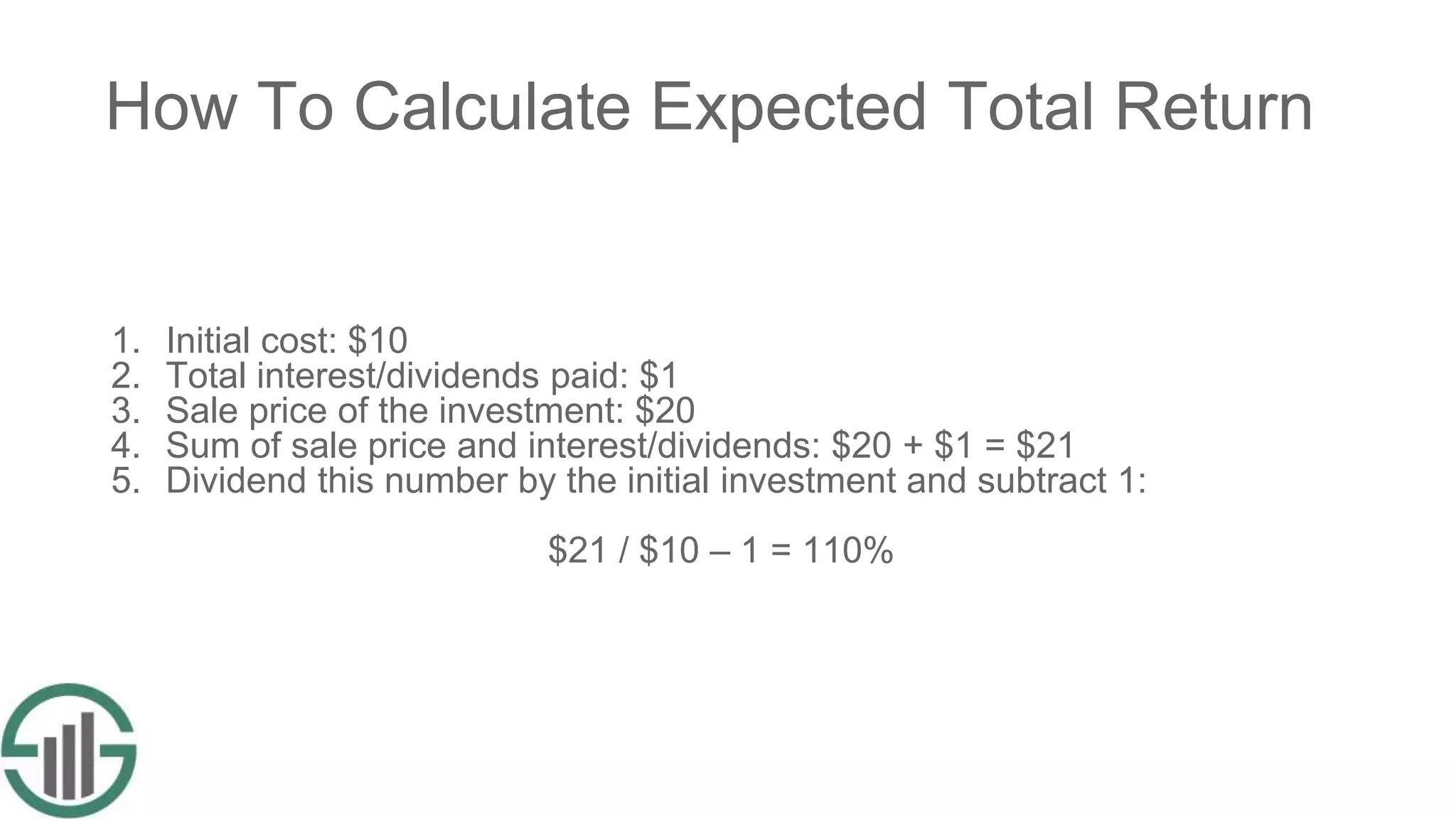

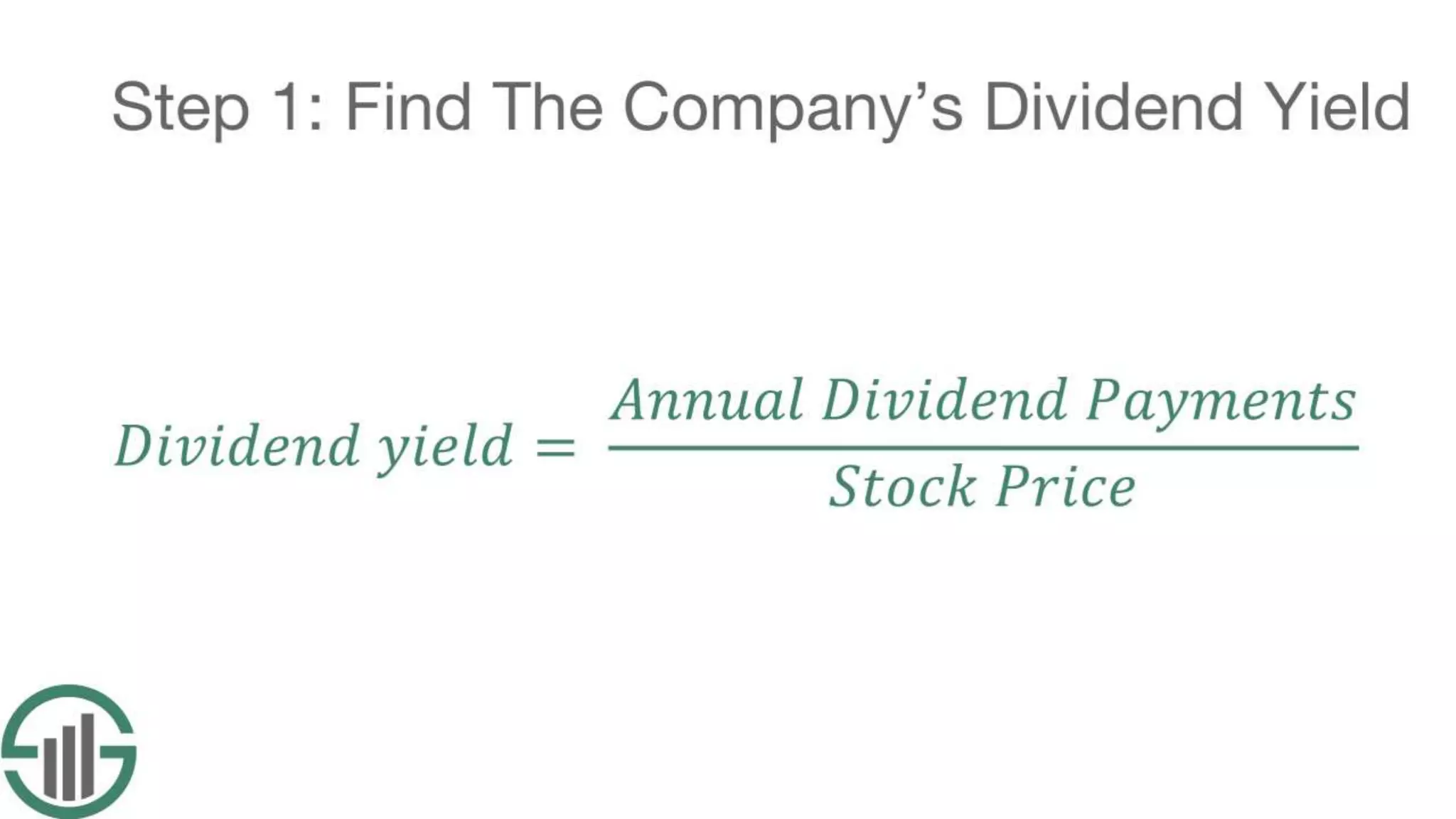

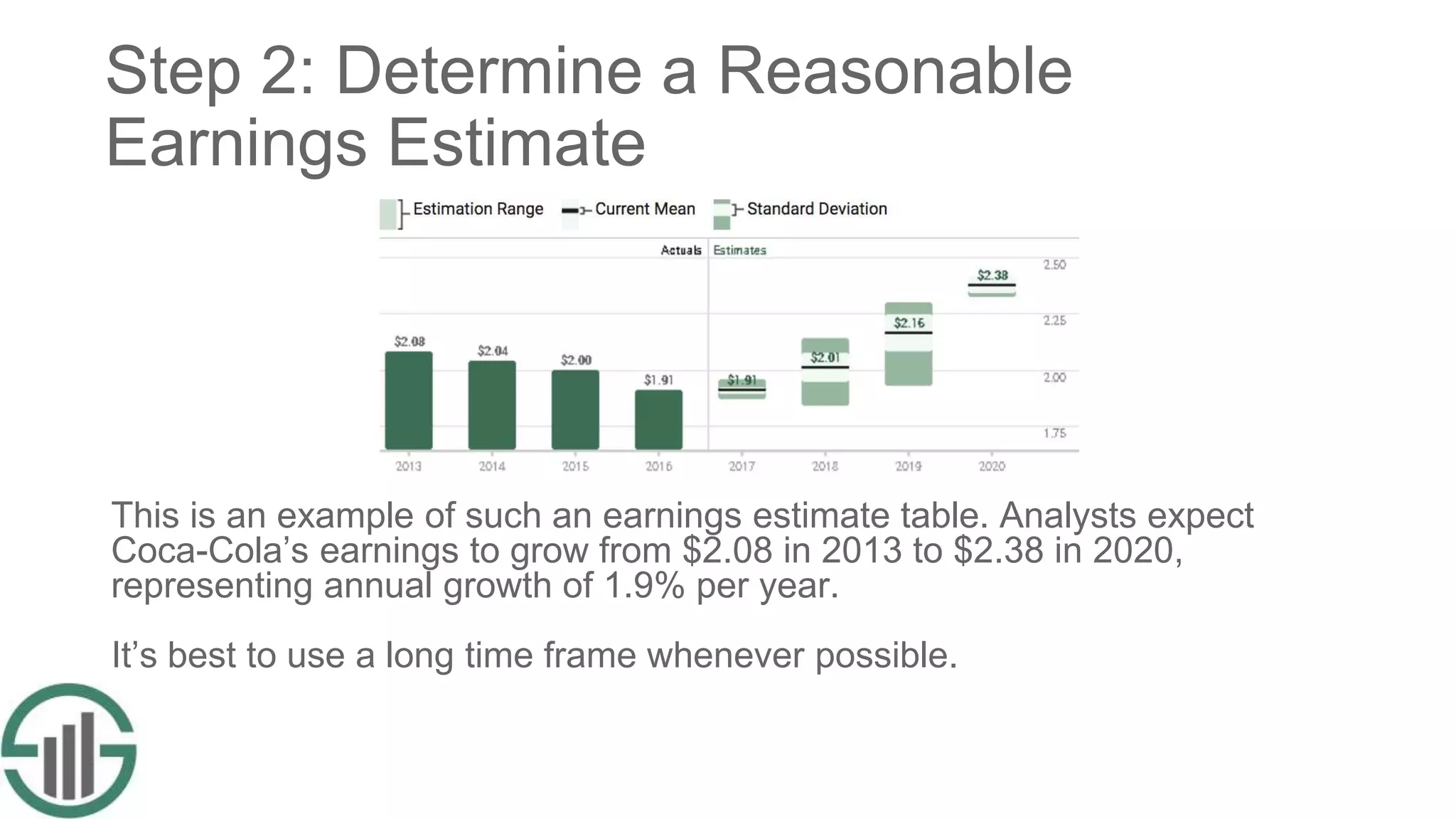

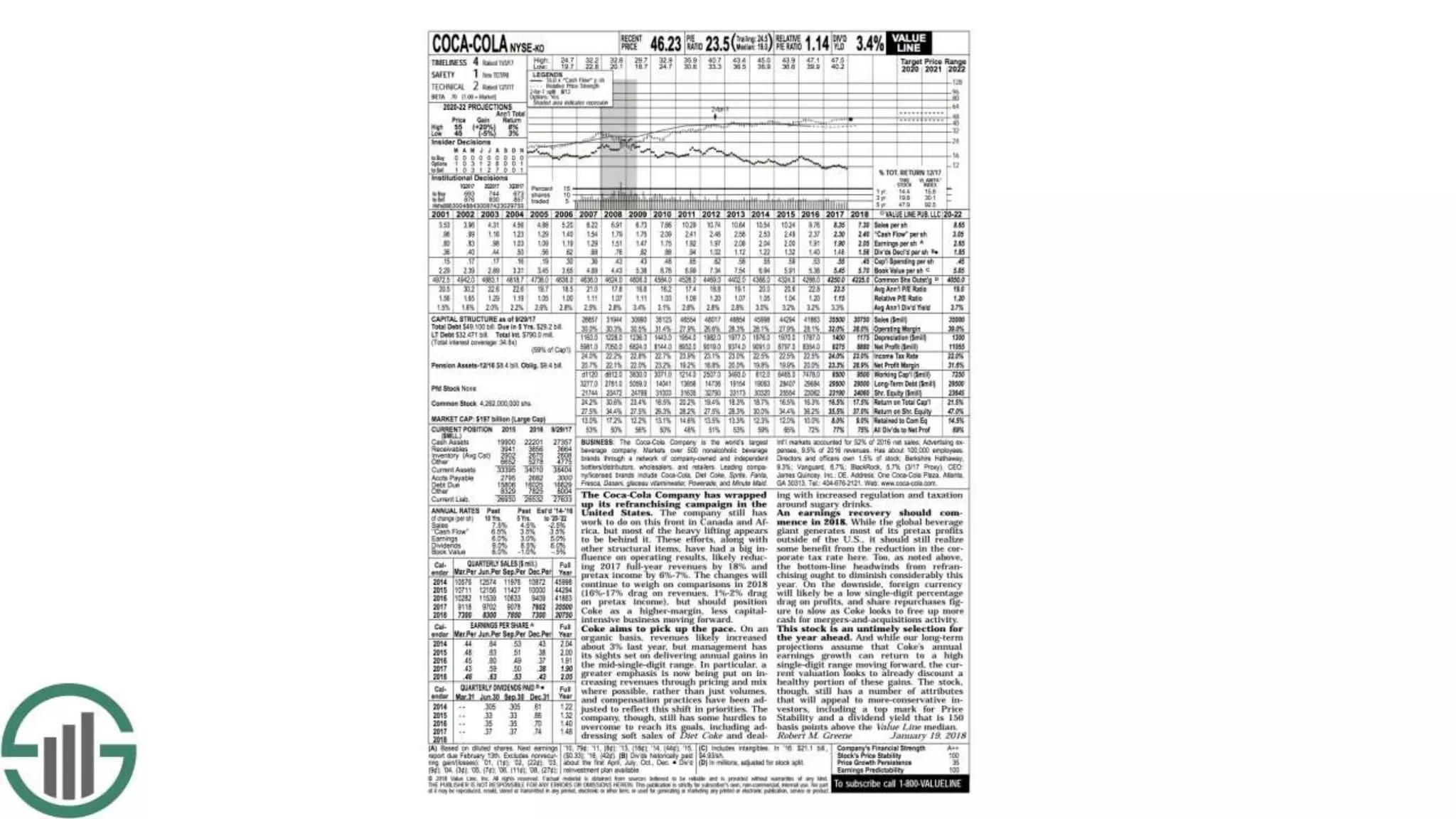

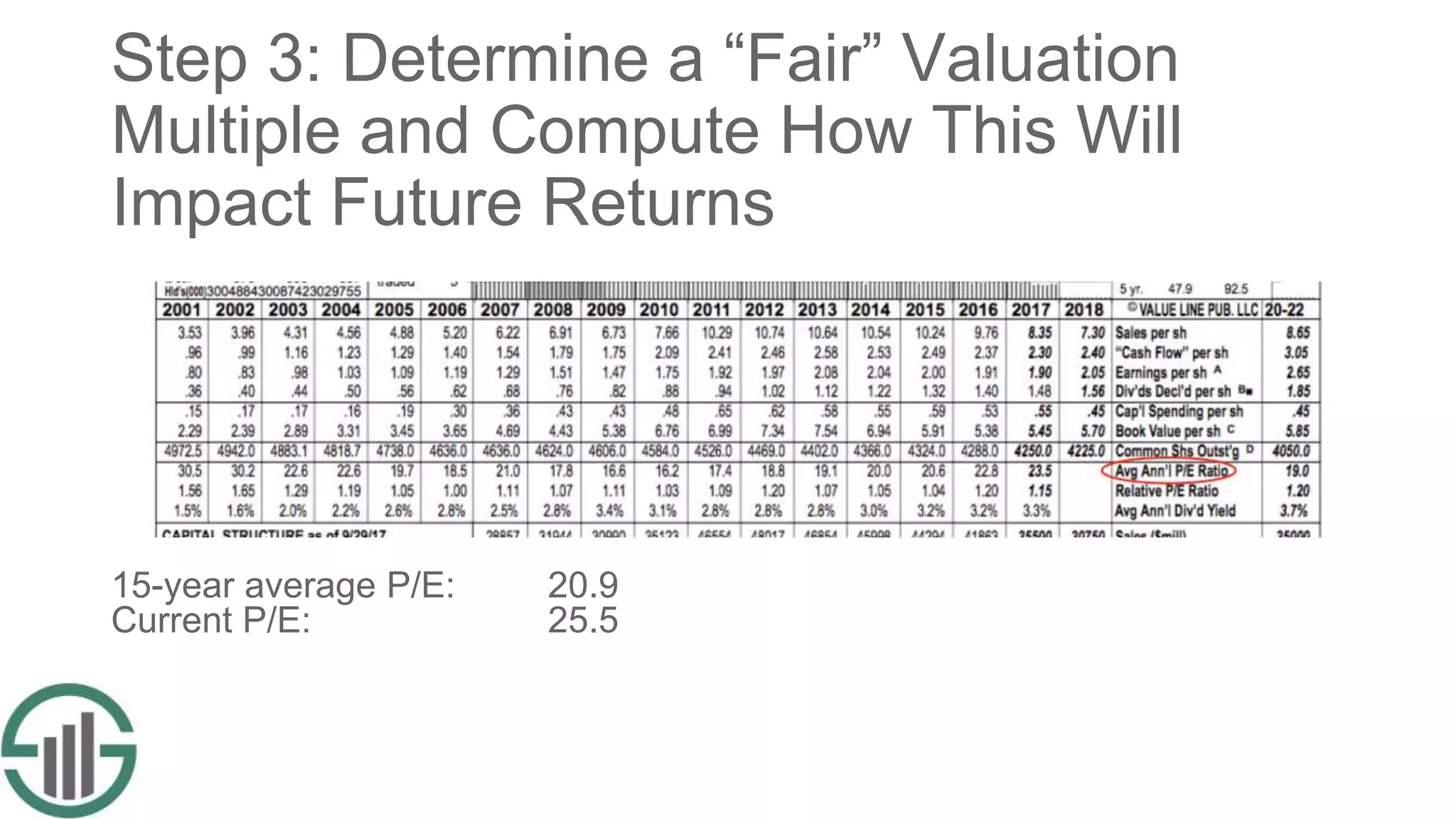

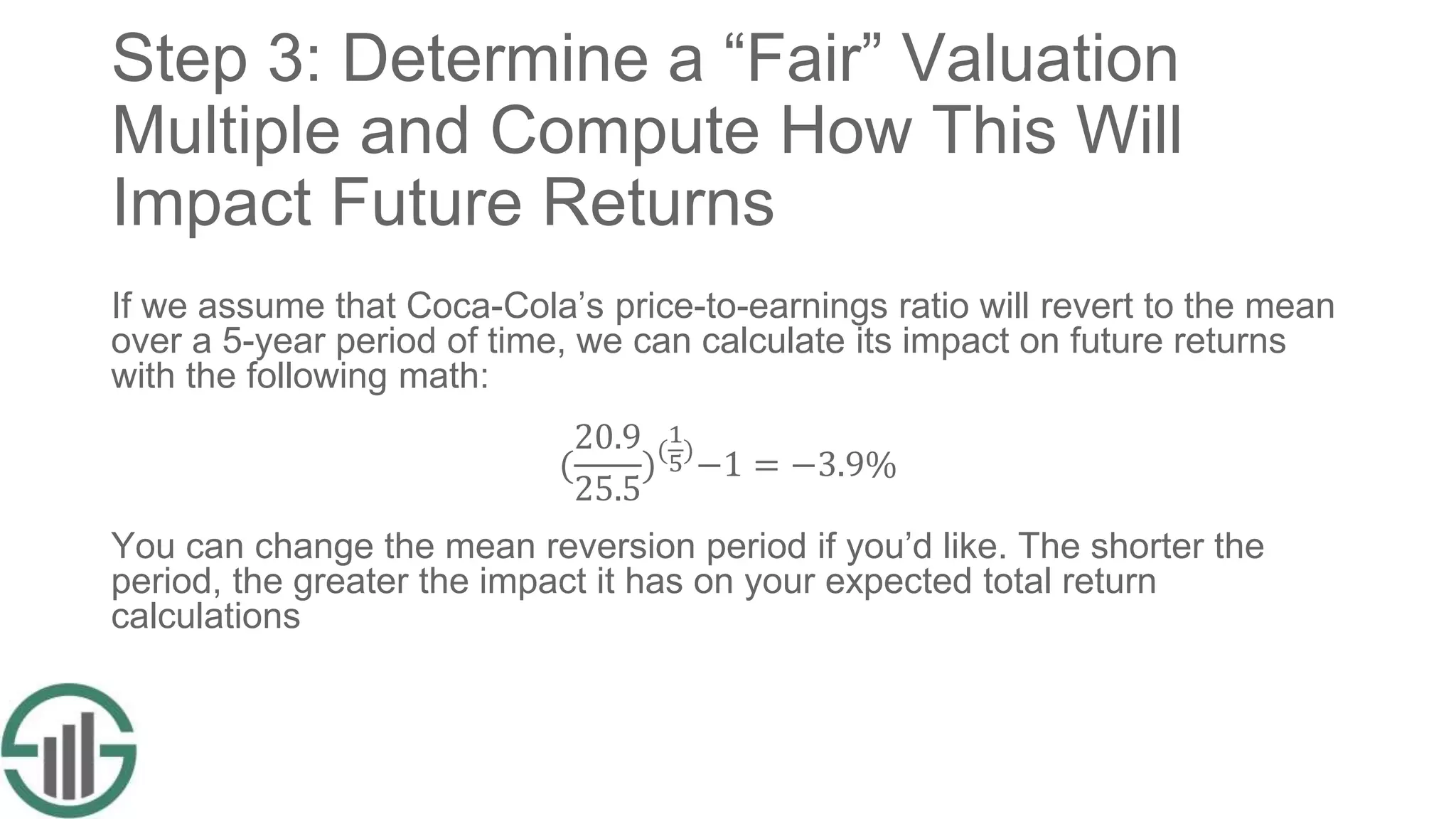

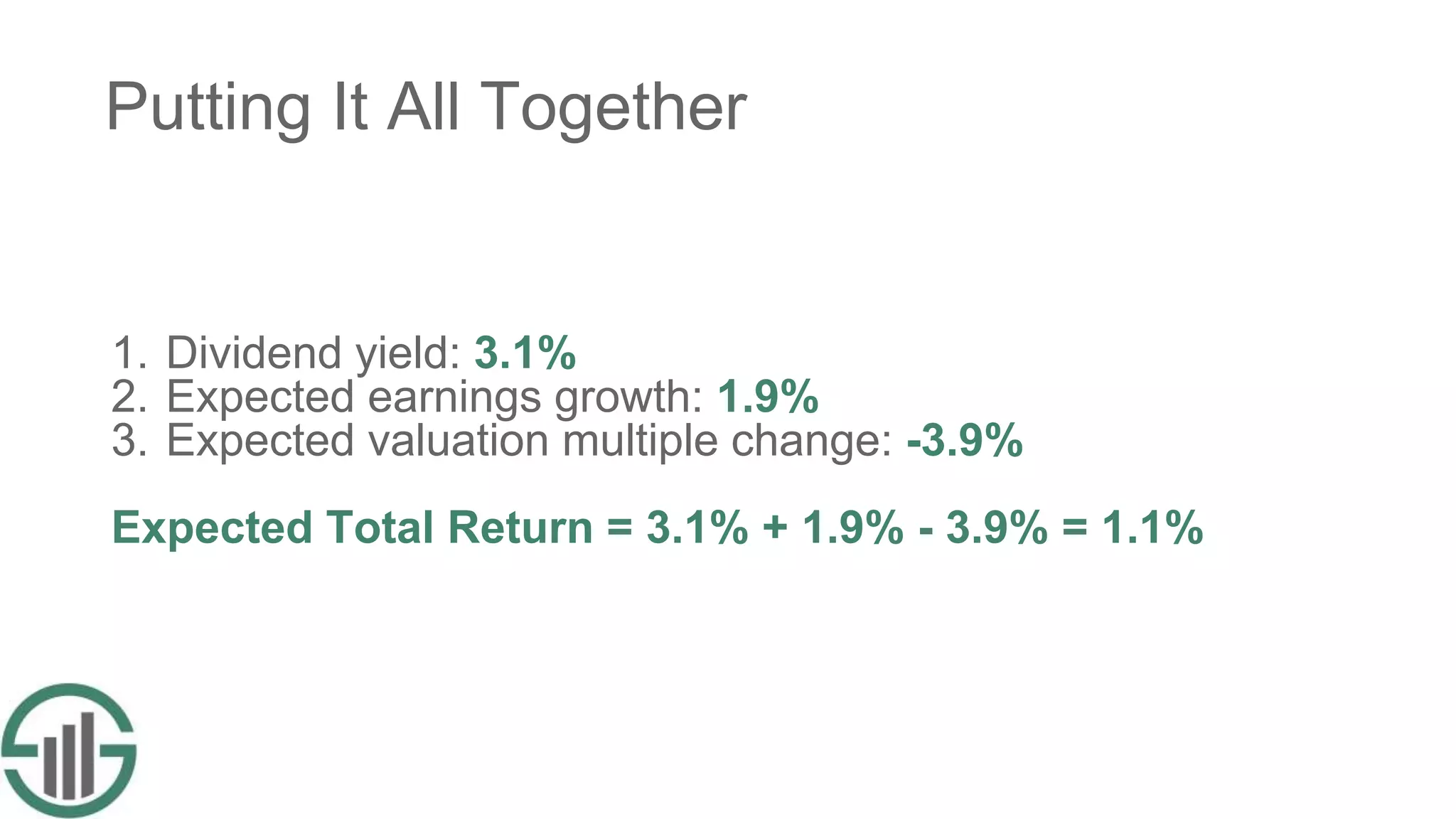

The document explains how to calculate the expected total return of a stock, which includes dividend payments and changes in stock price. It outlines a step-by-step process using an example with Coca-Cola, emphasizing the importance of estimating future earnings growth and valuation multiples. The expected total return for Coca-Cola is calculated to be 1.1%, taking into account a 3.1% dividend yield, 1.9% expected earnings growth, and a -3.9% change in valuation multiple.