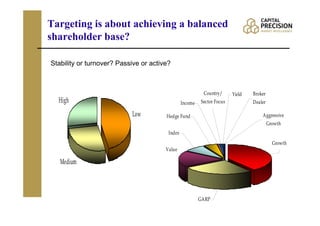

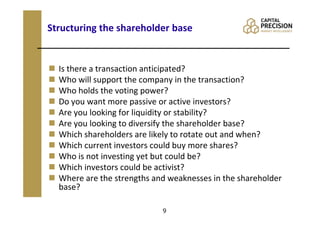

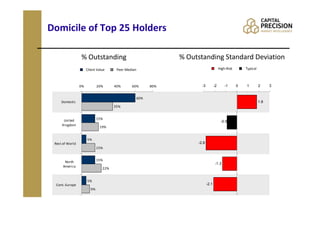

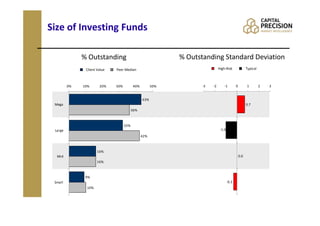

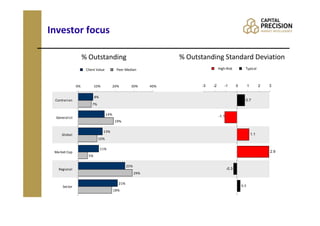

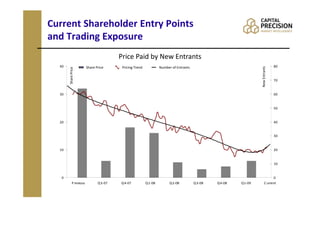

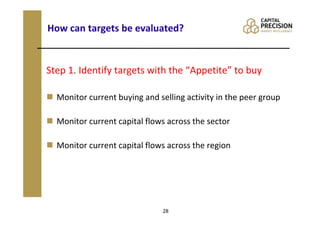

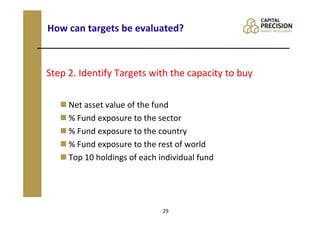

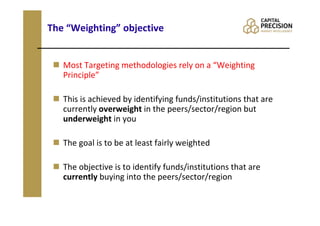

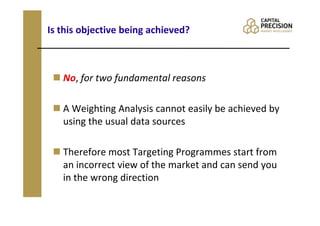

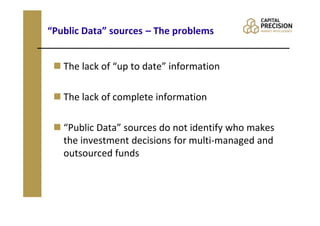

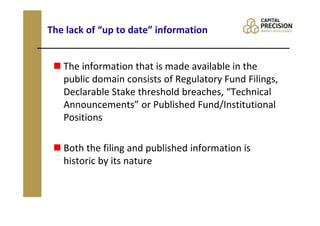

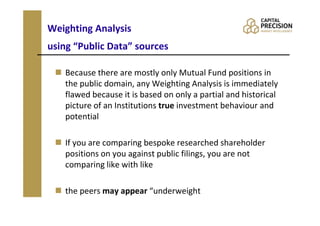

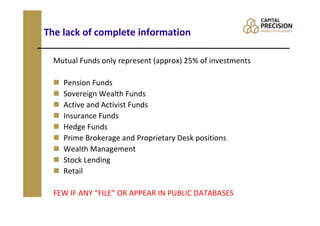

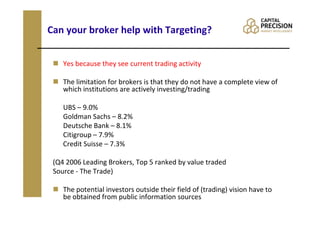

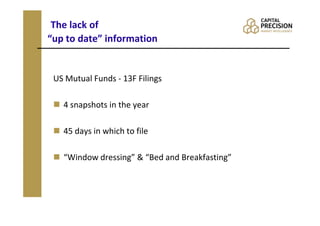

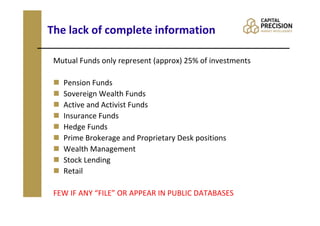

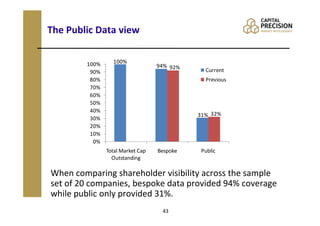

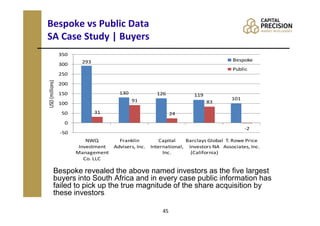

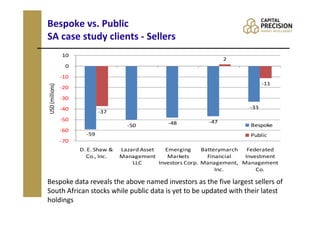

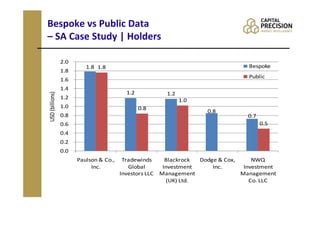

Capital Precision Ltd specializes in investor targeting, helping companies identify beneficial shareholders and potential new investors for their shares. The document outlines the complexities involved in targeting investor relationships, emphasizing the need for strategic planning and a clear understanding of shareholder structures. It discusses various factors affecting investor targeting, including shareholder concentration, fund sizes, and investor focuses, while also highlighting the limitations of public data sources in accurately informing targeting strategies.