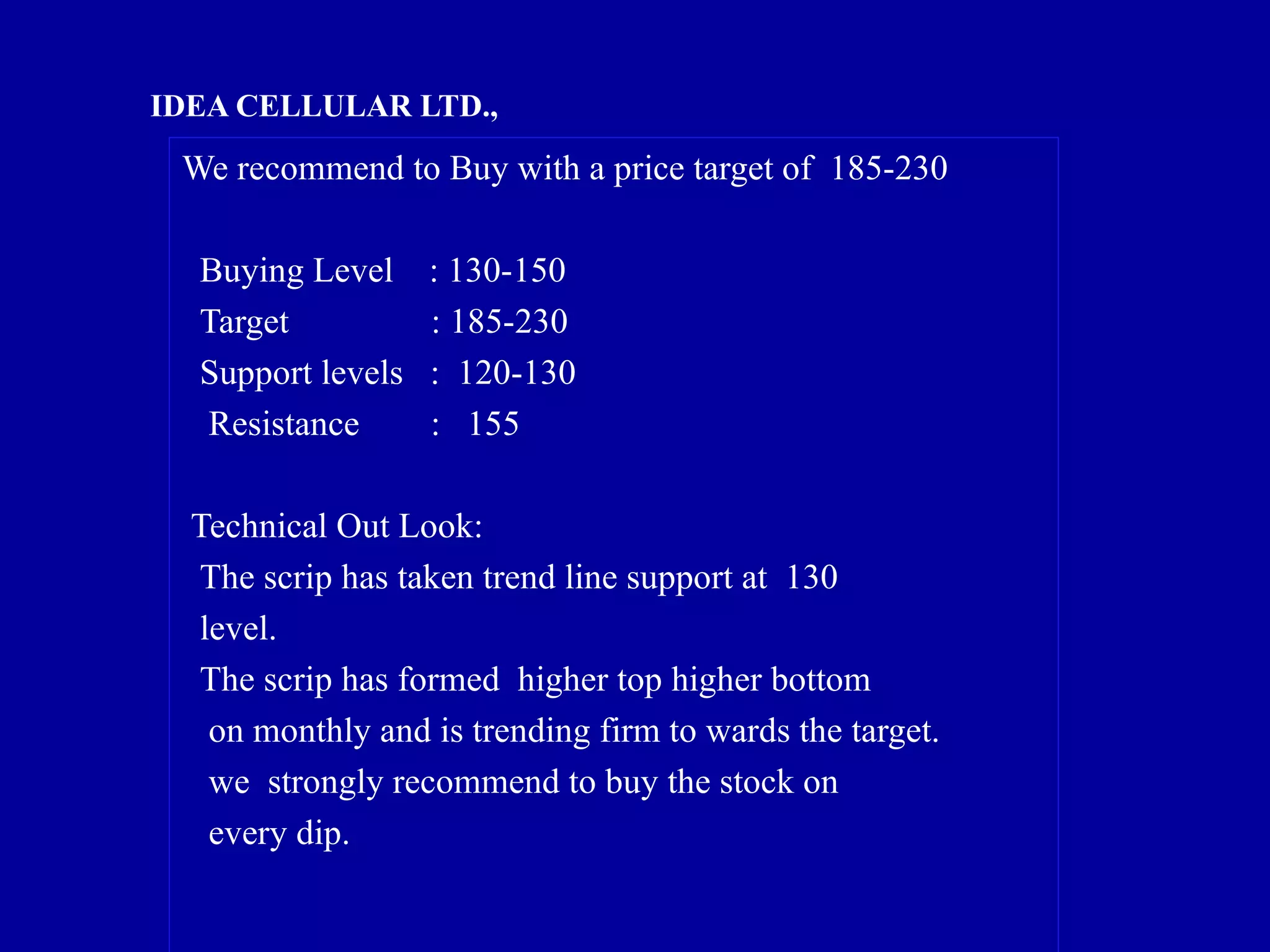

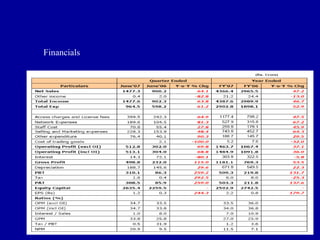

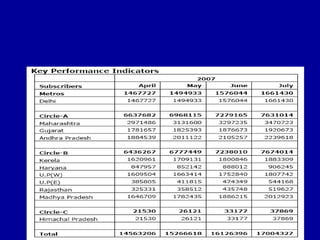

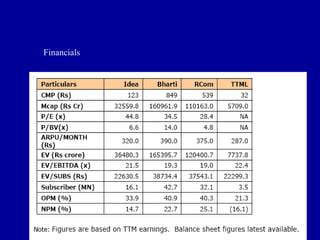

Idea Cellular Ltd. is recommended as a buy with a price target of Rs. 185-230. The technical outlook is positive as the stock has taken support at Rs. 130 and is trending higher. Company outlook is also positive due to expected robust subscriber growth, improving EBITDA margins, and potential value unlocking from hiving off its tower business. On the financial front, net sales increased 64% YoY while EBITDA and PAT grew 69% and 259% YoY respectively due to margin expansion and lower costs.