Homeready overview

•

1 like•533 views

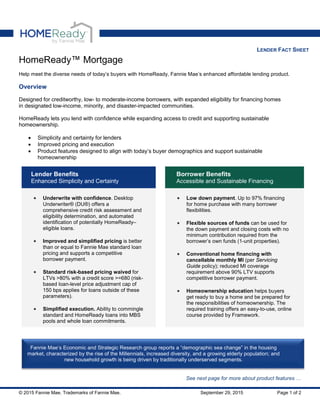

HomeReady™ Mortgage Help meet the diverse needs of today’s buyers with HomeReady, Fannie Mae’s enhanced affordable lending product. Overview Designed for creditworthy, low- to moderate-income borrowers, with expanded eligibility for financing homes in designated low-income, minority, and disaster-impacted communities. HomeReady lets you lend with confidence while expanding access to credit and supporting sustainable homeownership. • Simplicity and certainty for lenders • Improved pricing and execution • Product features designed to align with today’s buyer demographics and support sustainable homeownership

Report

Share

Report

Share

Download to read offline

Recommended

Home Ready by Fannie Mae

HomeReady by Fannie Mae is a home loan program intended to help make buying a home more within your means. It is designed for lower to moderate income people who have shown managed to show creditworthiness. If you plan to buy a home in California, the HomeReady home loan allows flexible sources of funds for the down payment, so if one of your family members plans to help you with the down payment, this may be the perfect program for you.

Fannie Mae Homeready Overview

An overview of Fannie Mae's Homeready home loan program. This is an excerpt from Fannie Mae's gracious presentation at the 2017 NAIHBR Chicago area leadership summit.

Homeready Product Matrix - December 12th, 2015

Homeready Product Matrix - December 12th, 2015Dean Wegner of Guardian Mortgage, Arizona 602-432-6388

HomeReady™ Mortgage

Designed for creditworthy, low- to moderate-income borrowers, with expanded eligibility for financing homes in designated

low-income, minority, and disaster-impacted communities. HomeReady lets you lend with confidence while expanding

access to credit and supporting sustainable homeownership. Key features:

Simplicity and certainty for lenders

Streamlined pricing and execution

Product features designed to align with today’s buyer demographics and support sustainable homeownership

1-Down payment assistance programs az booklet 04-22-14

Down payment assistance programs az booklet 04-22-14Dean Wegner of Guardian Mortgage, Arizona 602-432-6388

Down payment assistance guide for all of ArizonaHAS DODD-FRANK MOVED MY CHEESE?BY KEVIN W. HARDIN - Page 14

HAS DODD-FRANK MOVED MY CHEESE?BY KEVIN W. HARDIN - Page 14Dean Wegner of Guardian Mortgage, Arizona 602-432-6388

HAS DODD-FRANK MOVED MY CHEESE?

BY KEVIN W. HARDIN, JD, CMB, CMC, CMPS & KEVIN FALLON MCCARTHY, ESQ.

OVERVIEW

This article is an in-depth look at the Seller Carryback

Financing components of the Dodd-Frank Wall Street Reform

and Consumer Protection Act (Dodd-Frank Act). In it, the

authors detail the issues a seller must be aware of before

completing a carryback financing transaction. These include:

• Understanding what properties are covered

by the Secure and Fair Enforcement for

Mortgage Licensing Act (SAFE);

• The two exemptions available for sellers and real estate

agents: the One in One Year Rule, wherein financing

is provided for one property in a 12-month period and

the Three in One Year Rule wherein the seller finances

three or fewer properties in any 12-month period.

• The role of licensed real estate agents and

brokers in these transactions. Specifically, what

actions cross the line between performing

a sale and becoming a loan originator.The price is right! how to accurately value a home feb 18th

The price is right! how to accurately value a home feb 18thDean Wegner of Guardian Mortgage, Arizona 602-432-6388

The price is right! how to accurately value a home feb 18thRecommended

Home Ready by Fannie Mae

HomeReady by Fannie Mae is a home loan program intended to help make buying a home more within your means. It is designed for lower to moderate income people who have shown managed to show creditworthiness. If you plan to buy a home in California, the HomeReady home loan allows flexible sources of funds for the down payment, so if one of your family members plans to help you with the down payment, this may be the perfect program for you.

Fannie Mae Homeready Overview

An overview of Fannie Mae's Homeready home loan program. This is an excerpt from Fannie Mae's gracious presentation at the 2017 NAIHBR Chicago area leadership summit.

Homeready Product Matrix - December 12th, 2015

Homeready Product Matrix - December 12th, 2015Dean Wegner of Guardian Mortgage, Arizona 602-432-6388

HomeReady™ Mortgage

Designed for creditworthy, low- to moderate-income borrowers, with expanded eligibility for financing homes in designated

low-income, minority, and disaster-impacted communities. HomeReady lets you lend with confidence while expanding

access to credit and supporting sustainable homeownership. Key features:

Simplicity and certainty for lenders

Streamlined pricing and execution

Product features designed to align with today’s buyer demographics and support sustainable homeownership

1-Down payment assistance programs az booklet 04-22-14

Down payment assistance programs az booklet 04-22-14Dean Wegner of Guardian Mortgage, Arizona 602-432-6388

Down payment assistance guide for all of ArizonaHAS DODD-FRANK MOVED MY CHEESE?BY KEVIN W. HARDIN - Page 14

HAS DODD-FRANK MOVED MY CHEESE?BY KEVIN W. HARDIN - Page 14Dean Wegner of Guardian Mortgage, Arizona 602-432-6388

HAS DODD-FRANK MOVED MY CHEESE?

BY KEVIN W. HARDIN, JD, CMB, CMC, CMPS & KEVIN FALLON MCCARTHY, ESQ.

OVERVIEW

This article is an in-depth look at the Seller Carryback

Financing components of the Dodd-Frank Wall Street Reform

and Consumer Protection Act (Dodd-Frank Act). In it, the

authors detail the issues a seller must be aware of before

completing a carryback financing transaction. These include:

• Understanding what properties are covered

by the Secure and Fair Enforcement for

Mortgage Licensing Act (SAFE);

• The two exemptions available for sellers and real estate

agents: the One in One Year Rule, wherein financing

is provided for one property in a 12-month period and

the Three in One Year Rule wherein the seller finances

three or fewer properties in any 12-month period.

• The role of licensed real estate agents and

brokers in these transactions. Specifically, what

actions cross the line between performing

a sale and becoming a loan originator.The price is right! how to accurately value a home feb 18th

The price is right! how to accurately value a home feb 18thDean Wegner of Guardian Mortgage, Arizona 602-432-6388

The price is right! how to accurately value a home feb 18thPathway to Purchase

Here’s a few of the Pathway to Purchase program highlights:

1. The DPA will be 10% of the purchase price, up to a maximum of $20,000.

2. The Program is limited to the following 17 Cities:

a. Arizona City, Avondale, Buckeye, Casa Grande, Coolidge, Douglas, El Mirage, Fort Mohave, Goodyear, Huachuca City, Laveen, Maricopa, Red Rock, Sierra Vista, Snowflake, Tucson, Yuma.

3. The Pathway to Purchase program will carry a five-year, no interest, no payment forgivable second mortgage.

4. Program funding is provided by the U.S. Department of Treasury’s Hardest-Hit Fund with a $48 million allocation through the AZ Home Foreclosure Prevention Funding Corp.

5. The available underlying mortgage type is the Fannie Mae HFA Preferred at a max LTV / CLTV - 95%/105%.

6. Many of the current HOME Plus DPA program guidelines will be the same.

Mortgage Payment Options at HomeStreet Home Loans

Mortgage Payment Options at HomeStreet Home LoansDean Wegner of Guardian Mortgage, Arizona 602-432-6388

Mortgage Payment Options at HomeStreet Home LoansThe Closing Disclosure - Example 2015

The Loan Estimate: This form will be provided to consumers within three business days after they submit a loan application. It replaces the early Truth in Lending statement and the Good Faith Estimate, and provides a summary of the key loan terms and estimated loan and closing costs. Consumers can use this new form to compare the costs and features of different loans.

.85% mortgage insurance fha drop january 2015 obama

.85% mortgage insurance fha drop january 2015 obamaDean Wegner of Guardian Mortgage, Arizona 602-432-6388

This ML is effective for case numbers assigned on or after January 26, 2015.

FHA TO REDUCE ANNUAL INSURANCE PREMIUMS

Reduction to increase credit affordability and reflects improved economic health of FHA

WASHINGTON – As the nation’s housing market continues to improve, U.S. Housing and Urban Development Secretary Julián Castro today announced the Federal Housing Administration (FHA) will reduce the annual premiums new borrowers will pay by half of a percent. This action is projected to save more than two million FHA homeowners an average of $900 annually and spur 250,000 new homebuyers to purchase their first home over the next three years.

Today’s action also reflects the improved economic health of FHA’s Mutual Mortgage Insurance Fund (MMIF). FHA’s recent annual report to Congress demonstrates the economic condition of the agency’s single-family insurance fund continues to improve, adding $21 billion in value over the past two years.

“This action will make homeownership more affordable for over two million Americans in the next three years,” said U.S. Department of Housing and Urban Development Secretary Julián Castro. “Since 2009, the Obama Administration has taken bold steps to reduce risks in the mortgage market and to protect consumers. These efforts have made it possible to take this prudent measure while also ensuring FHA remains on a positive financial trajectory. By bringing our premiums down, we’re helping folks lift themselves up so they can open new doors of opportunity and strengthen their financial futures.”

In the wake of the nation’s housing crisis, FHA increased its premium prices to stabilize the health of its MMI Fund. In addition, the Obama Administration took dramatic steps to safeguard consumers in the mortgage market to ensure responsible borrowers continued to have access to mortgage capital as many private lending sources tightened their lending standards.

Today’s reduction will significantly expand access to mortgage credit for these families and is expected to lower the cost of housing for the approximately 800,000 households who use FHA annually.

FHA’s new annual premium prices are expected to take effect towards the end of the month. FHA will publish a mortgagee letter detailing its new pricing structure shortly.New purchase contract sample arizona - copy aar

New purchase contract sample arizona - copy aarDean Wegner of Guardian Mortgage, Arizona 602-432-6388

SAMPLE of the newFannie Mae Home ready overview - NAIHBR

Fannie Mae HomeReady and HomeStyle products overview - NAIHBR Chicago Leadership events 2017

Mha Borrower Presentation Long English 090909

From a Sept. 2009 Making Home Affordable meeting where a rep from the U.S. Treasury went more in depth on the HAMP and HARP programs along with representatives from Freddie and Fannie

NAIBHR Presenation National MI 8.28

National MI NAIHBR Chicago Leader Events 2017 - Think Past FHA with Private Mortgage Insurance

Why work with William Doom of loanDepot

Benefits of working with loanDepot to secure your home financing. Learn how we are helping real estate professionals grow their business and consumers secure their dream of homeownership.

Mktg Market Changes Guaranteed Rate Solutions040609

Realtors see what partnering with Guaranteed Rate can mean for your business

Reverse Mortgage Power Point

• What is a Reverse Mortgage?

• What is the Home Equity Conversion Mortgage

(HECM) for Purchase?

• How can it help you build your business?

• How can it help senior homebuyers?

• Example of a HECM for Purchase transaction

More Related Content

Viewers also liked

Pathway to Purchase

Here’s a few of the Pathway to Purchase program highlights:

1. The DPA will be 10% of the purchase price, up to a maximum of $20,000.

2. The Program is limited to the following 17 Cities:

a. Arizona City, Avondale, Buckeye, Casa Grande, Coolidge, Douglas, El Mirage, Fort Mohave, Goodyear, Huachuca City, Laveen, Maricopa, Red Rock, Sierra Vista, Snowflake, Tucson, Yuma.

3. The Pathway to Purchase program will carry a five-year, no interest, no payment forgivable second mortgage.

4. Program funding is provided by the U.S. Department of Treasury’s Hardest-Hit Fund with a $48 million allocation through the AZ Home Foreclosure Prevention Funding Corp.

5. The available underlying mortgage type is the Fannie Mae HFA Preferred at a max LTV / CLTV - 95%/105%.

6. Many of the current HOME Plus DPA program guidelines will be the same.

Mortgage Payment Options at HomeStreet Home Loans

Mortgage Payment Options at HomeStreet Home LoansDean Wegner of Guardian Mortgage, Arizona 602-432-6388

Mortgage Payment Options at HomeStreet Home LoansThe Closing Disclosure - Example 2015

The Loan Estimate: This form will be provided to consumers within three business days after they submit a loan application. It replaces the early Truth in Lending statement and the Good Faith Estimate, and provides a summary of the key loan terms and estimated loan and closing costs. Consumers can use this new form to compare the costs and features of different loans.

.85% mortgage insurance fha drop january 2015 obama

.85% mortgage insurance fha drop january 2015 obamaDean Wegner of Guardian Mortgage, Arizona 602-432-6388

This ML is effective for case numbers assigned on or after January 26, 2015.

FHA TO REDUCE ANNUAL INSURANCE PREMIUMS

Reduction to increase credit affordability and reflects improved economic health of FHA

WASHINGTON – As the nation’s housing market continues to improve, U.S. Housing and Urban Development Secretary Julián Castro today announced the Federal Housing Administration (FHA) will reduce the annual premiums new borrowers will pay by half of a percent. This action is projected to save more than two million FHA homeowners an average of $900 annually and spur 250,000 new homebuyers to purchase their first home over the next three years.

Today’s action also reflects the improved economic health of FHA’s Mutual Mortgage Insurance Fund (MMIF). FHA’s recent annual report to Congress demonstrates the economic condition of the agency’s single-family insurance fund continues to improve, adding $21 billion in value over the past two years.

“This action will make homeownership more affordable for over two million Americans in the next three years,” said U.S. Department of Housing and Urban Development Secretary Julián Castro. “Since 2009, the Obama Administration has taken bold steps to reduce risks in the mortgage market and to protect consumers. These efforts have made it possible to take this prudent measure while also ensuring FHA remains on a positive financial trajectory. By bringing our premiums down, we’re helping folks lift themselves up so they can open new doors of opportunity and strengthen their financial futures.”

In the wake of the nation’s housing crisis, FHA increased its premium prices to stabilize the health of its MMI Fund. In addition, the Obama Administration took dramatic steps to safeguard consumers in the mortgage market to ensure responsible borrowers continued to have access to mortgage capital as many private lending sources tightened their lending standards.

Today’s reduction will significantly expand access to mortgage credit for these families and is expected to lower the cost of housing for the approximately 800,000 households who use FHA annually.

FHA’s new annual premium prices are expected to take effect towards the end of the month. FHA will publish a mortgagee letter detailing its new pricing structure shortly.New purchase contract sample arizona - copy aar

New purchase contract sample arizona - copy aarDean Wegner of Guardian Mortgage, Arizona 602-432-6388

SAMPLE of the newViewers also liked (12)

.85% mortgage insurance fha drop january 2015 obama

.85% mortgage insurance fha drop january 2015 obama

Similar to Homeready overview

Fannie Mae Home ready overview - NAIHBR

Fannie Mae HomeReady and HomeStyle products overview - NAIHBR Chicago Leadership events 2017

Mha Borrower Presentation Long English 090909

From a Sept. 2009 Making Home Affordable meeting where a rep from the U.S. Treasury went more in depth on the HAMP and HARP programs along with representatives from Freddie and Fannie

NAIBHR Presenation National MI 8.28

National MI NAIHBR Chicago Leader Events 2017 - Think Past FHA with Private Mortgage Insurance

Why work with William Doom of loanDepot

Benefits of working with loanDepot to secure your home financing. Learn how we are helping real estate professionals grow their business and consumers secure their dream of homeownership.

Mktg Market Changes Guaranteed Rate Solutions040609

Realtors see what partnering with Guaranteed Rate can mean for your business

Reverse Mortgage Power Point

• What is a Reverse Mortgage?

• What is the Home Equity Conversion Mortgage

(HECM) for Purchase?

• How can it help you build your business?

• How can it help senior homebuyers?

• Example of a HECM for Purchase transaction

Home Loan Approval with Less Income in Anaheim, California.pptx

Getting a home loan approval with a lower income in Anaheim, California, involves several strategies to improve your chances. Here are key steps to follow:

Improve Your Credit Score: Ensure your credit score is as high as possible by paying off debts, correcting errors on your credit report, and maintaining timely payments.

Save for a Larger Down Payment: A substantial down payment reduces the loan amount and demonstrates financial responsibility to lenders.

Explore Government Programs: Look into federal and state assistance programs, such as FHA loans, which are designed to help low-income borrowers by offering lower down payment requirements and more lenient credit criteria.

Reduce Debt-to-Income Ratio: Pay down existing debts to lower your debt-to-income ratio, making you a more attractive candidate for lenders.

Seek Pre-Approval: Obtain a mortgage pre-approval to show sellers and real estate agents that you are a serious buyer with the financial backing to make a purchase.

Consider Co-Borrowers: Adding a co-borrower with a higher income or better credit can improve your loan approval chances.

Consult Local Programs: Investigate local Anaheim housing assistance programs that may offer additional support or incentives for low-income buyers.

By carefully managing your financial profile and exploring available resources, you can enhance your likelihood of securing a home loan in Anaheim, even with a lower income.

Realtor Information

A quick snap shot on what Crosscountry Mortgage has to over all of our Realtor\'s.

Similar to Homeready overview (20)

Mktg Market Changes Guaranteed Rate Solutions040609

Mktg Market Changes Guaranteed Rate Solutions040609

Home Loan Approval with Less Income in Anaheim, California.pptx

Home Loan Approval with Less Income in Anaheim, California.pptx

Mark S Johnson - Establishing a Family Office Credit Initiative

Mark S Johnson - Establishing a Family Office Credit Initiative

More from Dean Wegner of Guardian Mortgage, Arizona 602-432-6388

Freddie Mac HomeOneSM More flexibility

Freddie Mac HomeOneSM

More flexibility for maximum financing.

Qualify more first-time

homebuyers with our

3% down payment solution

Want 2 VA loans at same time? Guaranty calculation Examples VA rtgage

Want 2 VA loans at same time? Guaranty calculation Examples VA rtgageDean Wegner of Guardian Mortgage, Arizona 602-432-6388

Want 2 VA loans at same time? Guaranty calculation Examples VANew Mortgage Loan Application 2018

Copy of the new loan application coming up, much different than the existing 1003

Unison Buying a Home ebook

You’re thinking of buying a home? Congratulations -- it’s an exciting

process. And it can be a lot of fun. You get to envision the type

of lifestyle you want for yourself (and your family). Do you want

a beautiful two-story home close to your work? Do you want a

modern, stylish condo in the heart of downtown? Are you yearning

to live near the beach, the mountains, restaurants, good schools,

museums, or family?

One of the greatest things about purchasing your own home is

that you get to make it yours. Even before you move in, you’re in

charge of making the decisions about which home you will buy.

It’s a powerful feeling -- having total control. But it can also be a bit

overwhelming, especially when you’re doing it for the first time.

That’s why we wrote this guide. We want to make purchasing a home

less scary and give you the confidence to move forward through

each step of the process -- from beginning to end, when you move into your new home!

UNISON Program, how it works!

You’re thinking of buying a home? Congratulations -- it’s an exciting

process. And it can be a lot of fun. You get to envision the type

of lifestyle you want for yourself (and your family). Do you want

a beautiful two-story home close to your work? Do you want a

modern, stylish condo in the heart of downtown? Are you yearning

to live near the beach, the mountains, restaurants, good schools,

museums, or family?

One of the greatest things about purchasing your own home is

that you get to make it yours. Even before you move in, you’re in

charge of making the decisions about which home you will buy.

It’s a powerful feeling -- having total control. But it can also be a bit

overwhelming, especially when you’re doing it for the first time.

That’s why we wrote this guide. We want to make purchasing a home

less scary and give you the confidence to move forward through

each step of the process -- from beginning to end, when you move into your new home!

LLPA Matrix

Loan-Level Price Adjustment (LLPA) Matrix

This document provides the LLPAs applicable to loans delivered to Fannie. LLPAs are assessed based upon certain eligibility or other loan features, such as credit score, loan purpose, occupancy, number of units, product type, etc. Special feature codes (SFCs) that are required when delivering loans with these features are listed next to the applicable LLPAs. Not all loans will be eligible for the features described in this Matrix and unless otherwise noted, FHA, VA, Rural Development (RD) Section 502 Mortgages, HUD Section 184 Mortgages, and matured balloon mortgages (refinanced or modified, per Servicing Guide requirements) redelivered as fixed-rate mortgages (FRMs) are excluded from these LLPAs. This Matrix is incorporated by reference into the Selling Guide, and the related Selling Guide provision or Selling Guide announcement governs if there is an inconsistency. Refer to the Selling Guide, Eligibility Matrix, and your contracts with Fannie Mae to determine loan eligibility.

VA National Guard Benefit Summary to Buy a Home

VA National Guard Benefit Summary to Buy a HomeDean Wegner of Guardian Mortgage, Arizona 602-432-6388

As a member of the National Guard

or Reserve you may qualify for

a wide range of benefits offered

by the Department of Veterans

Affairs (VA). VA is here to help

you and your family understand

the benefits for which you may

be eligible and how to apply for

them. VA benefits include disability

compensation, pension, home loan

guaranty, education, health care,

insurance, vocational rehabilitation

and employment, and burial.Dean Wegner first time homebuyers presentation

Dean Wegner first time homebuyers presentationDean Wegner of Guardian Mortgage, Arizona 602-432-6388

Buying a home can seem daunting, but if you plan ahead and know all your mortgage options, it doesn’t have to be. Gaining a thorough understanding of the homebuying process can help ensure you have a smooth and positive experience.

Working with the right team of real estate and mortgage professionals makes all the difference. Academy commits to working seamlessly with you and your real estate agent as a team to get your loan closed in a timely and professional mannerTILA RESPA Integration Disclosure Timeline Example

TILA RESPA Integration Disclosure Timeline ExampleDean Wegner of Guardian Mortgage, Arizona 602-432-6388

TILA RESPA Integration disclosure

timeline exampleFannie Mae and Freddie Mac Maximum Loan Limits for Mortgages in Calendar Year...

Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages in Calendar Year...Dean Wegner of Guardian Mortgage, Arizona 602-432-6388

Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015More from Dean Wegner of Guardian Mortgage, Arizona 602-432-6388 (15)

Want 2 VA loans at same time? Guaranty calculation Examples VA rtgage

Want 2 VA loans at same time? Guaranty calculation Examples VA rtgage

TILA RESPA Integration Disclosure Timeline Example

TILA RESPA Integration Disclosure Timeline Example

Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages in Calendar Year...

Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages in Calendar Year...

Recently uploaded

How to Scan Tenants in NYC - You Should Know!

Scanning tenants in NYC requires a thorough and compliant approach to ensure you find reliable renters. For a positive rental experience, consider hiring a property management service. Belgium Management LLC specializes in NYC rental property management and tenant relationship management. We prioritize tenant satisfaction, making us a trusted name in New York property management. Our dedicated team ensures tenants feel valued and supported throughout their lease.

Presentation to Windust Meadows HOA Board of Directors June 4, 2024: Focus o...

Presentation to Windust Meadows HOA Board of Directors June 4, 2024: Focus on Public Safety as Job #1, Engagement, Wealth of HOA, Branding, Communication, Culture, Civic Responsibility

Rixos Tersane Istanbul Residences Brochure_May2024_ENG.pdf

Tersane Suites Residences is a luxurious real estate project located in the heart of Istanbul, next to the beautiful Golden Horn. This unique development offers hotel concept residences with Rixos management, making it the perfect choice for both homeowners and investors.

The Tersane Suites Residences offers a wide range of options, from studio apartments to spacious four-bedroom units, all designed to the highest standard. The suites are finished with high-quality materials and feature modern, open-plan living spaces, fully-equipped kitchens, and large balconies with stunning views of the city and sea.

One of the standout features of Tersane Suites Residences is the Rixos management, which provides a truly exclusive and upscale living experience. Residents will have access to a range of luxury amenities, including a fitness center, spa, and indoor and outdoor swimming pools. Plus, the on-site restaurants and cafes provide a taste of the local and international cuisine.

The Tersane Suites Residences also offers a great opportunity for investors, as it provides a rental guarantee program. This means that investors can enjoy a steady income stream, with the peace of mind that their property is being managed by a reputable and experienced team.

The location of Tersane Suites Residences is also unbeatable, with easy access to the city’s main transportation links and within close proximity to the historic center, making it the perfect base for exploring all that Istanbul has to offer.

Elegant Evergreen Homes - Luxury Apartments Redefining Comfort in Yelahanka, ...

Experience unmatched luxury at Elegant Evergreen Homes, offering exquisite 2, 3, and 4 BHK apartments in the serene locality of Yelahanka, Bangalore. These meticulously crafted homes blend modern design with timeless elegance, providing a harmonious living environment. Enjoy top-tier amenities and a prime location, making Elegant Evergreen Homes the ideal choice for discerning homeowners.

BricknBolt Understanding Load-Bearing Walls and Their Structural Support in H...

Load-bearing walls are the backbone of any home construction, providing crucial structural support that carries the weight of the house above. For companies like Brick and Bolt Mysore and Bricknbolt Faridabad, understanding and properly implementing these elements are key to constructing safe and durable buildings.

2BHK-3BHK NEW FLAT FOR SALE IN TUPUDANA,RANCHI.

Flat available for sale

Location- Tupudana, Ranchi

Savitri enclave

Area- 3BHK

Rate- 4000/sq.ft.

Super Build Up Area-1629 sq.ft.

Build-up area-1253 sq.ft.

Rate- 65lakh16k(approx)

Floor available- Flat available in all floor(G+12)

Balcony- 2

Washroom- 2

Parking - CAR PARKING

Amenities- Joggers track,temple, children's park,gym,banquet hall (5 Lakh)

Possession year (Handover year)- Dec 2025

Outside View from the apartment and flat balcony is very beautiful.

For more information contact AASHIYANA STAR PROPERTIES

7766900371

MC Heights-Best Construction Company in jhang

MC Heights stands as the epitome of excellence in construction within Jhang. With a commitment to unparalleled quality and innovative design, MC Heights redefines urban living in the heart of Jhang. Offering luxurious residential spaces, cutting-edge commercial complexes, and vibrant community areas, MC Heights caters to the diverse needs of modern lifestyles. Our dedication to superior craftsmanship and customer satisfaction ensures that every aspect of MC Heights exceeds expectations, making it the premier choice for those seeking unparalleled sophistication and comfort in Jhang.

One20 North Vancouver Floor Plans by Three Shores Development.

One20 North Vancouver Floor Plans by Three Shores Development.

One FNG by Group 108 Sector 142 Noida Construction Update

One FNG by Group 108 is launching a new commercial project in Sector 142 Noida. Office space and high street retail shops on the FNG and Noida Expressway. For more information visit the website https://www.onefng.com/

Avrupa Konutlari Yenimahalle - Listing Turkey

Welcome to Avrupa Konutları Yenimahalle, where luxury living meets unparalleled convenience in the heart of Istanbul. Developed by Artaş Holding, one of Turkey’s leading construction companies, this prestigious residential project offers a contemporary lifestyle experience like no other.

https://listingturkey.com/property/avrupa-konutlari-yenimahalle/

Optimizing Your MCA Lead Capture Process for Better Results

Need MCA leads? No sweat! MCAs are great for small biz funding. Learn how to snag top-notch leads: businesses needing cash, with repayment ability, decision-makers, and accurate contacts. Use content, social ads, lead platforms, partnerships, and capture processes for quality leads.

https://www.leadgeneration.media/blog/b/streamline-your-mca-sales-process-with-pre-qualified-leads

Brigade Insignia at Yelahanka Brochure.pdf

Brigade Insignia offers meticulously designed apartments with modern architecture and premium finishes. The project features spacious 3,3.5,4 and 5 BHK units, each thoughtfully planned to provide maximum comfort, natural light, and ventilation.

https://www.newprojectbangalore.com/brigade-insignia-yelahanka-bangalore.html

Riverview City Loni Kalbhor Pune Brochure

500 acres of brilliance await you here at Riverview City which offers modern living, effortless convenience, and a beautiful natural setting. It is a mega township by Magarpatta City in Loni Kalbhor, Pune. Enjoy easy access to work, schools, and fun while experiencing a perfect work-life balance.

Visit - magarpattacity.developerprojects.in

Simpolo Company Profile & Corporate Logo

Simpolo Tiles & Bathware

Tile ho,

toh Simpolo.

Since the first steps were taken in 1977, Simpolo Ceramics has carved its niche as a consistently growing organisation with unparalleled innovation and passion rooted in simplicity.

We endure gratification for every experience we offer, created to share something meaningful. It may not resonate with the majority, but that makes us a class apart. If only a handful were to understand the purpose of our existence, we would be proud to have found our believers. Rather, people with whom we can share our beliefs.

VISUALIZER

Design your space in your style with our very own Visualizer. Now, you can choose the tiles of your liking from our wide selection and see how they would look in a space. Select the tile from the multiple options and the visualiser will replace the surfaces in the image with the selected tiles. This way, instead of just your imagination, you can choose the tiles for your place by getting an actual picture of how they would look in a space. So, design your space the way you desire digitally and implement it in real life to get the best results!

You can also share this visualiser with others to help them design their space.

Committed to delighting customers with world-class ceramic products and services. Make Simpolo synonymous with the best quality and set new benchmarks of excellence for all stakeholders. Pursue best business practices with utmost integrity to make Simpolo an exciting organisation to work with, for vendors, channel partners, investors and employees alike.

Gain worldwide recognition in the field of ceramic building products through Research and Innovation and bring an enhanced lifestyle within reach for every household.

Biography and career about Lixin Azarmehr

Lixin Azarmehr, a Los Angeles-based real estate development trailblazer, co-founded JL Real Estate Development (JL RED) in 2015 and serves as its CEO. Her expertise has propelled the firm to specialize in luxury residential and mixed-use commercial projects, with a portfolio that features upscale retail spaces and sophisticated care facilities.

Omaxe Sports City Dwarka A Comprehensive Guide

Omaxe Sports City Dwarka stands out as a premier residential and recreational destination, offering a blend of luxury and sports-centric living. Located in the thriving area of Dwarka, this project by Omaxe Limited is designed to cater to modern lifestyle needs while promoting a healthy, active living environment.

Investing In The US As A Canadian… And How To Do It RIGHT!! (feat. Erwin Szet...

=== Investing In The US As A Canadian… And How To Do It RIGHT!! (feat. Erwin Szeto) ===

Ever been curious about Real Estate Investing in the US?? At Volition, for the past 14 years, we have been focused on helping investors invest in over $250M of real estate and generate $100M of wealth in the Toronto market, but we are always open to learning more about other business models and learning from other investors.

The US has always been an intriguing market to invest in. But the US is a big place… if you’re interested in investing in the US, you probably have a lot of questions, like:

☑️ Specifically WHERE should you invest?

☑️ What are the best markets to invest in and why?

☑️ How much are property prices there?

☑️ What are the returns like?

☑️ What is cashflow like?

☑️ Compared to investing in Toronto or other cities in Ontario, what are the benefits / tradeoffs?

☑️ What ownership structure should I use?

☑️ What are the tax implications?

☑️ Can I get financing?

☑️ What are tenants like?

Enter Erwin Szeto, a longtime friend of Volition. Since 2005, Erwin Szeto and his team have navigated the challenging landscape of being landlords in Ontario. Now, they are shifting their focus and guiding their clients' investments toward the more landlord-friendly environment of the USA. This decision comes after assisting Canadian clients in transacting over $440,000,000 in income properties. Faced with issues like affordability constraints, tenant-friendly laws, rent control, and rental licensing in Canada, Erwin sees a clear opportunity in the U.S. Here, there is a significant influx of investments leading to the creation of high-paying manufacturing jobs. Erwin and his clients are poised to capitalize on these opportunities where landlord rights are stronger and there is no rent control.

To facilitate this transition, Erwin has partnered with and become a client of SHARE, a one-stop-shop U.S. Asset Manager. Founded by Canadians for Canadians, SHARE enables as passive an ownership experience as possible for landlords in the U.S., while still maintaining direct, 100% ownership.

Erwin is “Making Real Estate Investing Great Again”!!

Website: https://www.infinitywealth.ca/

Facebook: https://www.facebook.com/iwinrealestate and https://www.facebook.com/ErwinSzetoOfficial

Podcast: https://www.truthaboutrealestateinvesting.ca/

Instagram: https://www.instagram.com/iwinrealestate/ and https://www.instagram.com/erwinszeto/

How to keep your Home naturally Cool and Warm

Keep Your Home Naturally Cool and Warm Out Change in Seasons

Vinra Construction is a private limited company registered under the ROC. The management has an experience of over 15 years of understanding the needs and delivering apt solutions to the end users We are providing turnkey solutions in construction fields. like Construction, Interior Designing Facility Management, Plantation Management, etc..

Vinra Construction Tech Enabled Company for Eco-Friendly Home Construction

Contact With Vinra for a Greener Future >>> Call us @ 888 4898 765

Oeiras Tech City, Developed by RE Capital and REIG, Will Become Lisbon's Futu...

Oeiras Tech City, a historic development in the Oeiras municipality of Lisbon, is acquired by RE Capital and REIG. It is located on a 93,000-square-meter plot of land and combines co-living, business, and residential areas. It highlights ESG principles and is close to Tagus Park, which improves the urban landscape of Lisbon.

Recently uploaded (20)

Presentation to Windust Meadows HOA Board of Directors June 4, 2024: Focus o...

Presentation to Windust Meadows HOA Board of Directors June 4, 2024: Focus o...

Rixos Tersane Istanbul Residences Brochure_May2024_ENG.pdf

Rixos Tersane Istanbul Residences Brochure_May2024_ENG.pdf

Elegant Evergreen Homes - Luxury Apartments Redefining Comfort in Yelahanka, ...

Elegant Evergreen Homes - Luxury Apartments Redefining Comfort in Yelahanka, ...

BricknBolt Understanding Load-Bearing Walls and Their Structural Support in H...

BricknBolt Understanding Load-Bearing Walls and Their Structural Support in H...

One20 North Vancouver Floor Plans by Three Shores Development.

One20 North Vancouver Floor Plans by Three Shores Development.

One FNG by Group 108 Sector 142 Noida Construction Update

One FNG by Group 108 Sector 142 Noida Construction Update

Optimizing Your MCA Lead Capture Process for Better Results

Optimizing Your MCA Lead Capture Process for Better Results

Investing In The US As A Canadian… And How To Do It RIGHT!! (feat. Erwin Szet...

Investing In The US As A Canadian… And How To Do It RIGHT!! (feat. Erwin Szet...

Oeiras Tech City, Developed by RE Capital and REIG, Will Become Lisbon's Futu...

Oeiras Tech City, Developed by RE Capital and REIG, Will Become Lisbon's Futu...

Homeready overview

- 1. LENDER FACT SHEET HomeReady™ Mortgage Help meet the diverse needs of today’s buyers with HomeReady, Fannie Mae’s enhanced affordable lending product. Overview Designed for creditworthy, low- to moderate-income borrowers, with expanded eligibility for financing homes in designated low-income, minority, and disaster-impacted communities. HomeReady lets you lend with confidence while expanding access to credit and supporting sustainable homeownership. • Simplicity and certainty for lenders • Improved pricing and execution • Product features designed to align with today’s buyer demographics and support sustainable homeownership Lender Benefits Enhanced Simplicity and Certainty Borrower Benefits Accessible and Sustainable Financing • Underwrite with confidence. Desktop Underwriter® (DU®) offers a comprehensive credit risk assessment and eligibility determination, and automated identification of potentially HomeReady– eligible loans. • Improved and simplified pricing is better than or equal to Fannie Mae standard loan pricing and supports a competitive borrower payment. • Standard risk-based pricing waived for LTVs >80% with a credit score >=680 (risk- based loan-level price adjustment cap of 150 bps applies for loans outside of these parameters). • Simplified execution. Ability to commingle standard and HomeReady loans into MBS pools and whole loan commitments. • Low down payment. Up to 97% financing for home purchase with many borrower flexibilities. • Flexible sources of funds can be used for the down payment and closing costs with no minimum contribution required from the borrower’s own funds (1-unit properties). • Conventional home financing with cancellable monthly MI (per Servicing Guide policy); reduced MI coverage requirement above 90% LTV supports competitive borrower payment. • Homeownership education helps buyers get ready to buy a home and be prepared for the responsibilities of homeownership. The required training offers an easy-to-use, online course provided by Framework. See next page for more about product features … Fannie Mae’s Economic and Strategic Research group reports a “demographic sea change” in the housing market, characterized by the rise of the Millennials, increased diversity, and a growing elderly population; and new household growth is being driven by traditionally underserved segments. © 2015 Fannie Mae. Trademarks of Fannie Mae. September 29, 2015 Page 1 of 2

- 2. Income Eligibility (Aligned with Fannie Mae’s regulatory housing goals and may help lenders meet applicable Community Reinvestment Act goals) Product Features • DU will automatically identify potentially eligible loans. • Underwriting flexibilities include: Offers an innovative new feature that supports extended family households: will consider income from a non-borrower household member as a compensating factor in DU to allow for a debt-to-income (DTI) ratio >45% to 50%. Allows non-occupant borrowers, such as a parent. Permits rental income from an accessory dwelling unit (such as a basement apartment). Allows boarder income (updated guidelines provide documentation flexibility). • Financing up to 97% LTV (DU is required for LTVs >95%). Borrower is not required to be a first-time buyer; purchase of one-unit principal residence (limited cash-out refi up to 95%). • Lower MI coverage requirement than standard (25% for LTVs >90% to 97%). • Allows for nontraditional credit. • Gifts, grants, Community Seconds®, and cash-on-hand permitted as a source of funds for down payment and closing costs. • Supports manufactured housing up to 95% and HomeStyle® Renovation (approved lenders) to 95%. Homeownership Education and Post-Purchase Support Comprehensive homeownership education. Requires online course provided by Framework, and offers additional post- purchase support through the life of the loan to help ensure sustainable homeownership. • Borrowers will invest 4−6 hours (average) of their time and a modest fee of $75 (paid to Framework) to learn the fundamentals of buying and owning a home, take an online test, and receive a certificate of completion. • Although one-on-one counseling is optional for HomeReady, Framework will offer borrowers a referral to a HUD-approved counseling agency for additional assistance. Borrowers also have the option to consult a counselor of their choice. • To further promote sustainability, borrowers will have access to post-purchase homeownership support for the life of the loan through Framework's homeownership advisor service. Bookmark the HomeReady page for resources and updates: www.FannieMae.com/singlefamily/HomeReady Borrower Income Eligibility 2015 Eligibility (Fannie Mae analysis using 2015 data) No income limit: Properties in low-income census tracts 31% of census tracts 100% of AMI: Properties in high-minority census tracts and designated disaster areas 20% of census tracts 80% of AMI: All other properties 49% of all U.S. census tracts AMI = area median income (AMI data source: FHFA) © 2015 Fannie Mae. Trademarks of Fannie Mae. September 29, 2015 Page 2 of 2