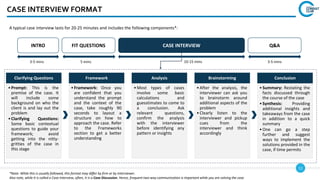

Here is a typical format for a case interview:

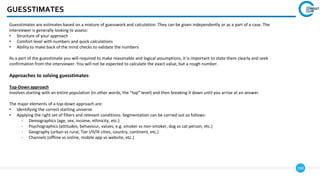

1. Intro (3-5 mins): The interviewer provides context on the client and outlines the problem statement.

2. Fit Questions (5 mins): The interviewer asks some basic questions to understand your approach and guide your framework without diving into case details.

3. Case Interview (10-15 mins): You present your framework, analyze the case, generate insights and recommendations through a discussion with the interviewer.

4. Q&A (3-5 mins): The interviewer wraps up with any final questions and gets your overall thoughts on the case and experience.

The key aspects are understanding the problem clearly, structuring your analysis systematically,

![174

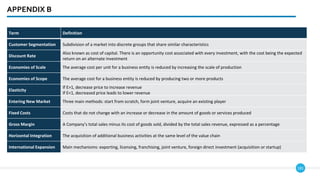

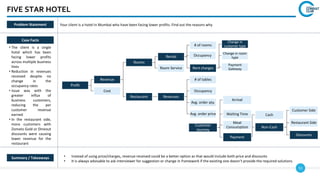

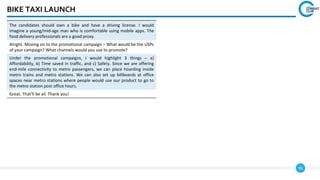

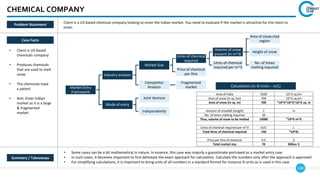

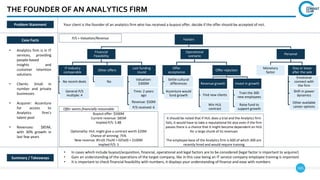

Fast Food Chain

Summary / Takeaways

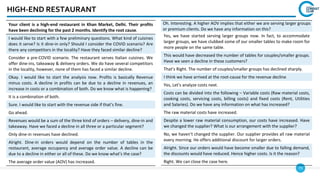

• A similar mathematical approach can be taken to estimate the total revenues via Takeaway and Delivery business

• For Delivery / Takeaway orders, you can include factors such as average order value, any special discounts / cashbacks offered, number of orders in a

hour basis demand

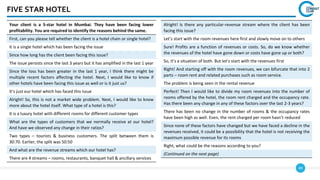

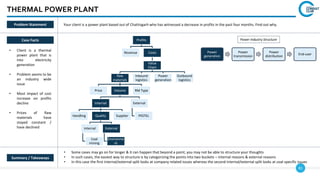

Case Facts

• Focus on Dine-In

orders only

Summary / Takeaways

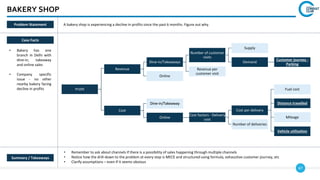

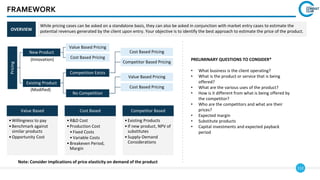

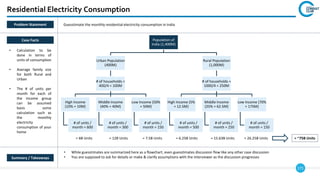

Problem Statement Guesstimate the daily revenue of a typical fast-food chain in Kolkata

Total Revenue

Average Price # of items sold

Dine-In

Takeaway

Delivery

# of items sold

in Dine-In

# of operational

hours

Capacity (# of

seats)

Average

occupancy

# of items per

person

/ Average time a

seat is occupied

Average Price ₹100

Operational Hours 12

Capacity 50

Average Occupancy 70%

# of items per person 2

/ Average time a seat is occupied* 30 mins = 0.5 hours

Total Daily Revenue ₹1.68L

*The average time every person eats at a fast food restaurant =30

min, therefore 2 (60min/30min) people occupying a seat per hour]](https://image.slidesharecdn.com/iimcalcuttacasebook2023-24-231028175258-ad6d8536/85/IIM-Calcutta-CaseBook-2023-24-pdf-174-320.jpg)

![180

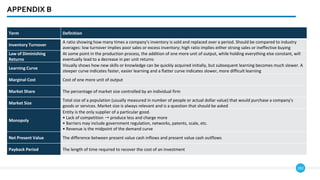

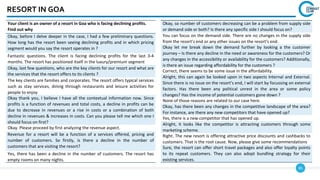

APPENDIX B

GLOSSARY Following are definitions to some key terms often used during case analysis

Term Definition

Adverse Selection

Situation in which an individual’s demand for insurance is aligned to their risk of loss (i.e. people with the highest expected

value will buy insurance) and the insurer cannot account for this correlation in the price

Arbitrage

The purchase of securities on one market for immediate resale on another market in order to profit from a price

discrepancy

Break-Even Total amount of revenue needed to offset the sum of a firm's costs. Implies that the firm's profit will be $0

CAGR

Compound Annual Growth Rate:

[(Ending Value/Beginning Value)^(1/n)]-1, n=no. of years

Capacity

The maximum level of output of goods and/or services that a given system can potentially produce over a set period of

time

Competitive Advantage

When a firm is able to deliver benefits equal to competitors but at a lower cost OR able to deliver greater benefits than

competitors

Consumer Surplus

Economic gain achieved when consumers purchase a product for a price less than their willingness to pay

Consumer Surplus = Willingness to Pay - Price

Contribution Margin C=P-V, where P is unit price, and V is variable cost per unit

Core Competencies The activities that a firm does well to create competitive advantage](https://image.slidesharecdn.com/iimcalcuttacasebook2023-24-231028175258-ad6d8536/85/IIM-Calcutta-CaseBook-2023-24-pdf-180-320.jpg)