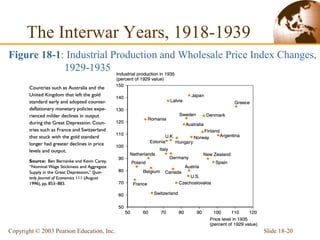

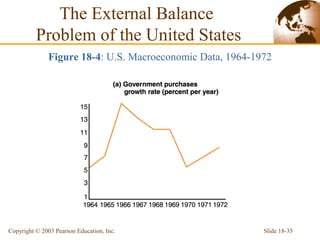

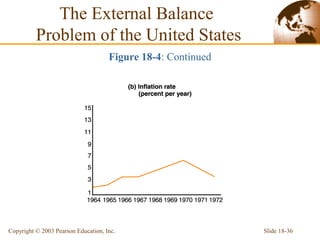

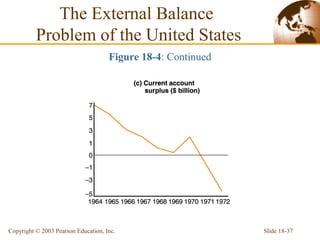

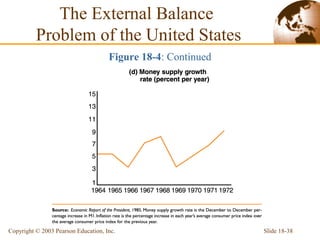

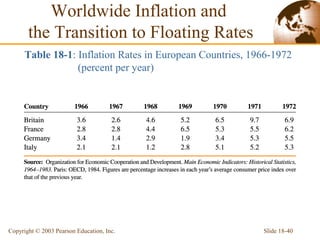

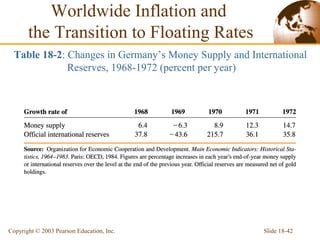

This document provides an overview of the international monetary systems between 1870-1973. It discusses the gold standard period prior to World War 1 and the instability during the interwar years. It then examines the Bretton Woods system established in 1944 which tied currencies to the US dollar and gold. However, inflation in the US during the 1960s put pressure on this system and it collapsed in 1973, leading to a transition to floating exchange rates.