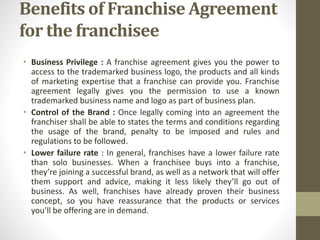

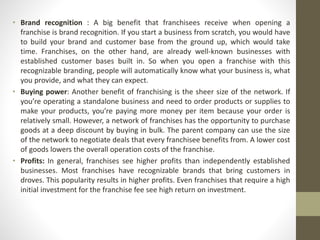

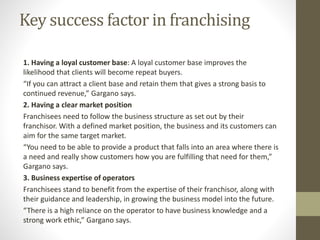

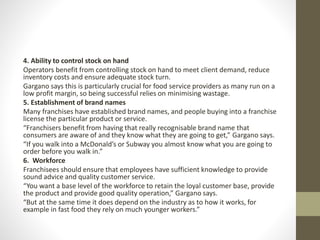

This document discusses franchising from the perspectives of both franchisees and franchisors. For franchisees, the main benefits are brand recognition, lower failure rates, and support from the franchisor network. However, franchisees also face restrictions, high initial costs, and potential conflicts with the franchisor. For franchisors, franchising allows for growth and capital through franchise fees, but franchisors lose some brand control and open themselves to potential legal disputes. Overall, the document outlines the advantages and disadvantages of franchising for both parties to a franchise agreement.