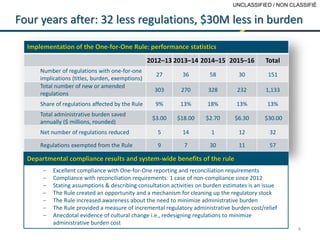

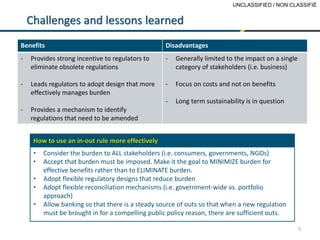

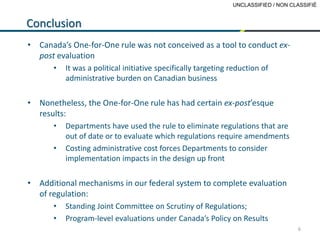

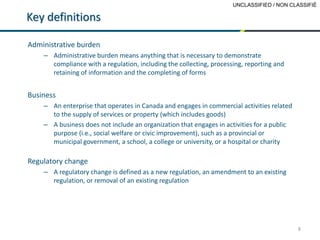

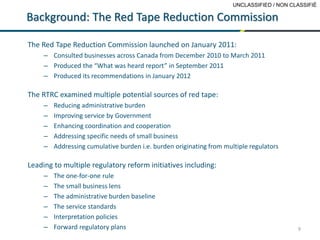

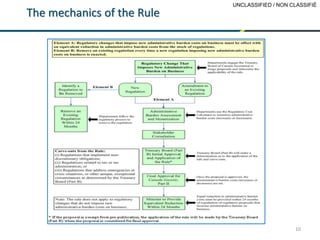

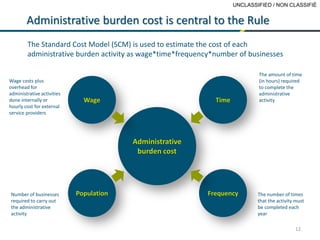

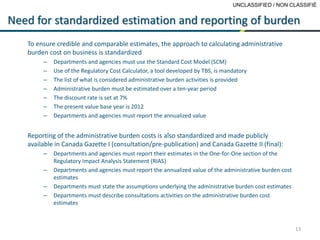

The One-for-One Rule was introduced in Canada to reduce administrative burdens on businesses by ensuring that for every new regulation imposing additional costs, an existing regulation must be removed, thereby maintaining a zero net increase in regulatory burden. Since its implementation, there has been a reported reduction of 32 regulations and an estimated savings of $30 million in administrative burden. The rule has faced challenges regarding its focus on costs rather than benefits and the need for long-term sustainability, while also providing a framework for cleaning up outdated regulations.