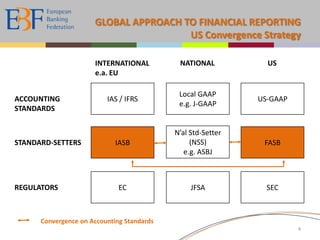

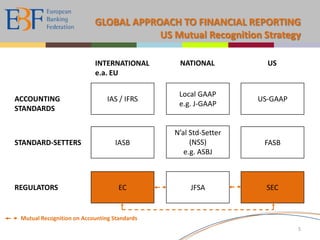

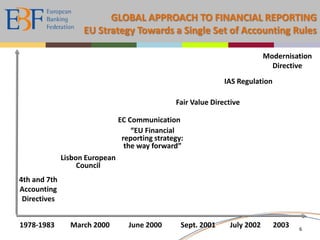

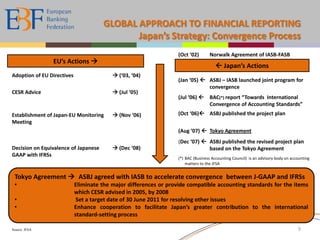

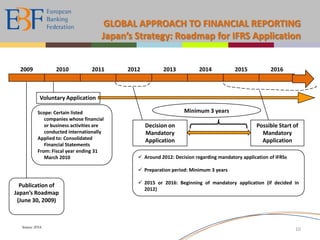

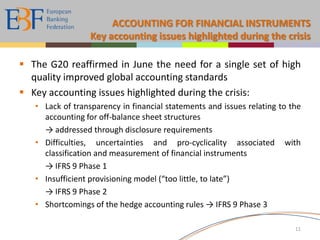

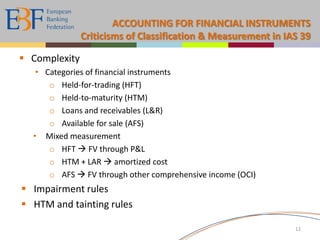

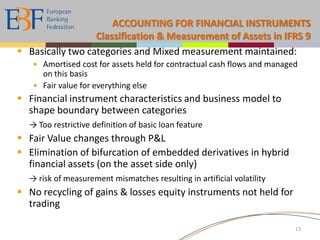

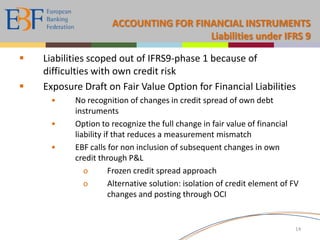

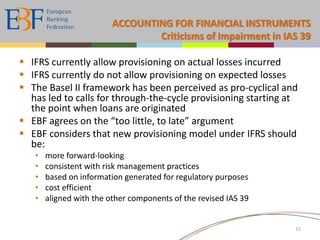

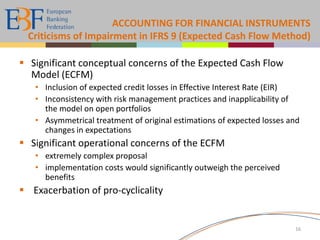

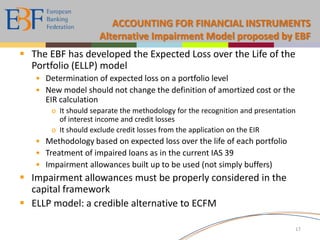

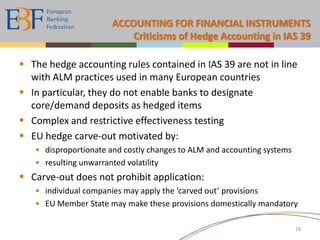

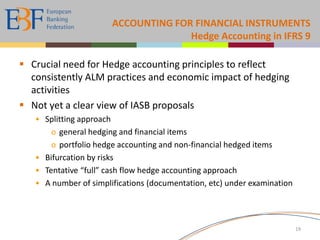

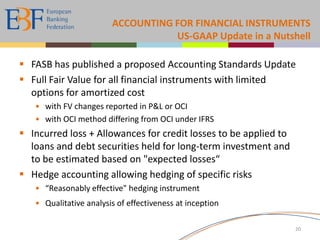

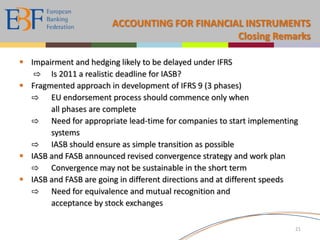

The European Banking Federation (EBF) represents around 5,000 banks in Europe and is committed to promoting competitive and efficient banking practices while advocating for a single set of accounting standards. The document discusses the need for global convergence in financial reporting standards, particularly focusing on the IFRS and its adoption across different countries, including Japan and the US. It also highlights key issues in accounting for financial instruments, such as classifications, impairments, and hedge accounting, and calls for the development of more robust and forward-looking standards.