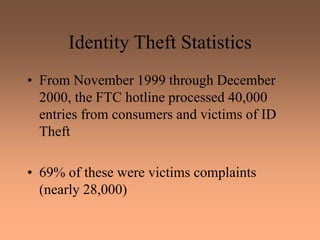

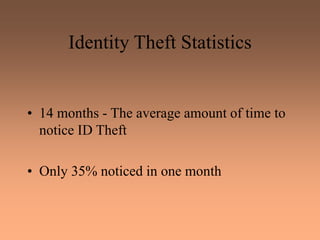

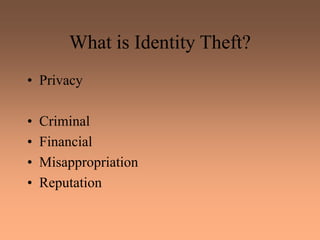

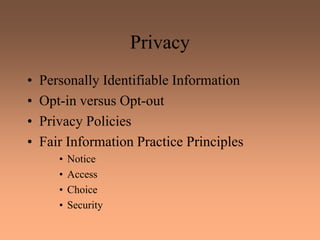

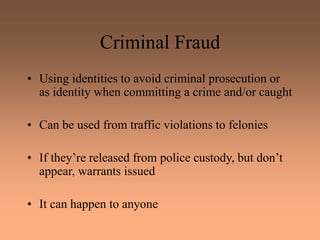

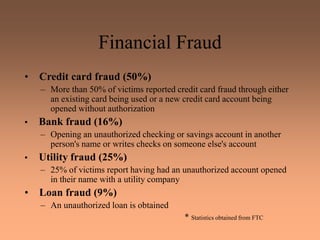

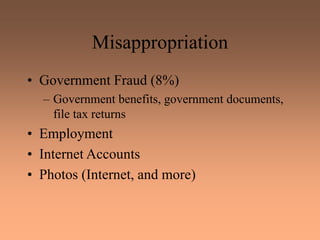

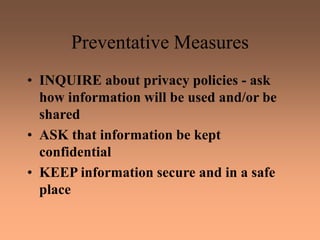

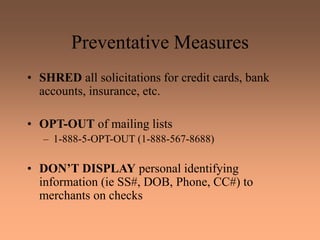

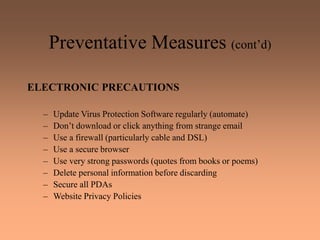

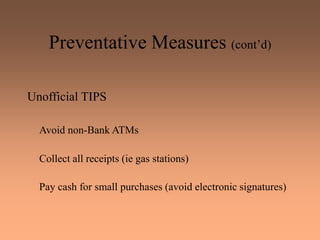

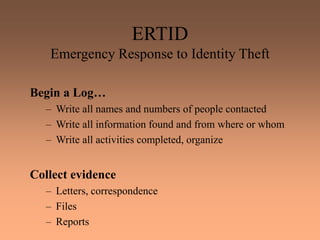

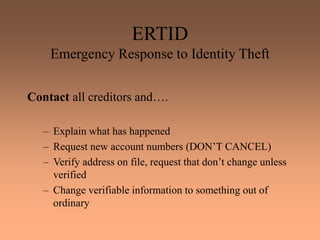

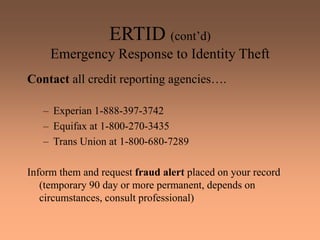

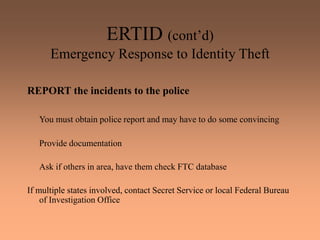

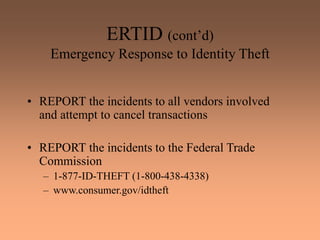

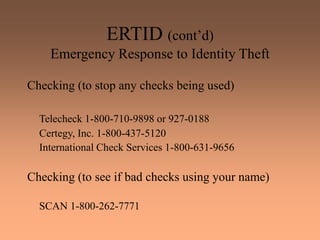

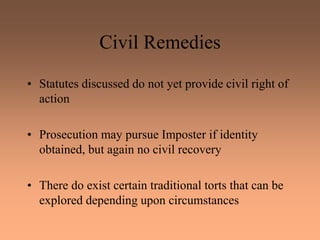

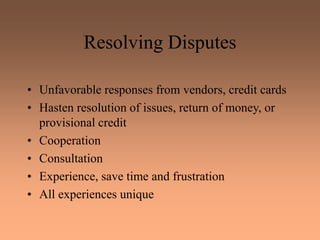

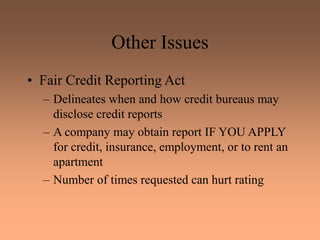

The document discusses identity theft, detailing its types such as financial, criminal, and misappropriation, along with statistics on its prevalence. It outlines preventative measures individuals can take to avoid becoming victims, including monitoring personal information and utilizing privacy policies. Additionally, it describes legal frameworks related to identity theft and suggests responses if one becomes a victim, including contacting creditors and law enforcement.