Ecosystems: ground Wave is coming

Customer Loyalty

(Churn prevention, customer

engagement and support,

then brand advocacy)

Customer Acquisition

(Unbanked & uninsured

customers, millennials, tech-

savvy and trendsetters )

Reduced price sensitivity

(When added value services

are integrated in a global

[Premium] package).

Convenience

“Consumers buy with their

foot”: When you make things

easier for people they will be

ready to give you their money

(and their data)

Revenue generation

(cross-selling and upselling,

revenue per customer growth)

Data Acquisition

(consumers insights, next best

action, predictive marketing)

First Wave effect Second Wave effect Third Wave effect

Ecosystem

Epicenter

Brand

Awareness

Raise

interest

Touchpoints](https://image.slidesharecdn.com/initiodigitalinnovationdigest11q42018-190114120033/85/Initio-Digital-Innovation-Digest-11-Q4-2018-11-320.jpg)