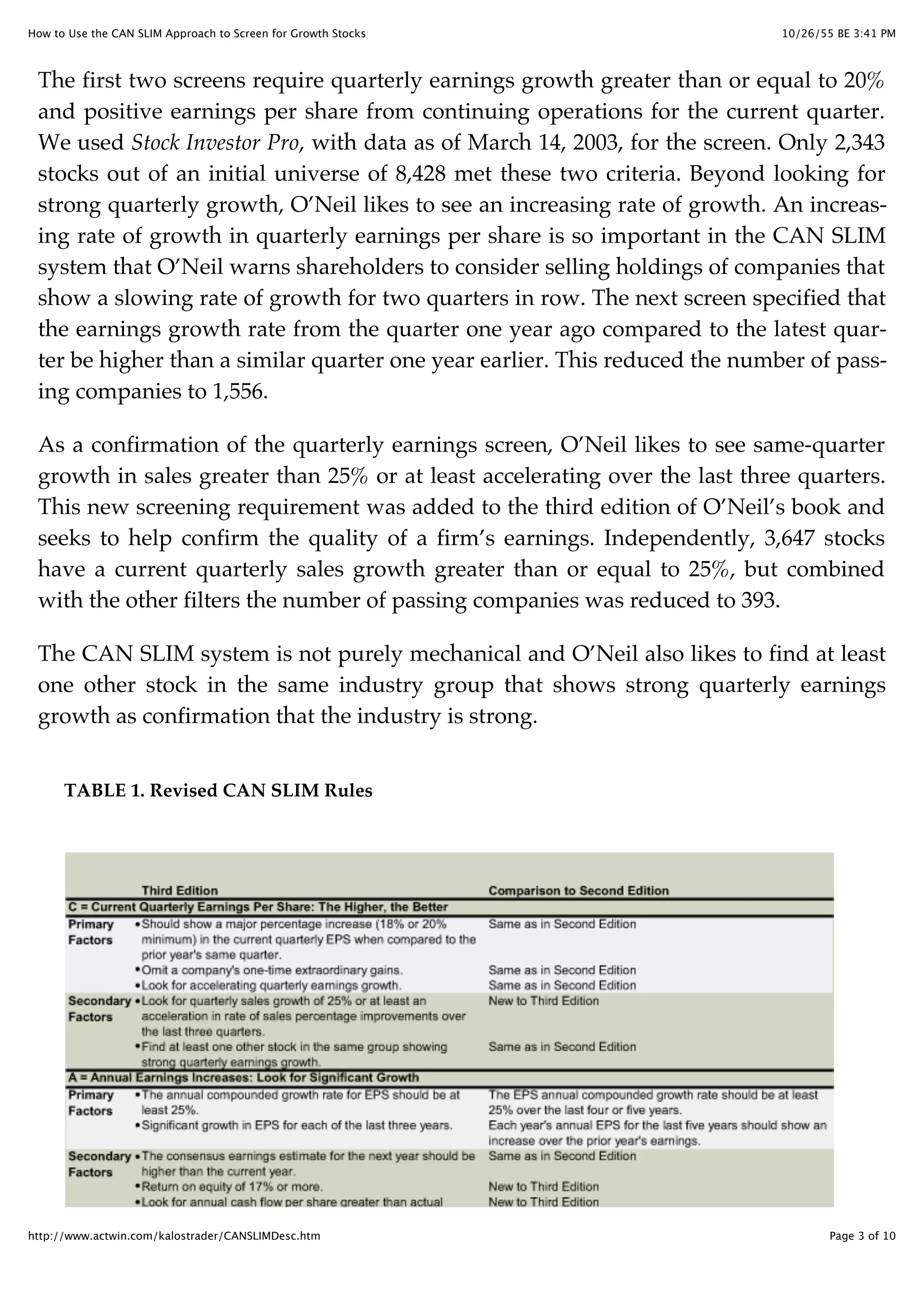

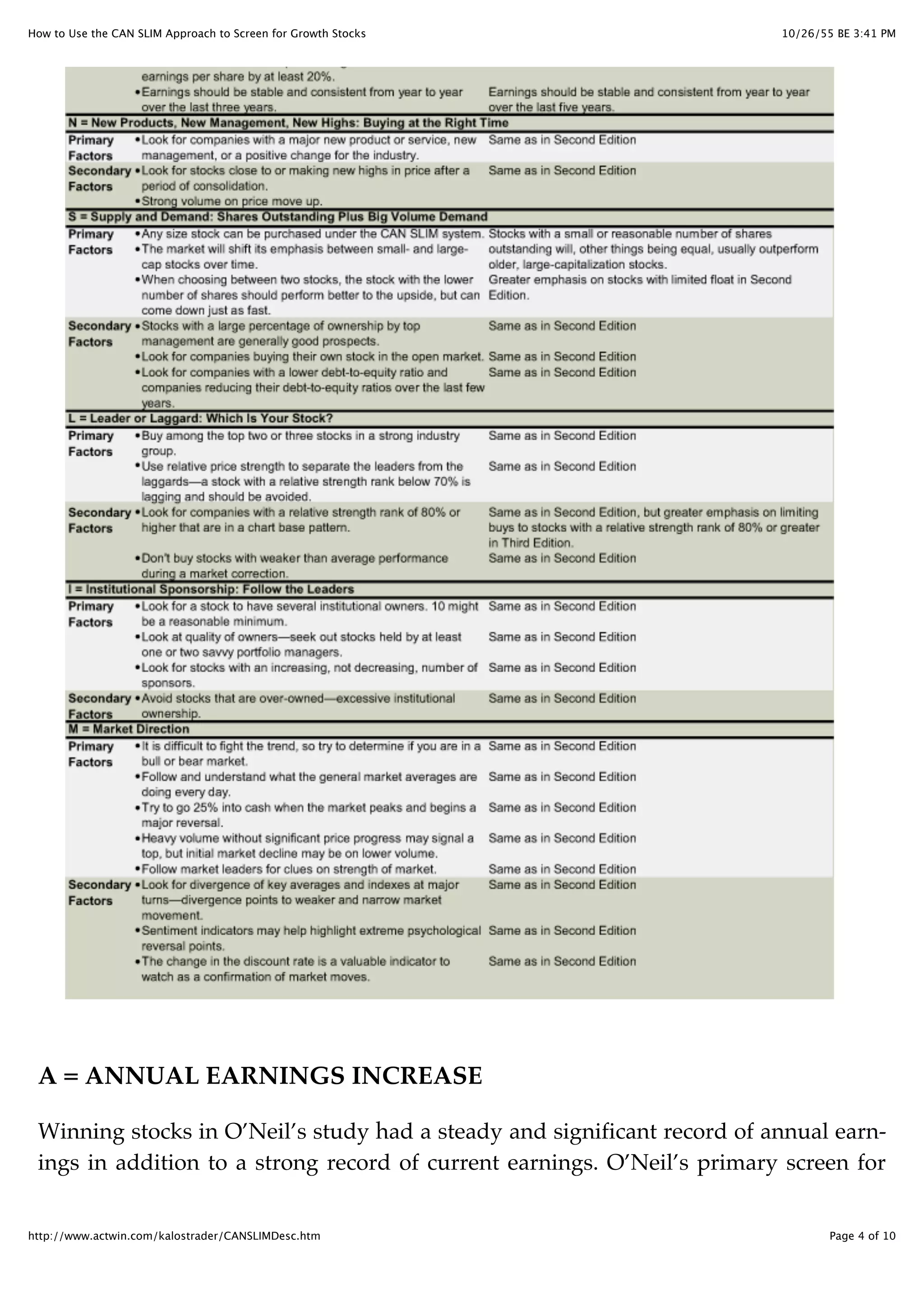

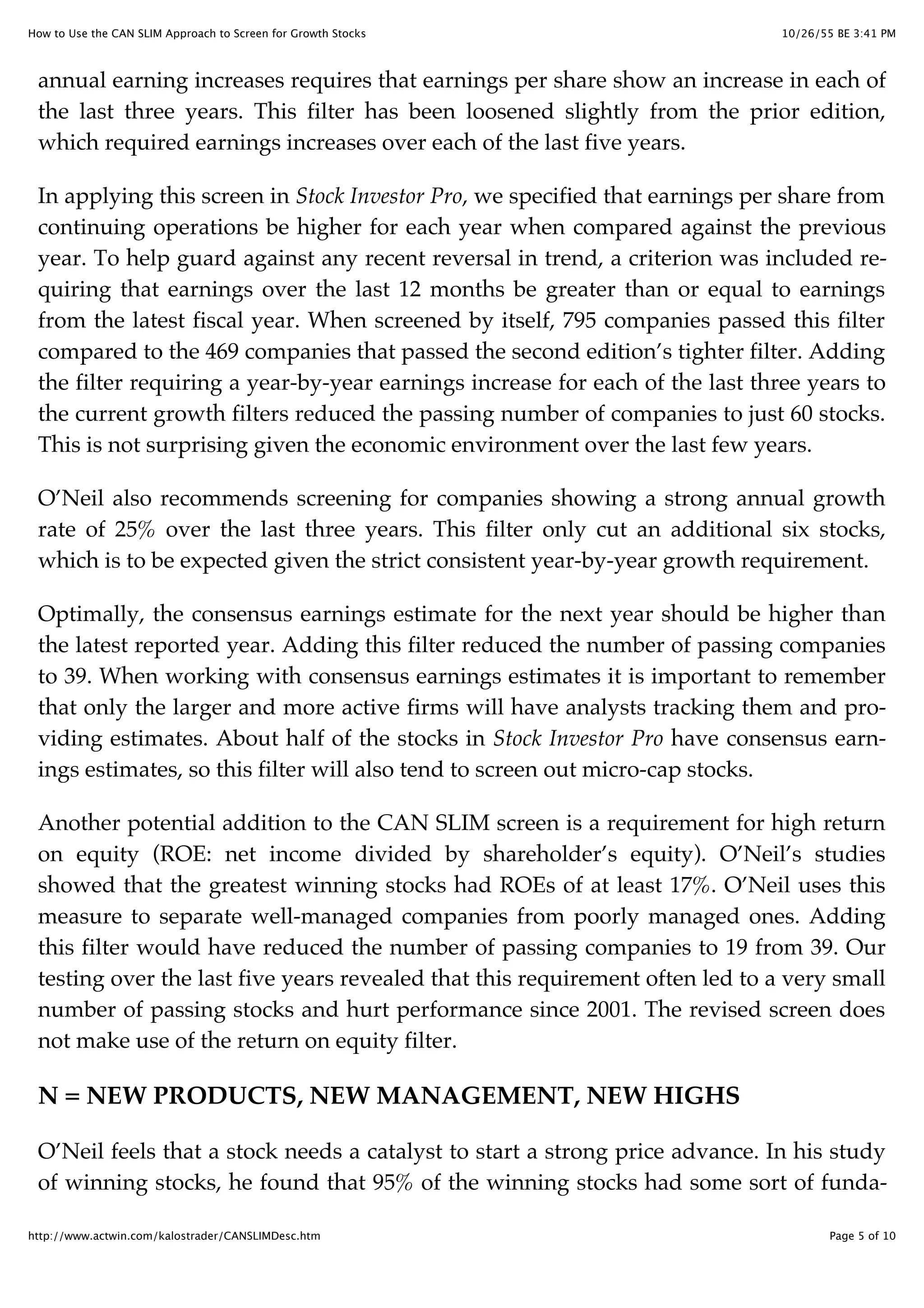

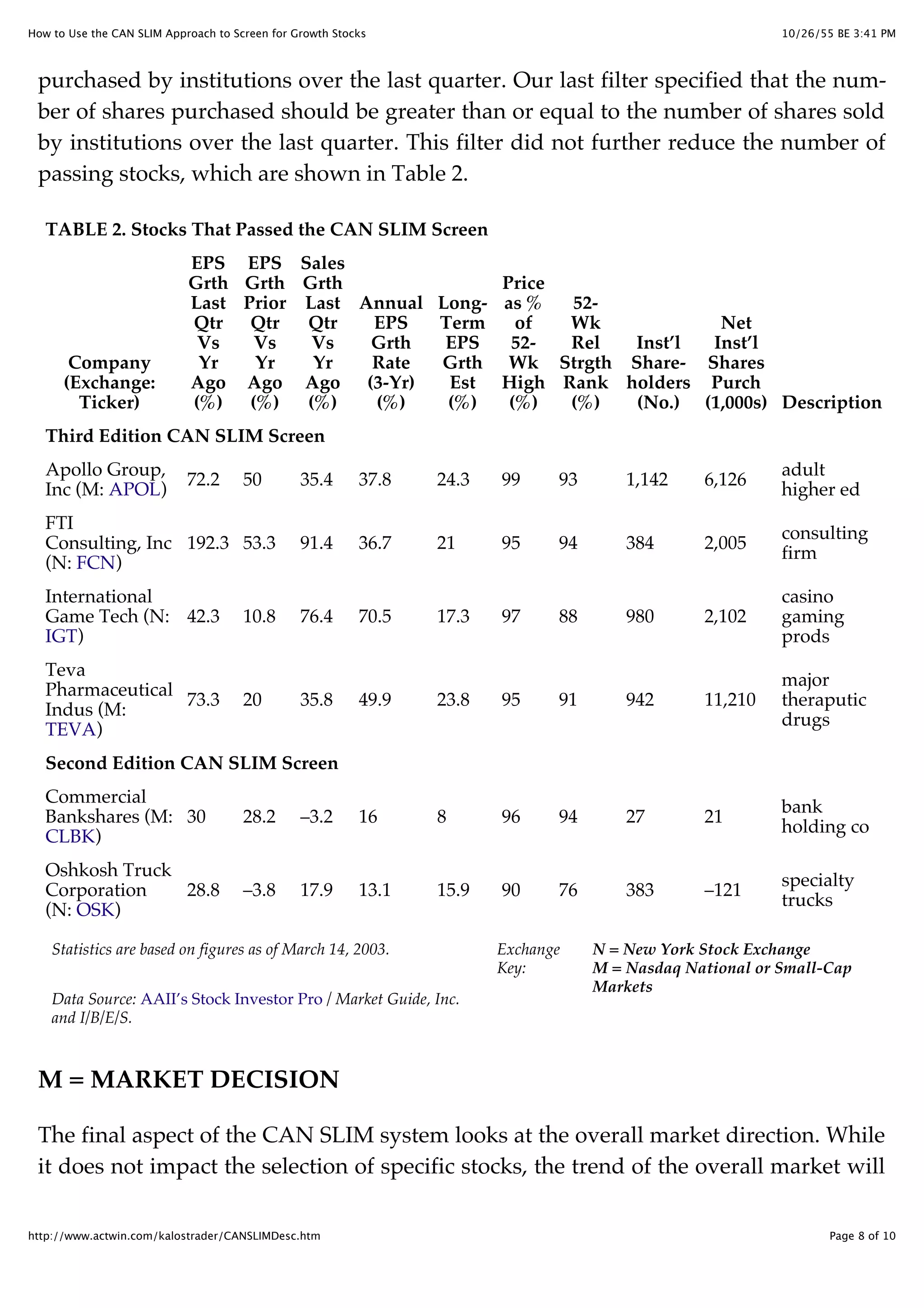

The document describes the CAN SLIM approach for screening growth stocks developed by William O'Neil based on his study of past market winners. The approach focuses on companies exhibiting strong quarterly and annual earnings growth, high relative price strength, and institutional sponsorship. The document outlines the specific criteria for each component of CAN SLIM (C-Current Quarterly Earnings, A-Annual Earnings, etc.) and provides an example screen applying the approach which identifies 4 stocks passing all the filters.