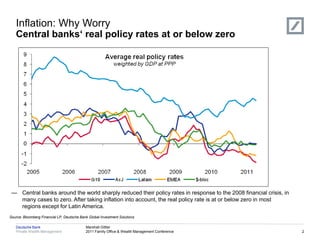

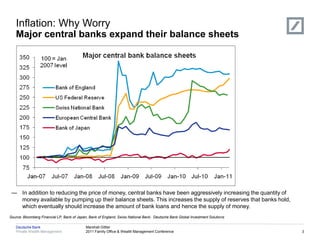

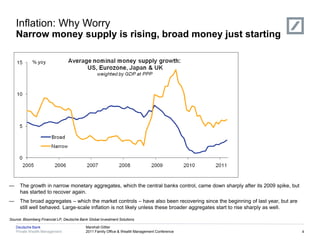

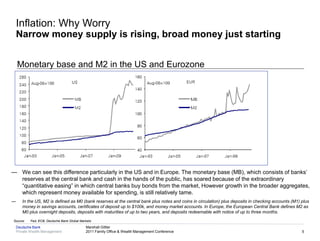

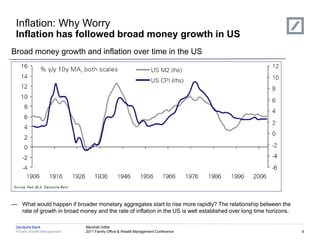

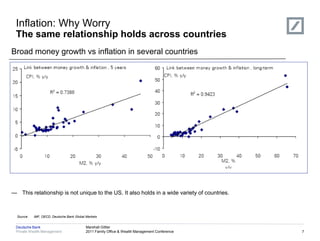

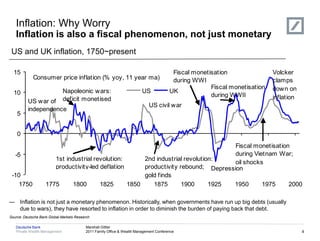

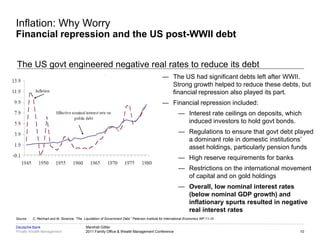

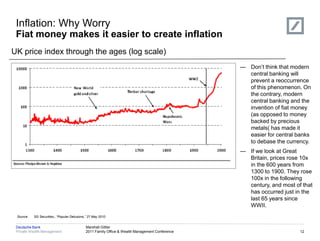

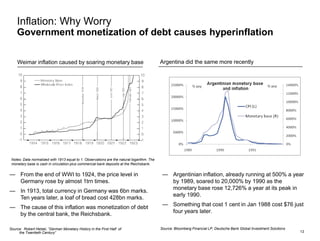

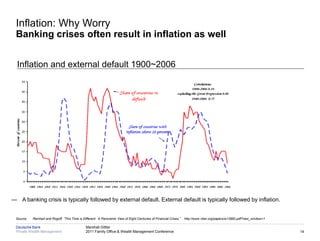

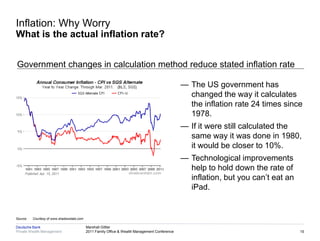

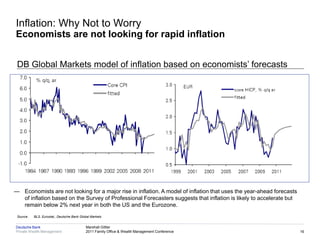

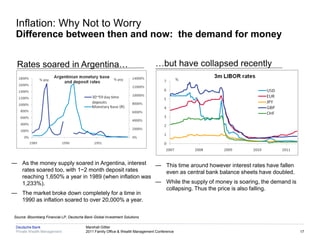

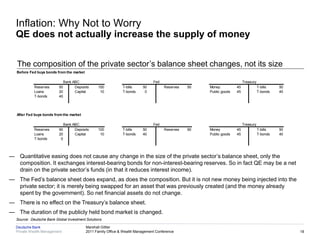

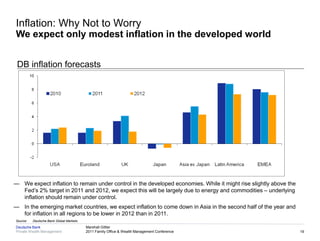

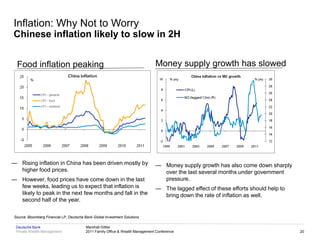

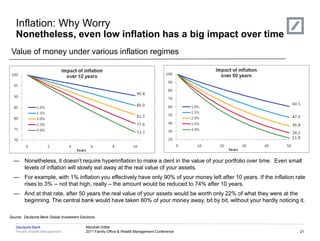

Central banks around the world have reduced interest rates to near or below zero in response to the 2008 financial crisis. This has increased money supply as central banks expand their balance sheets by purchasing bonds. Narrow money supply is rising but broad money is just starting to rise. If broad money rises sharply, inflation is likely to accelerate. However, economists are not forecasting rapid inflation. While central bank actions have increased money supply, quantitative easing does not directly increase private sector money holdings. Inflation is also impacted by fiscal policies and debt levels. Even low levels of inflation gradually reduce purchasing power over time.