1) The document provides an overview of Infosys, an Indian IT services company founded in 1981 with headquarters in Bangalore, India and revenue of Rs. 8,696 crore in Q3.

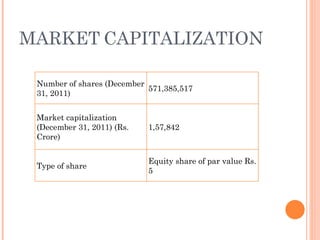

2) It defines key financial metrics like earnings per share (EPS), market capitalization, and price to earnings (P/E) ratio and provides Infosys' figures for these metrics.

3) In conclusion, it recommends Infosys as a long-term investment due to expected 16% growth despite economic volatility, supported by a global business and optimistic future outlook.