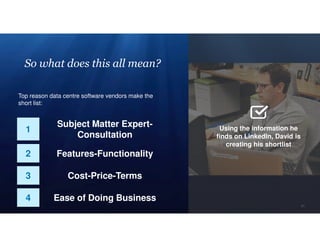

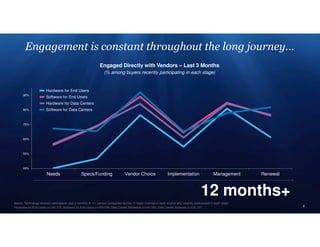

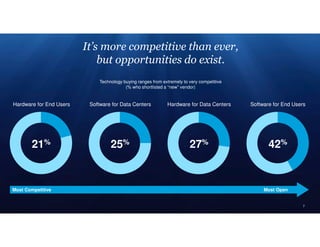

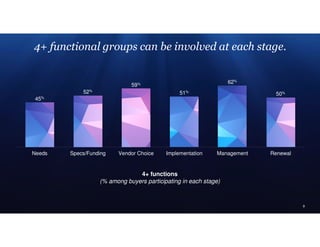

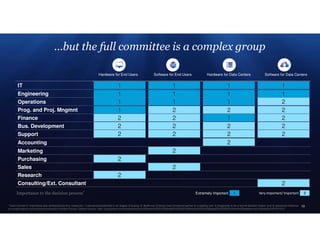

The document discusses the complexities of the tech buying process, highlighting that it is long, competitive, and involves various stakeholders with differing agendas. Key influencers and areas of interest are identified, along with the types of content buyers seek during each stage of their decision-making journey. It emphasizes the importance of understanding buyer motivations and preferences in order to effectively engage with decision-makers.

![What motivates this diverse group of decision-makers?

Proj. Mgmt. Finance Accounting

Top Factors Driving Willingness to Engage

IT Engineering Bus. Dev. Operations Purchasing Sales Support

Bases: N=32-598, recent technology buyers (last 3 months) in key functions

In general, how important are the following factors in your willingness to engage with sales professionals and other employees of [technology type] vendors? 12

Subject Matter Expertise

Consultation/Education/Tools

Business Model

Costs/Business Impact

User Adoption

Know/Trust Product /Service

Tier 1 audiences Tier 2 audiences

In general, all Audiences

in Australia prioritize

interacting with sales

professionals they

know/trust more so than

other countries](https://image.slidesharecdn.com/mahlabtecheventresearchpresooct2016-161110000656/85/Taking-a-Deeper-Look-at-Today-s-Tech-Buying-Process-12-320.jpg)