Questions For Management And Directors, A Roadmap For Expansion And Growth

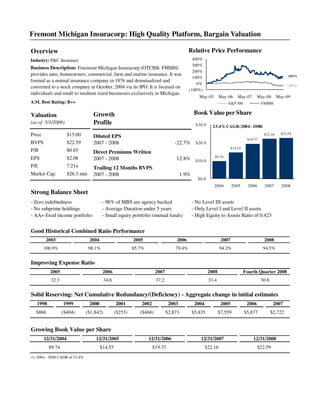

- 1. Fremont Michigan Insuracorp: High Quality Platform, Bargain Valuation Overview Relative Price Performance Industry: P&C Insurance 400% 300% Business Description: Freemont Michigan Insuracorp (OTCBB: FMMH) 200% provides auto, homeowners, commercial, farm and marine insurance. It was 109% 100% formed as a mutual insurance company in 1876 and demutualized and 0% (24%) converted to a stock company in October, 2004 via its IPO. It is focused on (100%) individuals and small to medium sized businesses exclusively in Michigan. May-05 May-06 May-07 May-08 May-09 A.M. Best Rating: B++ S&P 500 FMMH Valuation Growth Book Value per Share (as of 5/1/2009) Profile $30.0 23.4% CAGR (2004 - 2008) Price $15.00 Diluted EPS $22.16 $22.59 $19.37 BVPS $22.59 2007 - 2008 -22.7% $20.0 $14.55 P/B $0.65 Direct Premiums Written EPS $2.08 $9.74 2007 - 2008 12.8% $10.0 P/E 7.21x Trailing 12 Months BVPS Market Cap. $26.3 mm 2007 - 2008 1.9% $0.0 2004 2005 2006 2007 2008 Strong Balance Sheet - Zero indebtedness - 98% of MBS are agency backed - No Level III assets - No subprime holdings - Average Duration under 5 years - Only Level I and Level II assets - AA+ fixed income portfolio - Small equity portfolio (mutual funds) - High Equity to Assets Ratio of 0.423 Good Historical Combined Ratio Performance 2003 2004 2005 2006 2007 2008 100.9% 98.1% 85.7% 79.4% 94.3% 94.5% Improving Expense Ratio 2005 2006 2007 2008 Fourth Quarter 2008 32.3 34.6 37.2 33.4 30.8 Solid Reserving: Net Cumulative Redundancy/(Deficiency) - Aggregate change in initial estimates 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 $866 ($404) ($1,842) ($253) ($468) $2,873 $5,835 $7,559 $5,877 $2,722 Growing Book Value per Share 12/31/2004 12/31/2005 12/31/2006 12/31/2007 12/31/2008 $9.74 $14.55 $19.37 $22.16 $22.59 (1) 2004 - 2008 CAGR of 23.4%.

- 2. Direct Premium Written per Employee $1,000,000 $900,000 $800,000 $700,000 $600,000 $500,000 $400,000 $300,000 $200,000 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 Projected Source: June, 2008 Investor Presentation.

- 3. Some Questions for Fremont's Management and Directors It is highly important for management and directors to view core business issues from a variety of angles. Hopefully, these questions will stimulate constructive solutions to serious business issues that face Fremont. Of course, evidence of effective solutions will be concrete action which quantitatively improves results. The Problem Fremont's personal lines have gone from a 2006 gain of $4,129,003 to a 2008 loss of $806,725. Simultaneously, net premiums earned in personal lines have grown tremendously. This growth has continued in the latest quarter reported at an enormous rate. An executive in the Michigan insurance industry has told me that this rate of premium growth in personal lines (accompanied by losses) has few parallels among Fremont's peers and could easily become a mortal threat to Fremont's financial health if it is not swiftly rectified. What actions can management and directors take to assure shareholders that this development is of grave concern to those tasked with maximizing shareholder value? Why is management growing a line with profitability that has declined for years and has now gone negative? If management and directors really understand that this is a grave problem, why haven't they stopped and indeed contracted the growth in premiums in this line until the issue of losses has been shown to be successfully remedied for at least two years? I suggest that management and directors look at this from a shareholder perspective. As shareholders, would they sit idly by as losses are allowed to mount in personal lines, whose premium growth has continued unabated as of the latest quarter? Or would they demand a turnaround plan accompanied by concrete corrective action, whose success is measured quantitatively in profit and loss in ensuing quarters/years? Solutions The Michigan Essential Insurance Act makes it very difficult for insurance companies to reduce premiums in personal lines, but the company does have serious options. I. Fremont should rank insurance agencies by historical loss performance (perhaps adjusted to reflect their ranking in their geographic area). Then, Fremont should dispatch employees by telephone, and when necessary, in person, to ask underperforming agencies to voluntarily cancel their contracts with the company. II. Fremont needs to promptly stop using credit scoring. It is a fine quantitative method. However, due to the political environment, it hurts the company when it tries to raise rates. The use of credit scoring, which Fremont is particularly known for, is like waving a red cape in front of an angry bull when it comes to regulators. If the use of credit scoring keeps the company from getting its rates raised by regulators, its success at predicting loss performance is a moot point. III. Fremont needs to accept the inconvenient truth that the political environment in Michigan has become hostile to the adequate pricing of personal lines. I understand that a Michigan-only identity is dearly held by certain executives. However, Fremont's core value ought to be extending its great insurance services to individuals and to businesses, regardless of where they live. The pursuit of shareholder value has now made that mandatory. Please don't imitate the ostrich, which tries to hide from danger by burying its head in the sand. Bravely confront

- 4. reality with Evidence-Based Management (EBM) and intelligent solutions. Fremont needs to expand outside of Michigan. Indiana would be an excellent state for expansion. The regulatory environment is rational, the economy is better than a state such as Ohio, and the weather environment is mathematically modelable. There is competition from strong county mutuals. However, the company can win against these. Fremont can never win against a Michigan regulator who has all the power and refuses to allow the rate increases necessary for adequate pricing. You may protest that the regulators will allow adequate pricing, but that argument has failed on the strength of overwhelming evidence to the contrary in the Governor' actions s and in the company' own results in personal lines. s A Practical Roadmap for Expansion Fremont executives have told me that they are not sure how they would find the capital necessary to expand. Here are some ideas: I. First, Fremont already has excess capital. I believe Michigan law allows the company to pay a dividend of up to 10% of statutory surplus to shareholders without any approval from the Michigan OFIR. Statutory surplus stood at $33,169,00 in 2008 as of the company' latest 10-K. Fremont clearly has s excess capital. There would be more than enough money to acquire an insurance shell company in Indiana. The practice is very common, inexpensive, and allows firms to quickly move into states without many of the usual regulatory hurdles. There are investment banks which specialize in such transactions. Large and small insurance companies alike do this often. It is a well-regarded method of expansion. II. Fremont could easily do a sale-and-leaseback of its headquarters property to free up cash. It is owned free and clear, with no mortgage indebtedness. What could be easier? III. Obviously, as premiums decrease in Michigan personal lines, less capital will be needed to support those operations. The capital can be freed up to be used more efficiently elsewhere (in another state) to maximize shareholder value. IV. The company could sell all or part of its Michigan book of business in personal lines. If this is impossible due to its poor performance, the company could heavily reinsure the line and take steps which would approach run-off, while staying within the bounds of the Michigan Essential Insurance Act. I want to be clear, I have been the first to advocate a more efficient level of reinsurance for Fremont. However, that is for lines which are economically viable, for which adequate pricing and performance can be obtained. If a line has no future, do everything you can to minimize the pain and to expand in places where Fremont can make, as opposed to lose, money. Don'kid yourself, don'lose more money, and don'hope the line will come back. In insurance, “hope” is a four- t t t letter word for people who can'model risk. t