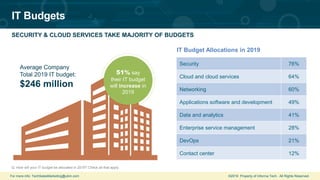

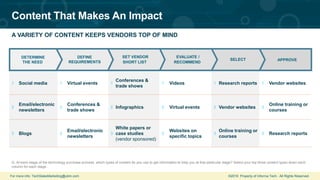

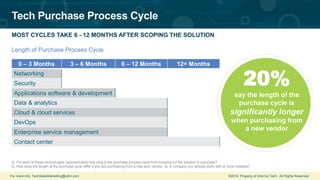

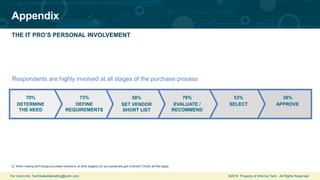

Informa Tech's 2019 IT buying research highlights key insights into modern IT professionals, their decision-making processes, and technology budgets. The study shows that IT professionals have considerable influence over technology purchases, with a significant focus on security and cloud services in budget allocations. It also reveals that reputation and vendor engagement are crucial for vendors to be shortlisted during the purchasing process.