Saltanat CuadraFarah Mohammad RasheedSabrina NaqviGloria the.docx

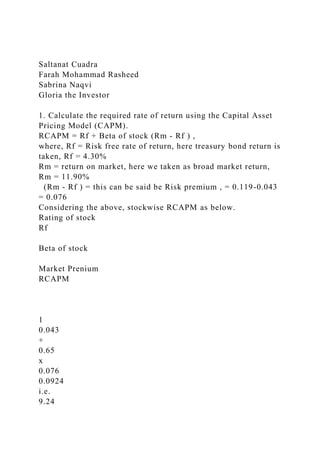

- 1. Saltanat Cuadra Farah Mohammad Rasheed Sabrina Naqvi Gloria the Investor 1. Calculate the required rate of return using the Capital Asset Pricing Model (CAPM). RCAPM = Rf + Beta of stock (Rm - Rf ) , where, Rf = Risk free rate of return, here treasury bond return is taken, Rf = 4.30% Rm = return on market, here we taken as broad market return, Rm = 11.90% (Rm - Rf ) = this can be said be Risk premium , = 0.119-0.043 = 0.076 Considering the above, stockwise RCAPM as below. Rating of stock Rf Beta of stock Market Prenium RCAPM 1 0.043 + 0.65 x 0.076 0.0924 i.e. 9.24

- 5. i.e. 7.188 % 13 0.043 + 0.71 x 0.076 0.09696 i.e. 9.696 % 14 0.043 + 1 x 0.076 0.119 i.e. 11.9 % 15 0.043 + 0.73 x 0.076 0.09848 i.e. 9.848 % 2. Value of stock under constant dividend growth model, P0 = D1 /(Ke-g) , D1 = D0 (1+g), D1 is the dividend receivable after 1 year

- 6. Rating of stock D0 ($) g D1($) Ke P0 = D0 x g (D1/ke-g) 1 0.95 0.0065 0.956 0.0924 = 11.13 2 0 -1 0.000 0.2178 = 0.00 3 0 0 0.000 0.18664 = 0.00 4

- 9. 1.080 0.119 = 27.69 15 1.35 0.0885 1.469 0.09848 = 147.24 3. Comparison of market price of stock & stock value computed. Rating of stock (given) Market Price (given) Market Value* Stock value over market price ($) 1 12.05 11.13 -0.92 2 28.02 0.00 -28.02 3 17.75 0.00 -17.75 4 92.43 19.21

- 11. 121.65 14 18.25 27.69 9.44 15 7.00 147.24 140.24 4. What do your results mean for Gloria? Following shall be sequence while investing in these stocks on the basis of stock value computed. Rating of stock (given) Market Price (given) Market Value* Stock value over market price ($) Sequence for investment 15 7.00 147.24 140.24 1 6 71.11 143.44

- 13. 9 9 101.00 3.50 -97.50 10 2 28.02 0.00 -28.02 11 3 17.75 0.00 -17.75 12 7 10.00 0.00 -10.00 13 10 39.78 0.00 -39.78 14 12 73.09 0.00 -73.09 15 Discussion Questions: 3. Compare the values you calculated in questions 1 & 2. Do the values closely approximate the stocks market price? If not, why

- 14. not? There is a significant difference between intrinsic value and market value. Intrinsic value is an estimate of the actual true value of a company. Market value is the value of a company as reflected by the company's stock price. Therefore, market value may be significantly higher or lower than the intrinsic value. 4. What do your results mean for Gloria? Out of the 15 stocks, Gloria can only consider those stocks, which have high Beta value and high required rate of return. Also the growth factor is also to be considered in the case. Thus after calculation and observation of the 15 stocks we can easily select 5 stocks which Gloria can consider for more profitability in the business. 5. Are there other options Gloria might consider for valuing stocks? The dividend discount model (DDM) is a method of valuing a company's stock price based on the theory that its stock is worth the sum of all of its future dividend payments, discounted back to their present value. The methods used to analyze securities and make investment decisions fall into two very broad categories: fundamental analysis and technical analysis. Fundamental analysis involves analyzing the characteristics of a company in order to estimate its value. Technical analysis takes a completely different approach; it doesn't care one bit about the "value" of a company or a commodity. Technicians are only interested in the price movements in the market. 6. How does your result affect the “market efficiency” theory? Market efficiency survives the challenge from the literature on long-term return anomalies. Consistent with the market efficiency hypothesis that the anomalies are chance results, apparent overreaction to information is about as common as under reaction, and post-event continuation of pre-event abnormal returns is about as frequent as post-event reversal. Most important, consistent with the market efficiency prediction. Basically, the market efficiency theory states that information asymmetry eventually dissipates, as the information

- 15. becomes known to investors and public and until the true value of the stock equates to current market price that apparent anomalies can be due to methodology, most long-term return anomalies tend to disappear with reasonable changes in technique. Investment Growth Analysis for Gloria - June 19, 2016 Kimberly Huh Casey Wilkins Kent Wright Calculate the required rate of return using the Capital Asset Pricing Model (CAPM). * for calculation risk free = 4.30% Beta = *retrieved from assignment expected market return = 11.9% Require Rate of Return 1 9.2400% 2 21.7800% 3 18.6640% 4 13.4200% 5 14.5600% 6 12.2800% 7 17.8280% 8

- 16. 11.5200% 9 11.2920% 10 15.7000% 11 10.7600% 12 7.1880% 13 9.6960% 14 13.4200% 15 9.8480% Using the constant growth formula, calculate the value of each stock P = D1/(r-g) Where P is the value estimate, D0 is the current dividend amount, D1 is the estimated dividend in year 1, r is the cost of common stock (or the required return by the shareholders), and g is the constant growth rate Constant growth value Current Stock Price Difference 1 $11.13 $12.05

- 18. 11 $24.03 $29.75 -23.00% 12 $0.00 $73.09 13 $142.04 $20.39 696.00% 14 $0.00 $18.25 15 $147.24 $7.00 2100.00% Compare the values you calculated in questions 1 & 2. Do the values closely approximate the stocks market price? If not, why not? No The calculated stock price does not reflect the current market prices. The current prices are quite higher than their intrinsic value which simply means stock value is overvalued. This difference could be because of high demand of stock which has increased stock price. These stocks maybe riding on economic growth. Economic conditions are the state of the economy in a country or region and are considered to be sound or positive when an economy is expanding, and are considered to be adverse or negative when an economy is contracting (www.investopedia.com). The differences in values (market

- 19. price vs constant growth value) are pretty high. Mostly, this is from the lack of dividends and dividend growth produced by a majority of the stocks. When evaluating the performance of any investment, it's important to compare it against an appropriate benchmark (www.investopedia.com). Since the constant growth formula uses the current dividend and expected increase in dividends as variables, the lack of these two components really dampen the accuracy and/or legitimacy of the stock valuations making this valuation tool non-applicable. However the companies that are paying a dividend need to have a growth rate comparable if not exceeding in order to meet the required rate of return. What do your results mean for Gloria? Gloria should pursue and acquire stocks which are undervalued like stocks 13 and 15. As they are undervalued and their prices may increase in the future. Even the growth potential of these companies is higher. Gloria should also look at growth patterns and risk factor. Companies that are having a negative growth rate may not perform well in near future and higher beta means that more risk involved. As a risk averse investor she should focus on companies with a higher return and lower risk. Once again what this means is that according to these numbers alone, only two of the fifteen stocks are "undervalued" and that she should pursue alternate methods of research for these stocks as there are possibly other and more appropriate methods for valuation. (Alternatively, this could also mean Mr. Bill is a big fat liar and is bad at his job). Unscrupulous investment advice is something Gloria should look at as well (Hunter, 2006). Are there other options Gloria might consider for valuing stocks? The one constant growth model is not enough as some companies are not paying dividends. Dividend and growth are not the only measures which reflect intrinsic values. Gloria could also calculate stock price through: * FCFF (Free Cash Flow from Firm) * FCFE (Free Cash Flow to Equity)

- 20. * Residual Income model *Discounted Cash Flow Model * Excess returns model * Adjusted Present Value * Relative Valuation * Standardized values and multiples model Comparing company's in the same sector would allow her to create standardized multiples defined by: Definitional Test- Even the simplest multiples are defined differently by different analysts. Consider, for instance, the price-earnings (P/E) ratio, the most widely used multiple in valuation. Analysts define it to be the market price divided by the earnings per share, but that is where the consensus ends. Descriptional - When using a multiple, it is always useful to have a sense of what a high value, a low value, or a typical value for that multiple is in the market. In other words, knowing the distributional characteristics of a multiple is a key part of using that multiple to identify under- or overvalued firms. Analytical- In discussing why analysts were so fond of using multiples, it is argued that relative valuations require fewer assumptions than discounted cash flow valuations. The difference is that the assumptions in a relative valuation are implicit and unstated, whereas those in discounted cash flow valuation are explicit and stated. Application-When multiples are used, they tend to be used in conjunction with comparable firms to determine the value of a firm or its equity. In addition, no matter how carefully we choose comparable firms, differences will remain between the firm we are valuing and the comparable firms (Damodaran, 2006). Essentially throwing darts at a board is what is happening now. Without comparison, we are not sure whether non dividend paying companies will be better choice or not. How does your result affect the “market efficiency” theory?

- 21. Market efficiency theory says it is impossible to beat the market which makes us uncertain that our decision to invest in undervalued could result in Gloria's favour. As there will be a lot of other investors looking for undervalued stock. Such increase in demand could increase stock price, eliminate any gain and bring price equal to its intrinsic value. But it is not necessary so as everyone in the market does not possess entire available information and there is always a chance to gain a bit. Periods marked by high arbitrage flows are periods during which markets are more efficient. These periods are likely to see a correction of cross-sectional mispricing, resulting in lower returns for quantitative strategies in the future (Akbas, 2016). Plus an efficient market is subject to rational investors. Rational investors, we are told, have adequate information to make investment decisions and act on that information, rationally and in their own best interest. They also make lifestyle choices, generally preferring aggressive portfolios early in their lives, and gradually becoming more conservative as they near retirement (Basu, 2008). References Akbas, F., Armstrong, W. J., Sorescu, S., & Subrahmanyam, A. (2016). Capital Market Efficiency and Arbitrage Efficacy. Journal Of Financial & Quantitative Analysis, 51(2), 387-413. doi:10.1017/S0022109016000223 Basu, S., Raj, M., & Tchalian, H. (2008). A Comprehensive Study of Behavioral Finance. Journal Of Financial Service Professionals, 62(4), 51-62 Damodaran, Aswath. ( © 2006). Damodaran on valuation: security analysis for investment and corporate finance, second edition. [Books24x7 version] Available fromhttp://common.books24x7.com.ezproxy.umuc.edu/toc. aspx?bookid=16748. Hunter, T. (2006). 'The sell sell sell crowd are back again' Unscrupulous financial advisers have been accused of

- 22. choosing investments that pay them the biggest commissions rather than deliver the best returns for clients. Teresa Hunter reports.Sunday Telegraph (London, England).